- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAUUSD drifts lower but is faring well considering USD fresh highs

Gold Price Forecast: XAUUSD drifts lower but is faring well considering USD fresh highs

- The Gold Price firms in a key support area, despite fresh highs in DXY.

- The Russia-Ukraine war continues to attract a safe-haven bid.

- Fed Chair Jerome Powell will be eyed for further clues and USD will be the focus.

Gold price is flat for the day so far as markets move into a consolidation of the uptrend. At the time of writing, the gold price is trading at $1,978 and has stuck to a tight $1,974.93 and $1,979.01 range, so far. The US dollar was also firm against most currencies, notably the yen. The DXY index was at 100.953, for a fresh two-year high.

The benchmark US 10-year Treasury yield on Tuesday was hovering just off its three-year high of 2.884% hit Monday, while the Bank of Japan has been intervening to keep the yield on Japanese 10-year government bonds around 0% and no higher than 0.25%. This is fulling support for the greenback and likely capping the advance in gold prices.

All eyes on the Fed and US dollar

More hawkish comments from Federal Reserve officials have reinforced expectations for faster US policy tightening. They started to flow in from New York Fed President John Williams who said last week that a half-point rate rise next month was "a very reasonable option," in a further sign that even more cautious policymakers are on board with faster monetary tightening.

Meanwhile, Fed member James Bullard spoke on Monday and offered further insight on the outlook for Fed policy. Bullard is one of the bank's most hawkish and has called for interest rates to reach 3.0% this year.

US inflation is "far too high," he said on Monday, repeating his case for increasing interest rates to 3.5% by the end of the year to rein in inflation expectations and slow what are now 40-year-high inflation readings.

"What we need to do right now is get expeditiously to neutral and then go from there," Bullard said at a virtual event held by the Council on Foreign Relations, adding that he doesn't expect to need to raise rates by more than half a percentage point at any meeting.

He said that the Unemployment Rate can continue to fall even with aggressive rate hikes, repeating his view that unemployment, now at 3.6%, will go below 3% this year.

This all comes ahead of the Fed Chair Jerome Powell later this week, where he is expected to solidify expectations for a 50 bps rate hike at the coming Fed policy meeting.

As a consequence of such sentiment, the US rate futures market has priced in a 96% chance of a 50 basis-point tightening at next month's Fed policy meeting, and about 215 basis points in cumulative rate increases in 2022, providing ample support for the dollar.

As for positioning, speculators' net long bets on the US dollar fell for a second straight week, according to calculations by Reuters and US Commodity Futures Trading Commission data released on Friday. The value of the net long dollar position was $13.22 billion for the week ended April 12.

Also read: Gold Price Forecast: XAUUSD needs to crack this level to take on the $2,000 mark

Meanwhile, gold price climbed to a five-week high dispute USD strength amid fears of more sanctions. ''Increasing likelihood of a European Union embargo on Russian gas could see inflation staying high, supporting gold demand as an inflation hedge,'' analysts at ANZ Bank said. ''ETF flows continued to be strong, with total holdings rising to a 14-month high of 106.6 million ounces.''

Gold technical analysis

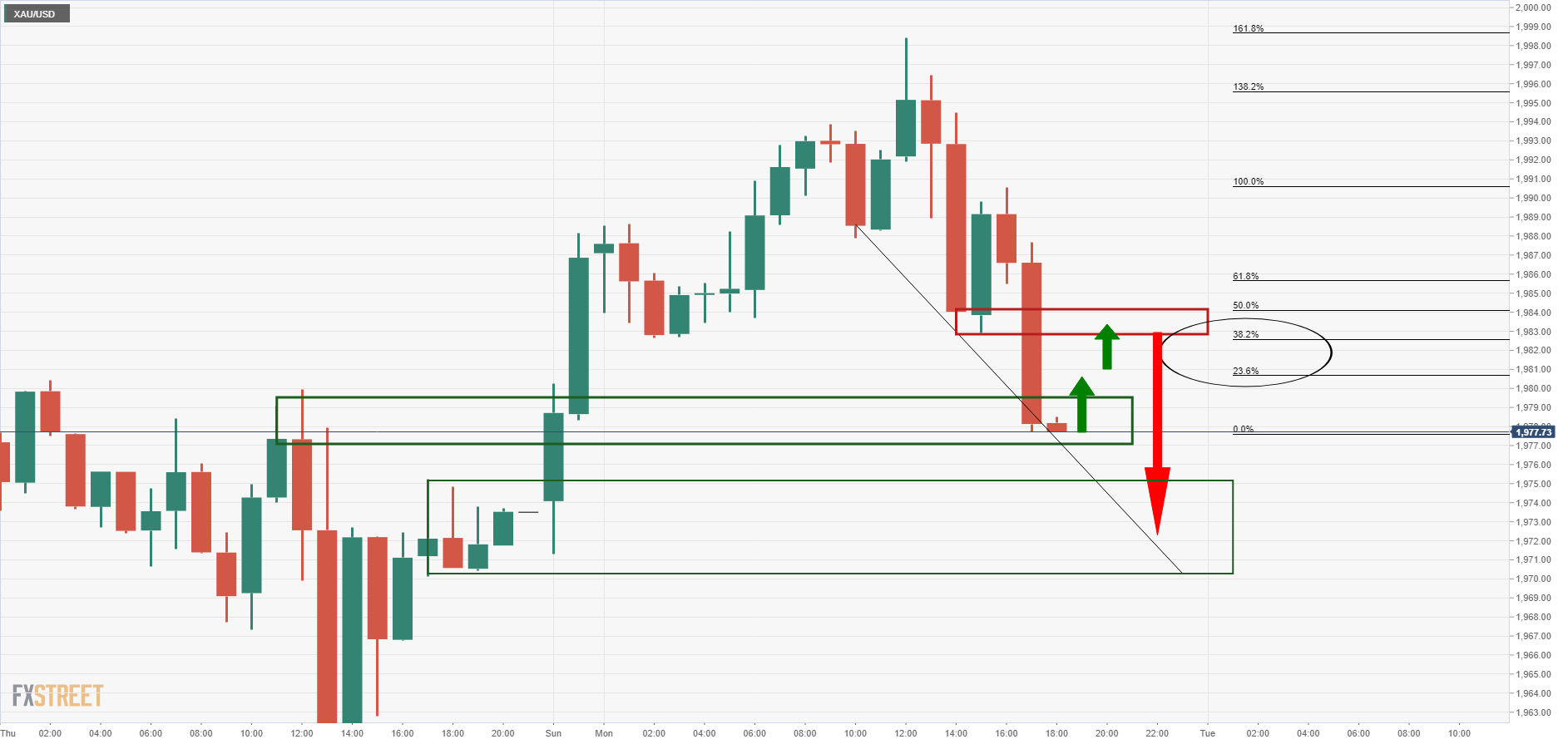

The price had moved in on a firm area of hourly support:

The price was expected to reset the prior lows as resistance and then mitigate the remainder of the price imbalance below targeting the $1,970s.

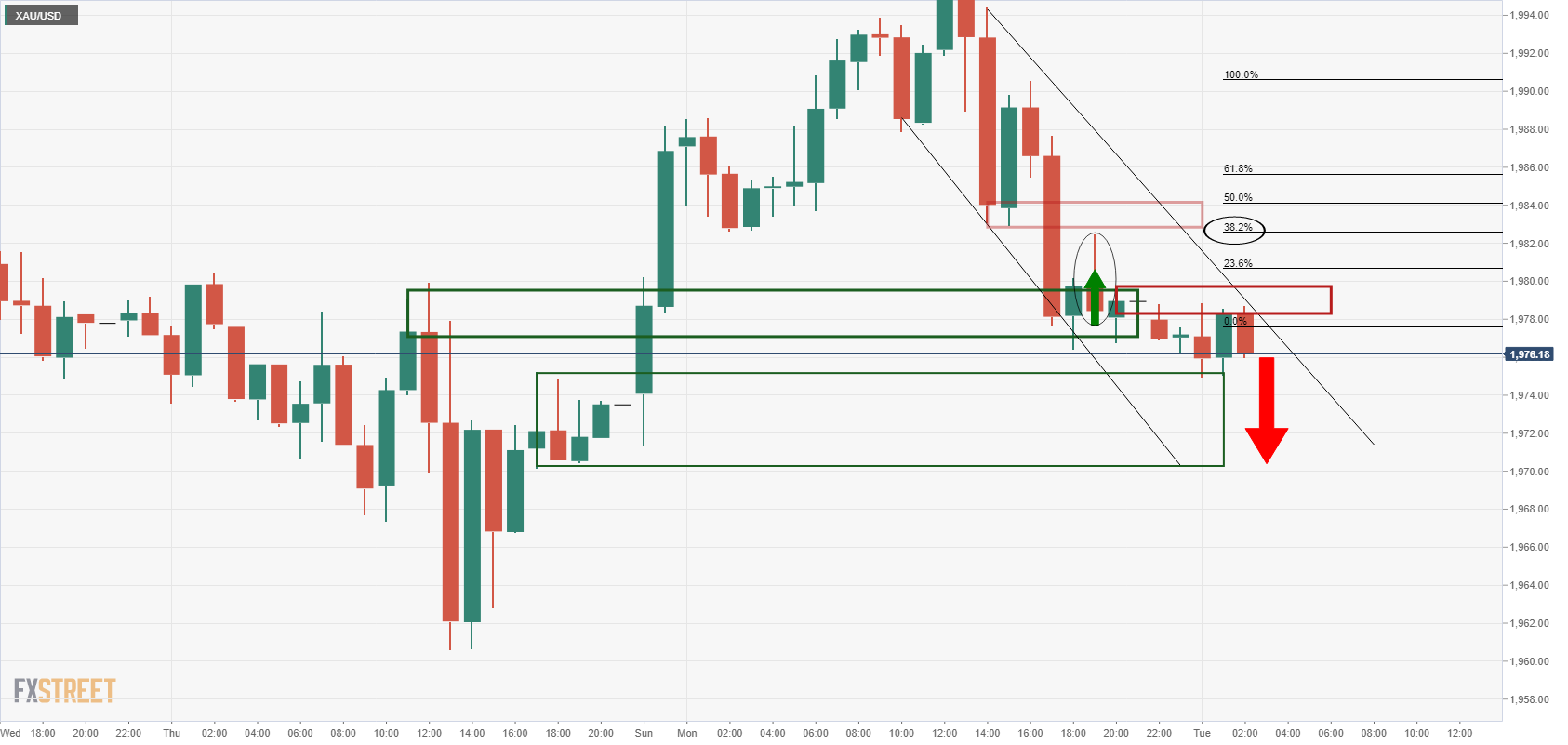

The price is making progress:

The price was rejected near the old lows and has since crumbled, drifting lower and now meeting a freshly established resistance made up of a confluence of the dynamic trendline and horizontal highs.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.