- Analytics

- News and Tools

- Market News

- GBP/USD bears are on the prowl into hourly support, eye a break to 1.2980

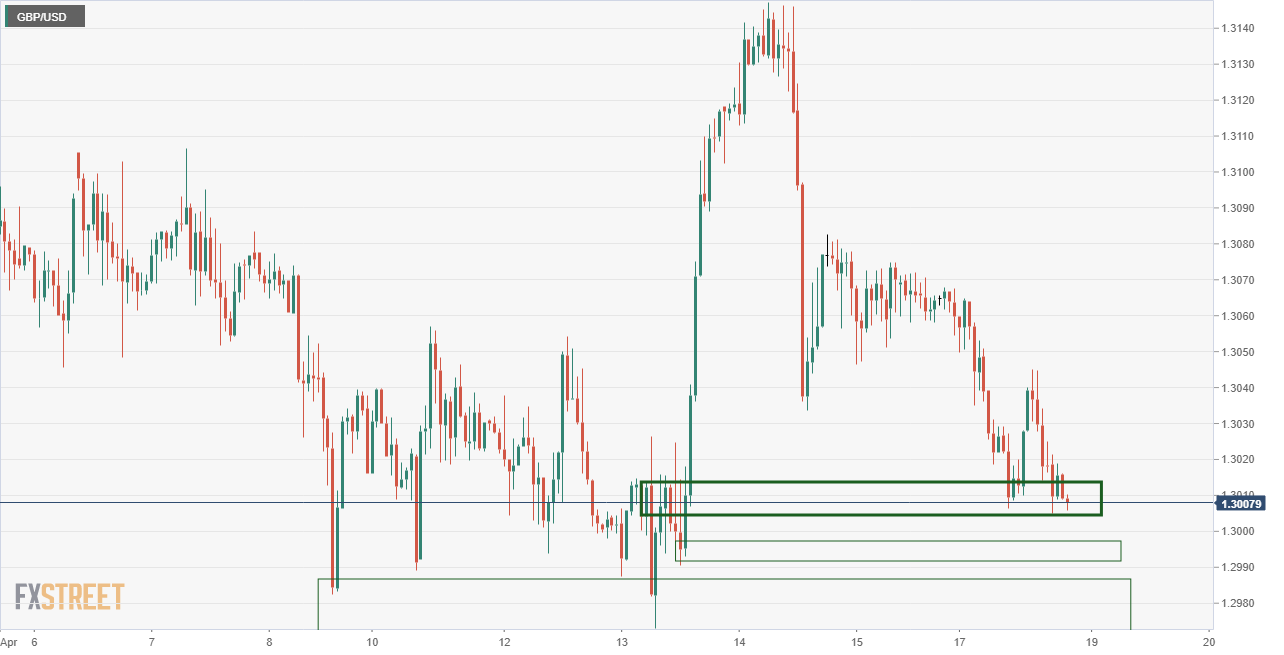

GBP/USD bears are on the prowl into hourly support, eye a break to 1.2980

- GBP/USD is sliding into hourly support on the back of a strong US dollar in holiday thin trading.

- Traders will focus on the Fed and BoE speakers this week.

GBP/USD is on the back foot, falling from a high of 1.3064 to a low of 1.3004, down some 0.37% at the time of writing. There were no UK data releases scheduled for Monday and markets have been closed for the Easter Monday Bank holidays.

Instead, the focus has been on the US dollar which has been firmer against its major trading partners ahead of a light data schedule. The week's data highlights include home construction on Tuesday, Existing Home Sales on Wednesday, and Weekly Initial Jobless Claims on Thursday. The Federal Reserve will release its Beige Book summary of economic conditions on Wednesday. Before then, St. Louis Fed President James Bullard speaks at 4:00 pm ET today on the economic and policy outlook.

Meanwhile, the minutes of the March 15-16 Federal Open Market Committee meeting released last week point to a more hawkish Fed. The greenback is supported by firm rates in the US in expectation of a 50 bps rate hike at next month's meeting, May 3-4 meeting. Therefore, the comments from Bullard today will be important before the observed quiet period begins on Saturday.

Similarly, traders will be on the lookout for commentary from the Bank of England's Governor Andrew Bailey who speaks twice on the economy this week. This will offer a strong platform to discuss his dovish views on the BoE's policy stance. ''Thursday's discussion at PIIE is likely to be the most important, but he'll address inflation on an IMF panel on Friday as well. External MPC member Mann speaks on decision-making under uncertainty earlier Thursday as well,'' analysts at TD Securities explained.

GBP/USD technical analysis

The price is reaching hourly support but a break here opens the risk of mitigation of the price imbalance between here and 1.2990/80.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.