- Analytics

- News and Tools

- Market News

- When is the Aussie Employment report and how might it affect AUD/USD?

When is the Aussie Employment report and how might it affect AUD/USD?

Australia’s March labour force survey is released today at 01.30GMT and there are expectations for another strong headline print, in line with the Reserve Bank of Australia's upbeat outlook.

Given that weekly payrolls indicate jobs growth held up through recent flooding events in March, Westpac anticipates employment to rise by 25k for the month.

''A lift in participation to 66.5% should see the unemployment rate hold flat at 4.0%. The median forecast is +30k jobs and 3.9% unemployment rate, which would be the first sub-4% rate since 1974.''

How might the data affect AUD?

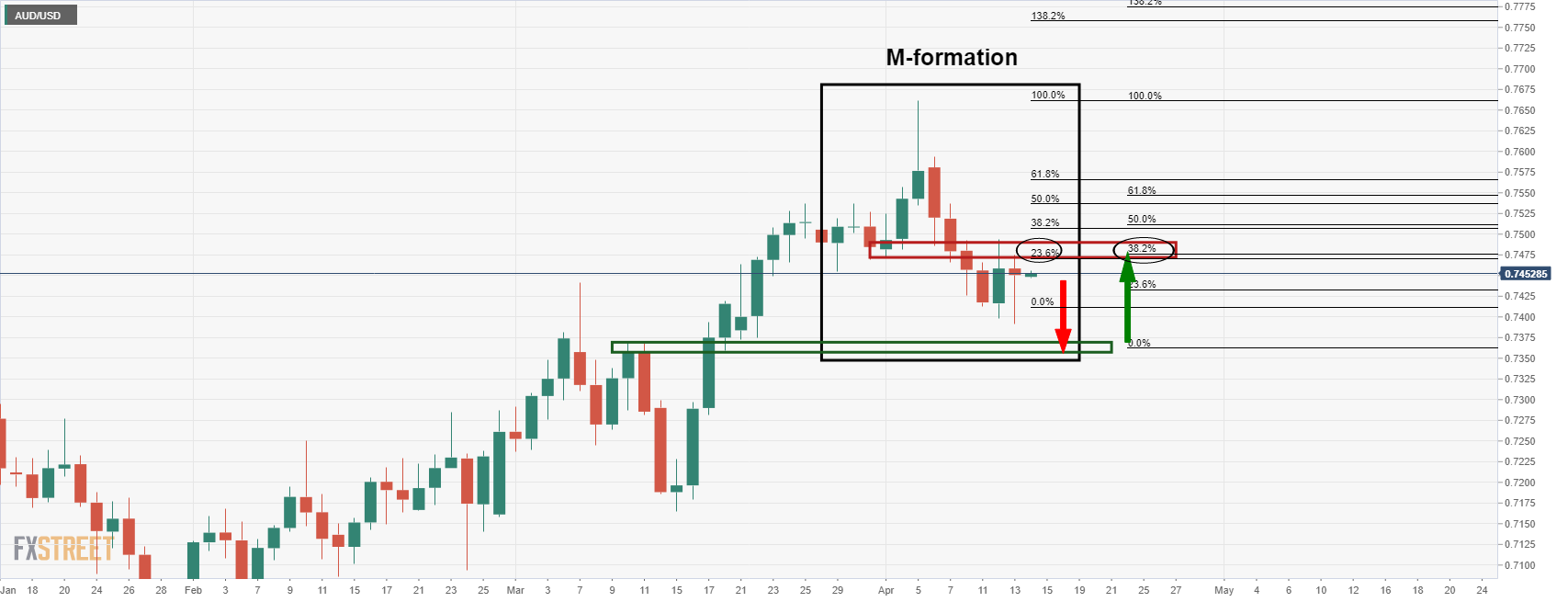

Lower yields have weighed on the US dollar overnight supporting AUD on Wednesday, which finished the day flat. However, strong employment data today could see the Aussie ride higher in this correction. On the other hand, a disappointment would likely send the price on course for a downside extension as illustrated in the following analysis:

-

AUD/USD Price Analysis: More to come from the bears?

''The price is being resisted which could lead to a downside continuation for the days ahead and complete the bearish weekly candle trajectory into the weekly support one around 0.7360. The next catalyst is the Aussie Employment report and if there is a disappointment, AUD would be expected to slide.''

AUD/USD H1 chart

The price will need to get below the 0.7440s on the hourly chart and then 0.7380.

About the Employment Change

This is released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.