- Analytics

- News and Tools

- Market News

- AUD/USD banging its head on the ceiling, NFP could be the adjudicator

AUD/USD banging its head on the ceiling, NFP could be the adjudicator

- AUD/USD bulls are running into a ceiling of resistance as commodities rise.

- The Ukraine crisis is intensifying, pressuring oil prices higher again.

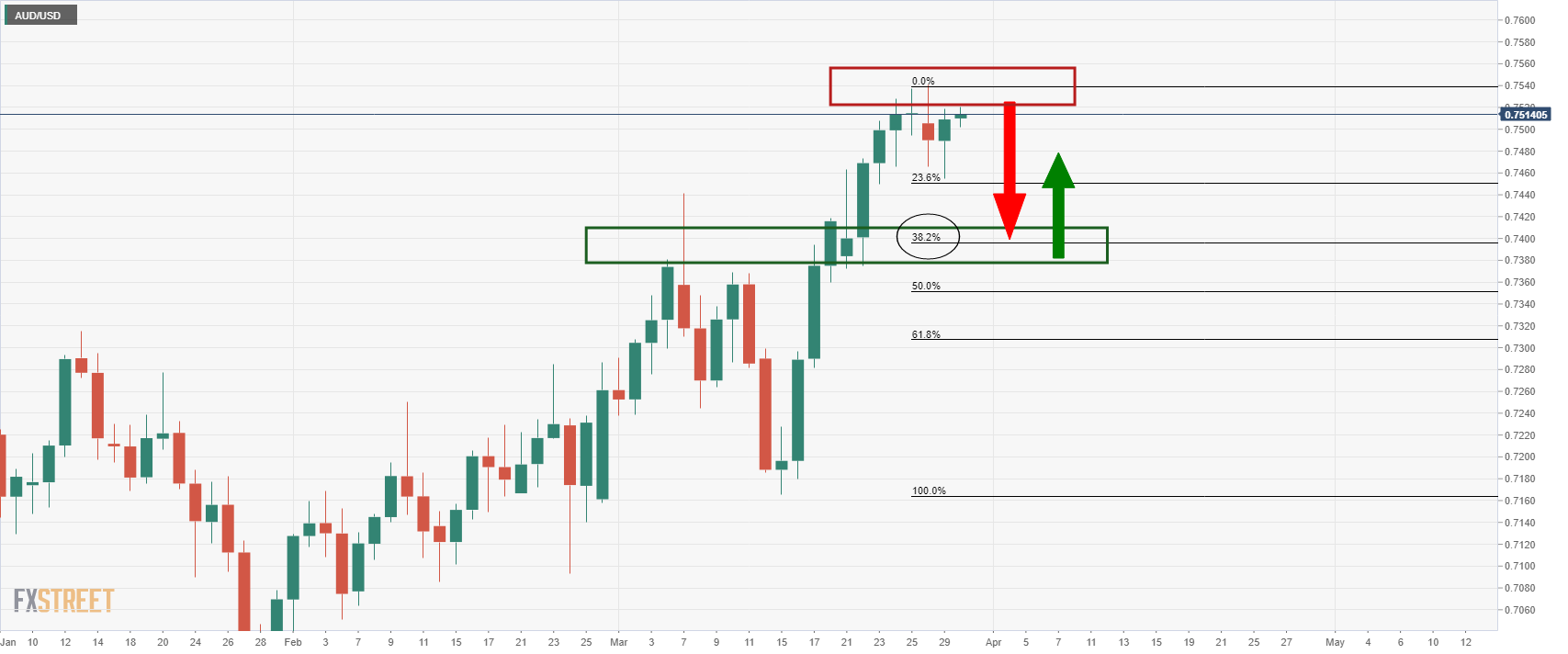

AUD/USD has been stuck in a tight range on the day as the price attempts to move higher to test the resistance on the daily chart, but without conviction so far. At the time of writing, AID/USD is trading at 0.7508 and has chopped between 0.7502 and 0.7536 range so far.

The commodities markets have been given another boost by the prospects of the Ukraine crisis dragging on for longer. The prospects of a cease-fire have been dashed by the latest comments by key officials involved in the war.

The Kremlin on Wednesday has said there was no sign of a breakthrough yet. Ramzan Kadyrov, who is a powerful head of the Russia's republic of Chechnya, said on Wednesday that Moscow would make no concessions in its war in Ukraine and that Kremlin negotiator Vladimir Medinsky had been wrong to suggest otherwise.

Both the Ukraine Defence Ministry and the Polish Deputy Prime Minister crossed the wires and stated that Russia is preparing for a new attack in Ukraine. All indications are that we are facing a long war, Aljazeera Tweeted, quoting the Polish PM. A Ukraine Defence Ministry spokesperson expressed a view that the Russian military continues to aim to take control of Mariupol, a strategic city in the east, saying that a major withdrawal is not taking place, and Russia is ready to resume attacks.

Indeed, on Wednesday, Russian forces bombarded the outskirts of Kyiv and the US administration had warned on Tuesday they were sceptical of Russia’s vow to curtail its military assault on Ukraine, ending the day with a note of caution after hours of peace talks between the two sides appeared to make some headway.

As a consequence, equities ticked down and oil bounced as doubts grew over Russia’s intentions in Ukraine. The Thomson Reuters CRB Index rallied 2.2% with West Texas Intermediate crude in the spot market breaking $108bbl in New York trade. This in turn is supporting the Aussie.

Market pricing remains very responsive to sudden shifts in sentiment and the onset of quarter and month-end is an additional hurdle for markets to contend with. The end of the week's data will be important in this regard to determine whether the US dollar can continue to run higher on both positive economic data and central bank prospects in the face of higher interest rates and a wave of mounting inflation pressures.

On Friday, US Nonfarm Payrolls data will take centre stage as a meanwhile distraction to the Ukraine crisis this Friday. ''Employment likely continued to advance in March following two strong reports averaging +580k in Jan and Feb,'' analysts at TD Securities said.

''That said, we expect some of that boost to fizzle, though to a still firm job growth pace of +350k. Indeed, job gains should lead to a new drop in the unemployment rate to a post-COVID low of 3.7%. We also expect wage growth to slow to a still firm 0.3% MoM pace.''

AUD/USD technical analysis

The price is testing the resistance in the daily chart but is yet to move in to mitigate that imbalance from the bullish rally on the daily chart. Therefore, the bears will be looking for a move to test at least 38.% Fibonacci retracement area that correlated with the prior resistance at the start of March near 0.74 the figure.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.