- Analytics

- News and Tools

- Market News

- GBP/USD running higher as US dollar slides to test day's lows

GBP/USD running higher as US dollar slides to test day's lows

- GBP/USD bulls step up the pace in the hint for the 1.3160s.

- The US dollar bleeds as the focus remains on a breakthrough in peace talks Russia/ Ukraine.

GBP/USD is trading around 1.3110 and near the highs of the day as the US dollar slides. Sterling underperformed, returning to around 1.3100, net flat overnight, although the pair is picking up a bid in Asian markets ahead of the European open as Asia shares joined a global rally on Wednesday.

The hope for a negotiated end to the Ukraine conflict is keeping spirits alive and adding riskier currencies, such as the pound. The bond markets have signalled concern that aggressive rate hikes could damage the US economy after 10-year yields briefly dipped below two-year rates, but markets are shrugging this off.

The focus is on Russia and Ukraine whereby the Russians have promised to scale down military operations around Ukraine's capital and north, while Kyiv proposed Ukraine join the EU while adopting neutral status by not joining NATO. The peace talks are taking place in an Istanbul palace more than a month into the largest attack on a European nation since World War II.

''Talks successful enough for a possible meeting between Putin and Zelensky, says Ukrainian presidential advisor Mykhailo Podolyak. “We have documents prepared now which allow the presidents to meet on a bilateral basis," he said.

European currencies have generally been under pressure vs. the USD in the spot market given concerns about energy security and/or the economic impact of higher prices for gas and oil. However, the energy sector has tailed off in the hopes of a breakthrough in peace talks and a potential ceasefire. Net short GBP positions increased noticeably for a third week as concerns rise as to the cost of living crisis in the UK, so any signs of relief there are bound to support the pound in the spot market as inflation concerns abate.

Meanwhile, the Old Lady's Governor Andrew Bailey acknowledged that the Bank of England softened its guidance on rate hikes this month to reflect the high level of economic uncertainty. ''At the March 17 decision, the bank said that further tightening of policy “might be” appropriate in the coming months vs. the forward guidance in February, when such a move was seen as “likely.” Bailey said that while it’s been appropriate for the BoE to tighten policy under current circumstances, forward guidance should reflect the current heightened uncertainty,'' analysts at Brown Brothers explained.

''WIRP suggests a hike at the next meeting May 5 is fully priced in, with around 30% odds of a 50 bp move then vs. 50% before Bailey’s comments. Swaps market now sees the policy rate peaking near 2.25% over the next 24 months, down from 2.5% before Bailey’s comments but still up from 2.0% at the start of last week.''

Key data events

Looking ahead for the week, US Nonfarm Payrolls data will take centre stage as a meanwhile distraction to the Ukraine crisis this Friday. ''Employment likely continued to advance in March following two strong reports averaging +580k in Jan and Feb,'' analysts at TD Securities said.

''That said, we expect some of that boost to fizzle, though to a still firm job growth pace of +350k. Indeed, job gains should lead to a new drop in the unemployment rate to a post-COVID low of 3.7%. We also expect wage growth to slow to a still firm 0.3% MoM pace.''

GBP/USD technical analysis

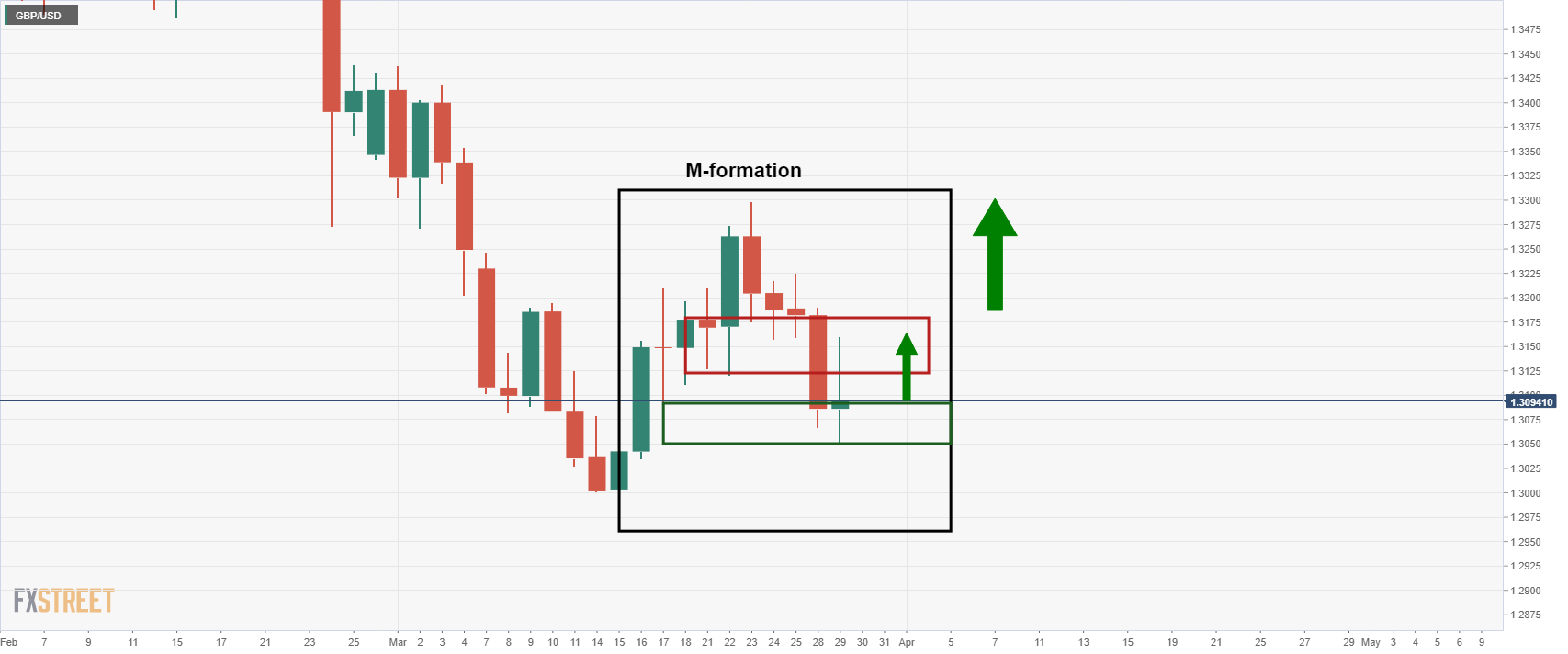

The following illustrates the pound's bullish trajectory on the daily chart in an M-formation:

GBP/USD daily chart

The chart above was from the prior day's close. The price is now higher in Asia as it attempts to recover towards the neckline of the formation:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.