- Analytics

- News and Tools

- Market News

- US Dollar Index looks offered and challenges 99.00

US Dollar Index looks offered and challenges 99.00

- DXY loses some upside momentum near 99.00.

- US yields keep the upside bias unchanged on Tuesday.

- CB Consumer Confidence, housing data, Fedspeak next on tap.

The greenback, in terms of the US Dollar Index (DXY), gives away part of the recent strong advance and returns to the 99.00 neighbourhood on turnaround Tuesday.

US Dollar Index looks to geopolitics, data

The index trades on the defensive for the first time after four consecutive daily advances on the back of the re-emergence of some buying interest in the risk-associated space.

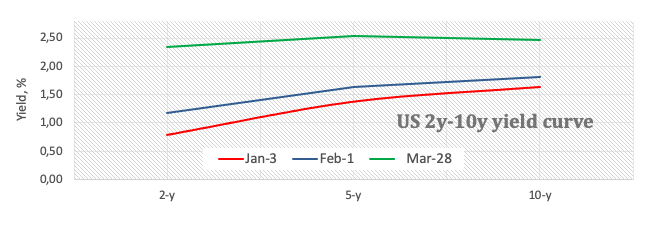

In the meantime, US yields resume the upside across the curve and remain in levels last seen in nearly 3 years ago when it comes to the short end and the belly of the curve, while the long end look side-lined also in the upper end of the range.

Support for the riskier assets seems to have resurged in the form of renewed hopes ahead of another round of peace talks between Russia and Ukraine in Turkey due later in the day.

In the US data space, the Conference Board will release its Consumer Confidence gauge seconded by the FHFA’s House Price Index, the S&P/Case-Shiller Index and JOLTs Job Openings. In addition, NY Fed and permanent voter J.Williams (centrist) is due to speak.

What to look for around USD

The upside momentum in the index seems to have taken a breather on Tuesday. Concerns surrounding the geopolitical landscape are expected to keep propping up the demand for the buck in combination with prospects of extra tightening by the Fed. Looking at the broader picture, bouts of risk aversion – exclusively emanating from Ukraine - should underpin inflows into the safe havens and lend legs to the dollar at a time when its constructive outlook remains well supported by the current elevated inflation narrative, a potential more aggressive tightening stance from the Fed, higher US yields and the solid performance of the US economy.

Key events in the US this week: FHFA House Price Index, CB Consumer Confidence (Tuesday) – Mortgage Applications, ADP Employment Change, Final Q4 GDP (Wednesday) – PCE Price Index, Initial Jobless Claims, Personal Income, Personal Spending (Thursday) – Nonfarm Payrolls, Unemployment Rate, Final Manufacturing PMI, ISM Manufacturing PMI (Friday) .

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Futures of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is losing 0.14% at 98.98 and a break above 99.41 (2022 high March 7) would open the door to 100.00 (psychological level) and finally 100.55 (monthly high May 14 2020).On the flip side, the next down barrier emerges at 98.40 (low March 25) seconded by 97.72 (weekly low March 17) and then 97.71 (weekly low March10).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.