- Analytics

- News and Tools

- Market News

- Silver Price Forecast: XAG/USD breaks below $25.50 amid a strong greenback

Silver Price Forecast: XAG/USD breaks below $25.50 amid a strong greenback

- Silver lost some of its brightness as the last week of March began, down almost 2%.

- The market mood is mixed while a stronger US Dollar weighs on XAG/USD.

- XAG/USD Price Forecast: In the long term is upward biased, but once the $25.40 support was broken, it opened the door for further losses.

Silver spot (XAG/USD) slides after last Friday’s “gravestone-doji” in an uptrend, a candlestick pattern meaning “indecision” amongst traders. However, Monday’s price action showed that XAG bears prevailed of late. At the time of writing, XAG/USD is trading at $25.08.

Market sentiment is mixed, and the greenback remains firm

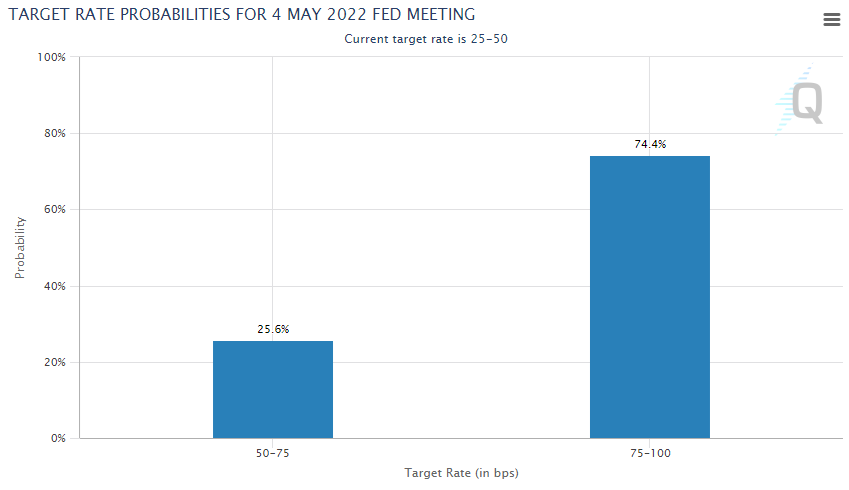

Factors like the Covid-19 outbreak in China, and the Russia – Ukraine conflict, weigh on the market mood. China is placing Shanghai, one of its major cities, in lockdown due to the zero-tolerance restrictions in the country. The Russia-Ukraine war continues as peace talks stagnated, while market players begin to price in a 50-bps increase of the Federal Reserve to its Federal Funds Rate (FFR) in its May meeting, as shown by the CME MarketWatch tool, with the odds at 74% as of March 28, 2022.

That said, the US Dollar Index, a gauge of the buck’s performance against a basket of majors, sits at 99.076, up 0.27%, underpinned by the aforementioned, while US Treasury yields fall. The US 10-year T-note is almost flat in the day at 2.471%, while the yield curve between 5s and 30s inverted during the day, a signal that triggered “recession concerns” in investors.

Aside from this, in the precious metals space, gold also lost some of its brightness, down close to 1%, sitting at $1938.94 a troy ounce.

The US economic docket featured the US Goods Trade Balance for February, which came at $-106.59B better than the $107.57B in January’s deficit. The Dallas Fed Manufacturing for March rose by 8.7, lower than the 11 foreseen, and trailed February’s 14 figure.

XAG/USD Price Forecast: Technical outlook

In the long-term, silver remains upward biased, but in the near term, silver is downward pressured once XAG/USD gave way to Friday’s low at $25.26. Also, once the November 16, 2021, daily high resistance-turned-support at $25.40 was broken, exposed XAG/ÛSD to be trading back in the $24.70-$25.40 area.

That said, XAG/USD’s first support would be $25.00. Breach of the latter would expose $24.88, followed by $24.70.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.