- Analytics

- News and Tools

- Market News

- Platinum Price Analysis: XPT/USD rebound remains elusive below $1,060

Platinum Price Analysis: XPT/USD rebound remains elusive below $1,060

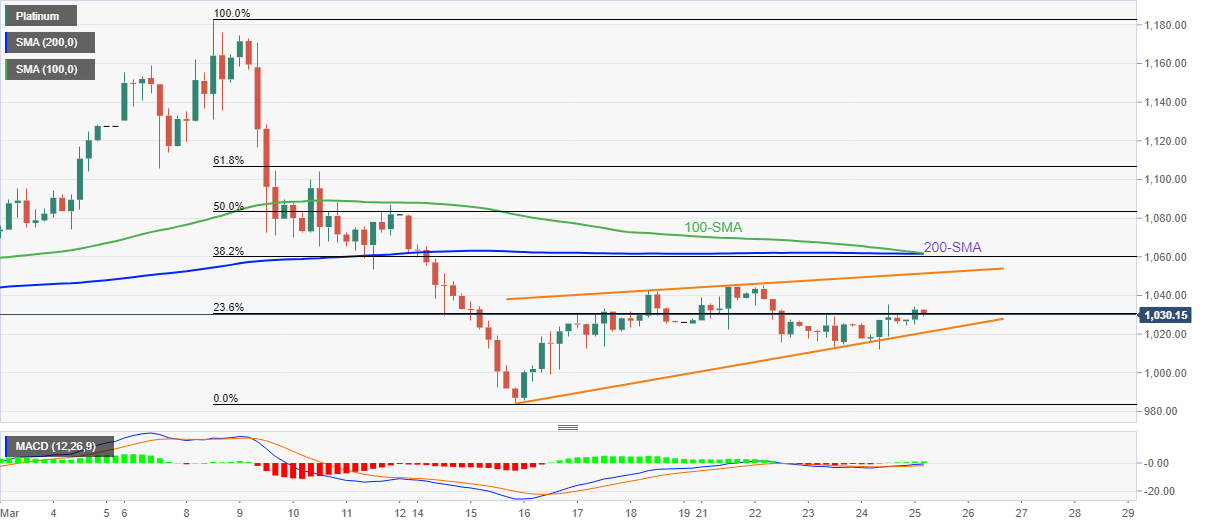

- Platinum prices remain positive for the second consecutive day inside rising wedge bearish formation.

- Convergence of 100-SMA, 200-SMA appears tough nut to crack for bulls.

- Downside break of $1,020 will challenge the yearly low.

Platinum (XPT/USD) extends the previous day’s rebound from a weekly low, up 0.54% intraday around $1,030 heading into Friday’s European session.

Despite rising for the second day in a line, the precious metal portrays a one-week-old rising wedge bearish chart pattern, which in turn tests the upside momentum around $1,051.

Even if the commodity prices rally beyond $1,051, a convergence of the 100 and 200 SMAs will join the 38.2% Fibonacci retracement (Fibo.) of early March downturn to highlight the $1,061 as a crucial resistance.

It’s worth noting that the MACD conditions signal that the buyers don’t have control, which in turn suggests the pullback moves.

However, the quote’s run-up beyond $1,061 won’t hesitate to challenge the March 10 swing high near $1,105.

Meanwhile, pullback moves remain less important until staying above the stated wedge’s lower line, at $1,020 by the press time.

Following that, a south-run towards the $1,000 psychological magnet and then to the yearly bottom surrounding $922 can’t be ruled out.

Platinum: Four-hour chart

Trend: Pullback expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.