- Analytics

- News and Tools

- Market News

- US Dollar Index advances modestly to the 98.50 area, focus on yields, Powell

US Dollar Index advances modestly to the 98.50 area, focus on yields, Powell

- DXY trades with marginal gains in the mid-98.00s.

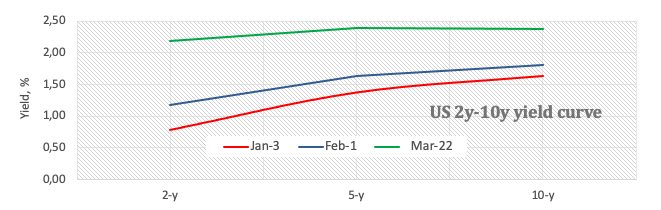

- Upside in US yields seem to have entered a pause mode.

- Powell, Daly, housing data next in the US calendar.

The US Dollar Index (DXY), which tracks the greenback vs. its main rivals, so far manages well to leave behind Tuesday’s pullback and chart decent gains around the 98.50 region.

US Dollar Index looks to geopolitics, Fed

The index regains upside traction and reclaims ground lost on Tuesday on the back of the offered tone in the risk-linked assets, while the recent strong upside in US yields appears to have run out of some steam for the time being.

Also collaborating with the bid bias in the buck appears the absence of news from the geopolitical scenario along with the lack of progress seen in the Russia-Ukraine peace talks in past hours.

Later in the US docket, Chief Powell will participate in a virtual discussion panel organized by the BIS. In addition, San Francisco Fed M.Daly is due to speak, while MBA Mortgage Applications, New Home Sales and the EIA’s report on US crude oil supplies will also be on tap later in the NA session.

What to look for around USD

The weekly recovery in the dollar met resistance near 99.00 so far. Concerns surrounding the geopolitical landscape prop up further the demand for the buck in combination with the offered stance in the risk-associated complex. Looking at the broader picture, bouts of risk aversion – exclusively emanating from Ukraine - should underpin inflows into the safe havens and lend legs to the dollar at a time when its constructive outlook remains well supported by the current elevated inflation narrative, a potential more aggressive tightening stance from the Fed and the solid performance of the US economy.

Key events in the US this week: MBA Mortgage Applications, Fed Powell, New Home Sales (Wednesday) – Initial Claims, Durable Goods Orders, Flash PMIs (Thursday) – Final Consumer Sentiment, Pending Home Sales (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Futures of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is up 0.15% at 98.56 and a break above 98.96 (weekly high March 22) would open the door to 99.29 (high March 14) and finally 99.41 (2022 high March 7). On the flip side, the next down barrier emerges at 97.72 (weekly low March 17) followed by 97.71 (weekly low March10) and then 97.44 (monthly high January 28).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.