- Analytics

- News and Tools

- Market News

- S&P 500 sits above the 200-DMA as dip buyers reclaim 4500

S&P 500 sits above the 200-DMA as dip buyers reclaim 4500

- Wall Street is set to finish Tuesday’s trading session in the green.

- The sell-off of US Treasuries continues, while the 10-year yield closes to 2.40%.

- S&P 500 Price Forecast: Bulls reclaiming the 200-DMA might open the door for further gains.

US stocks recovered on Tuesday, following Monday’s hawkish remarks of Fed Chief Jerome Powell, who said that “inflation is too high” and opening the door for 50 basis points increases.

The S&P 500 is advancing some 1.10%, sitting at 4517 above the 200-day moving average (DMA), a bullish signal for dip buyers. Meanwhile, the tech-heavy Nasdaq rises almost 2%, sits at 14,106.28, while the Dow Jones Industrial climb 0.69%, up at 34792.36.

On Monday, US central bank chief Jerome Powell said that “if we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so.”

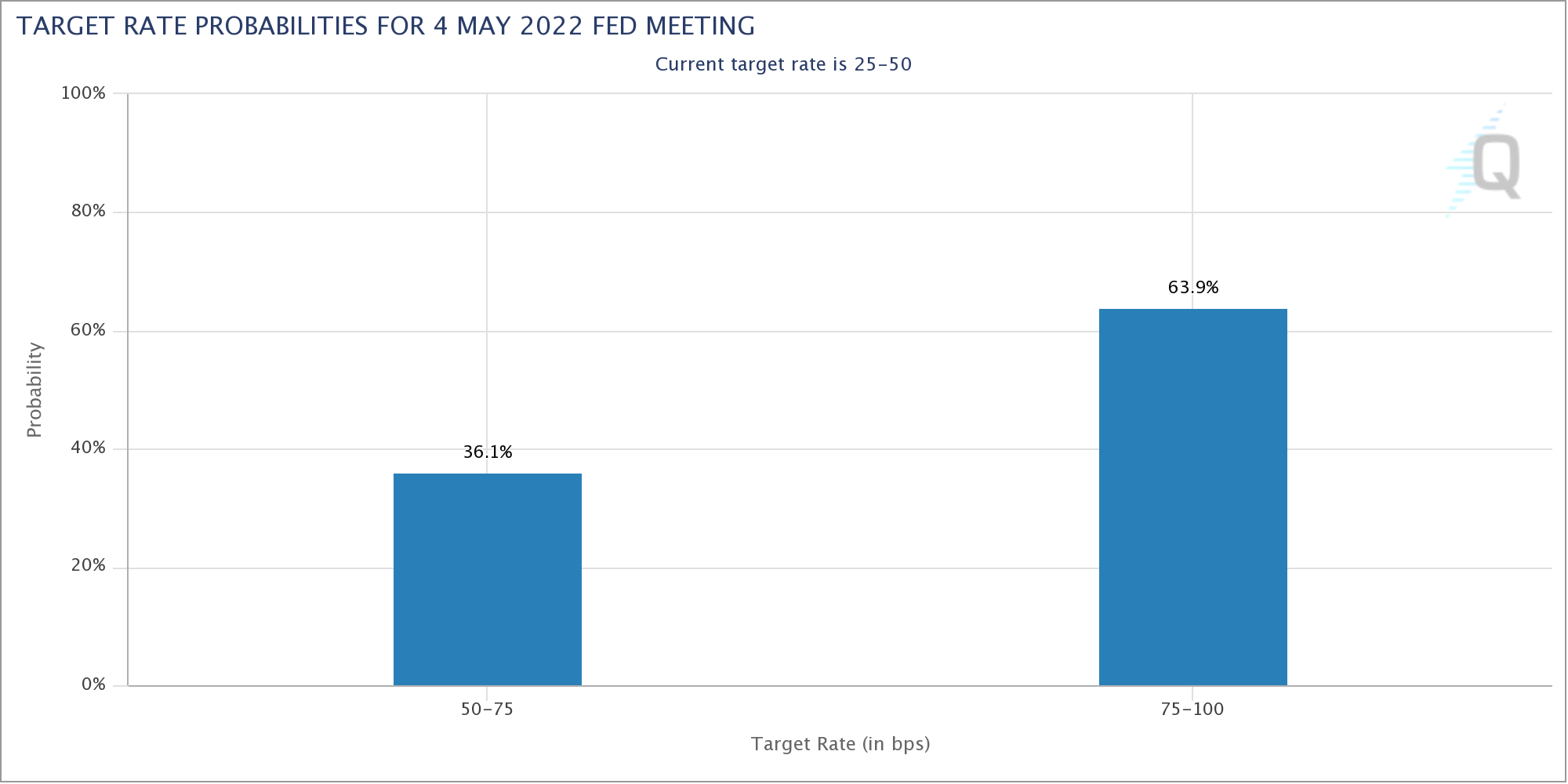

Meanwhile, money market futures have priced at least a 63.9% chance of a 50 basis point increase to the Federal Funds Rate (FFR) in the May 4 Fed monetary policy meeting, as shown by CME Fed Watch Tool.

In the meantime, the sell-off on US Treasuries continues, as reflected by the US Treasury yields rising. The 10-year benchmark note gains six basis points, sitting at 2.384%. The greenback is barely down 0.01%, at 98.461.

Sector-wise, consumer discretionary, communication services, and financials rose 2.65%, 2.17%, and 1.62%, respectively. Meanwhile, the energy sector is logins 0.57%, weighed by Russia – Ukraine tussles, while Hungary and Germany backpedaled the ban of Russian oil.

S&P 500 Price Forecast: Technical outlook

The S&P 500 broke above the 200-DMA at 4473.08, as mentioned above. However, a daily close above it would open the door for further gains. Nevertheless, as equities are highly sensitive to market mood, stock traders need to be aware of it before opening fresh bullish bets on the S&P 500 index.

With that said, the S&P 500 first resistance would be September 4545.85. Once cleared, the next resistance would be February 2, daily high at 4595.81, short of the following resistance, the 4600 mark.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.