- Analytics

- News and Tools

- Market News

- EUR/JPY Price Analysis: The rally stalls at 132.00 though upside risks remain

EUR/JPY Price Analysis: The rally stalls at 132.00 though upside risks remain

- The EUR/JPY has rallied for four consecutive days in the week, eyeing for a fifth one.

- A positive market mood kept safe-haven peers under pressure.

- EUR/JPY Price Forecast: The path of least resistance is upward, though would need a decisive break above 132.00.

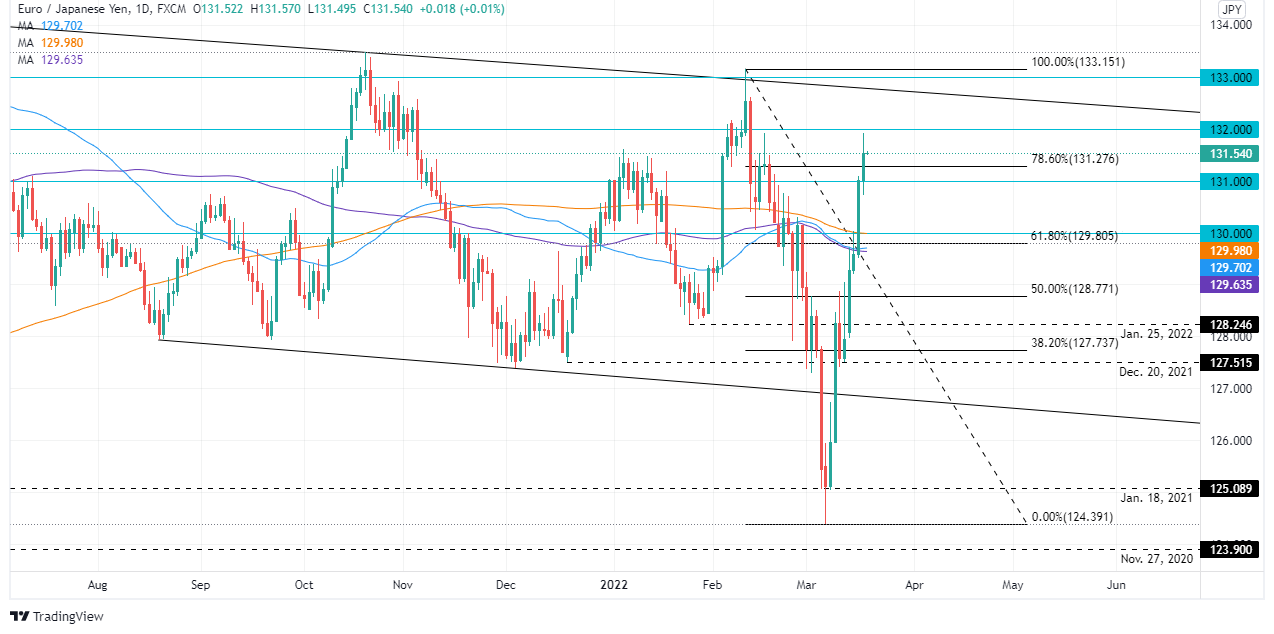

The EUR/JPY weekly rally persists for the fourth consecutive day, up 2.83% as the Asian session is about to begin. The financial market mood reflects an upbeat market mood, though of late, news citing a US intelligence official saying that “Putin is likely to make nuclear threats if the war drags” caused some nervousness on market players, though not enough to spur a sell-off on equities. At the time of writing, the EUR/JPY is trading at 131.54.

Overnight, the EUR/JPY seesawed around the 131.00 mark, though break upwards once North American traders got to their desks, and reached a new YTD high at 131.90, retreating afterward towards 131.50s.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY achieved to break above the 78.6% Fibonacci retracement, which sat at 131.27 and left the Japanese yen vulnerable to further weakness, which indeed happened. The EUR/JPY rallied short the 132.00 figure, though retreated and is trading above 131.52 Thursday’s close.

The EUR/JPY path of least resistance is upwards, and the first resistance would be 132.00. Breach of the latter would expose the downslope trendline around the 132.70-80 area, followed by the February 10 at 133.15.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.