- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD’s road to recovery eyes $1,940 and $1,950 – Confluence Detector

Gold Price Forecast: XAU/USD’s road to recovery eyes $1,940 and $1,950 – Confluence Detector

- Gold price extends rebound amid weaker Treasury yields, DXY and firmer stocks.

- Traders digest the hawkish Fed outcome amid ongoing Russia-Ukraine peace talks.

- Gold Price: Acceptance above 21-DMA is critical for additional recovery gains.

Gold price remains in the hands of buyers this Thursday, following a decent comeback amidst a hawkish Fed and worries over the Russia-Ukraine peace talks. Concerns over risks to global economic growth play out and influence gold price, in the aftermath of the Fed decision, as the focus remains on the ongoing Russia-Ukraine peace talks. The extended correction in the US Treasury yields and the dollar is lending support to gold price.

Read: Gold reversal from 2022 yearly Pivot

Gold Price: Key levels to watch

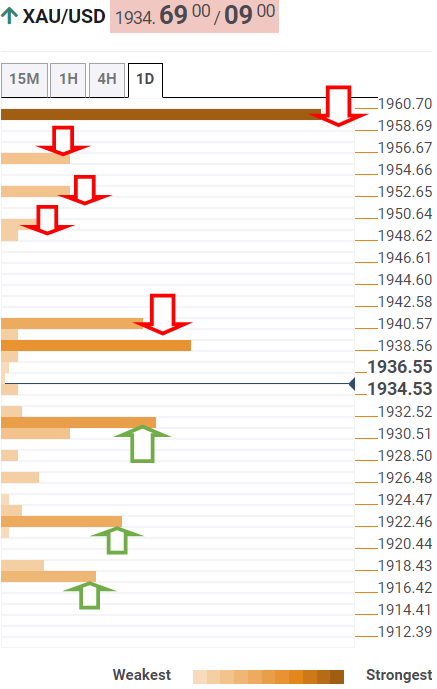

The Technical Confluences Detector shows that gold price is looking to regain the upside moment to test powerful resistance at $1,940, which is the convergence of the pivot point one-day R1, pivot point one-week S1 and Bollinger Band one-day Middle.

The next bullish target is envisioned at $1,950, which is the psychological barrier as well as the SMA100 four-hour.

Further up, the pivot point one-day R2 at $1,952 will get tested, above which the SMA5 one-day at $1,955 will be on bulls’ radars.

The confluence of the previous week’s low and the previous year’s high around $1,960 is the level to beat for gold optimists.

Alternatively, the immediate support is seen at $1,931, the intersection of the Fibonacci 23.6% one-month and the previous day’s high.

Fresh selling opportunities will arise below the latter, exposing critical support at $1,922, where the Fibonacci 23.6% one-day and SMA10 four-hour coincide.

The line in sand for gold buyers is the Fibonacci 38.2% one-day at $1,917.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.