- Analytics

- News and Tools

- Market News

- GBP/JPY Price Analysis: Faces solid resistance around 154.60, braces to the 154.10s

GBP/JPY Price Analysis: Faces solid resistance around 154.60, braces to the 154.10s

- The British pound rally continues vs. the Japanese yen.

- Positive UK labor data and GDP further cement a BoE’s rate hike.

- GBP/JPY Price Forecast: Neutral-upward biased, but downside risks remain due to solid resistance around the 154.60-155.00.

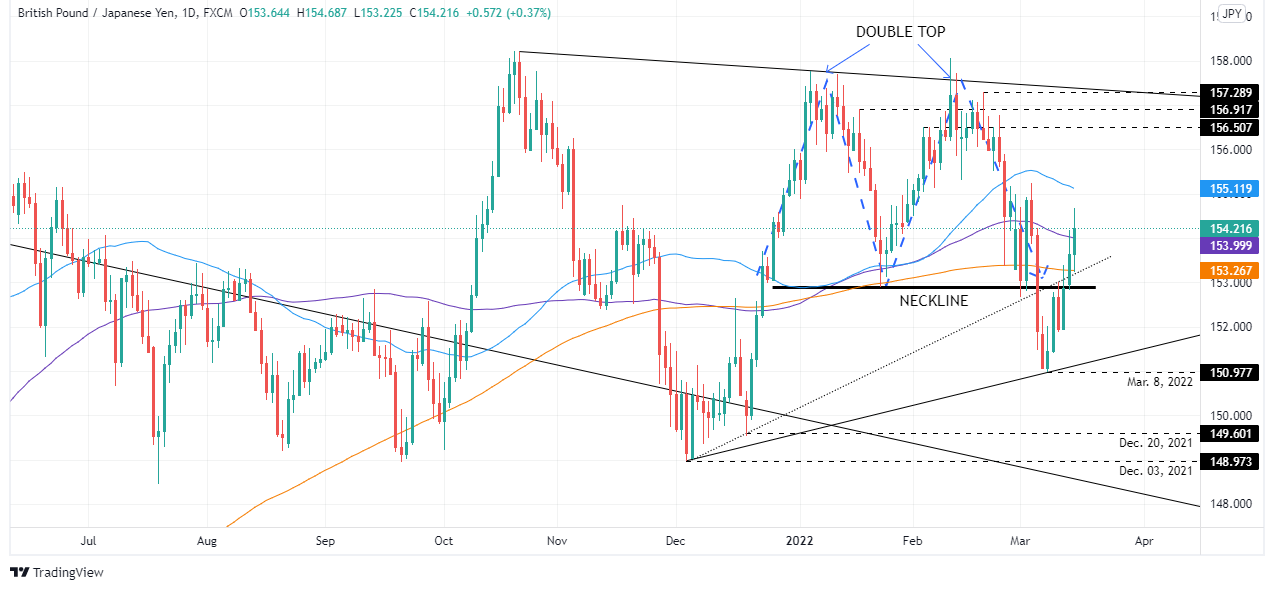

GBP/JPY extends its rally to three straight days, thus negating the double-top chart pattern, as the cross-currency pair turns bullish on a positive UK employment report amid a mixed market mood. At the time of writing, the GBP/JPY is trading at 154.21.

Late in the New York session, the market mood is “somewhat” positive, as portrayed by US equities trading with gains. In the FX space, safe-haven peers trade softer as the trading day progresses.

Goodish UK data and a “hawkish” BoE to lift the pound

Data-wise, the UK reported employment figures, which beat expectations, thus raising the prospects of the GBP. Along with last Friday’s solid GDP data, those figures and the Bank of England (BoE) third rate hike on Thursday would keep the GBP buoyant against the JPY.

Overnight, the GBP/JPY climbed near the 154.50 area but plunged 100-pips, though recovered on risk-appetite near the 154.50 area, which is a strong resistance level, difficult to break for GBP/JPY bulls.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY is neutral-upward biased. The longer time-frame daily moving averages (DMAs) like the 100 and the 200-DMAs reside below the spot price, a sign of bullishness in the pair. Contrarily the 50-DMA is at 155.11, above the spot price, and due to the last couple of candles, the 154.60-155.00 area would be a solid resistance area to overcome.

Upwards, the GBP/JPY first resistance would be March 15 high at 154.68. Breach of the latter would expose the 155.00 mark but beware of a possible consolidation in the 154.60-155.00 range. Nevertheless, a decisive break of the former would expose 156.00.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.