- Analytics

- News and Tools

- Market News

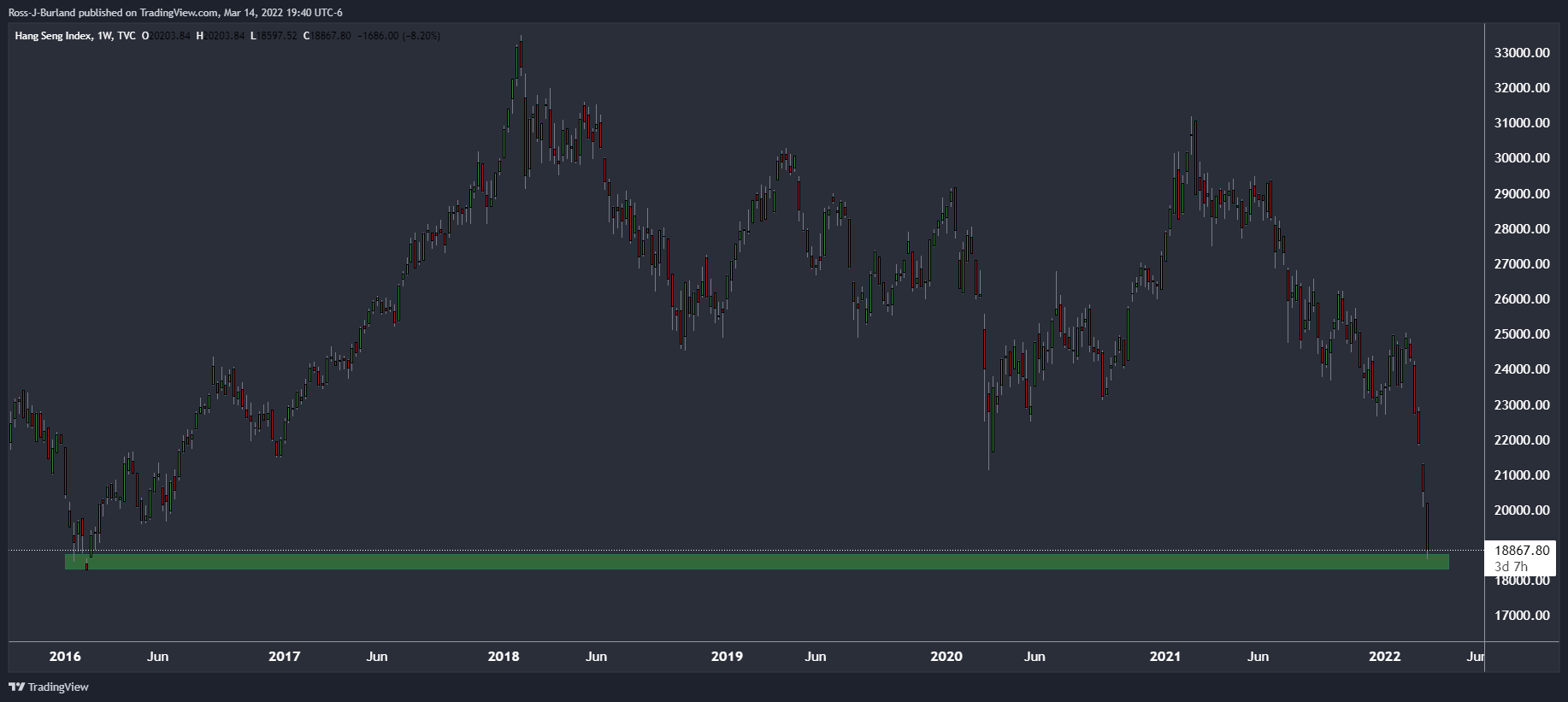

- PBOC leaves its MLF rate unchanged, Chinese stocks selling off to lowest levels since 2016

PBOC leaves its MLF rate unchanged, Chinese stocks selling off to lowest levels since 2016

The Peoples Bank of China has left its MLF rate unchanged which has weighed on Chinese stocks in the open as a 5 to 10 basis point cut was priced in.

China's central bank was expected to roll over maturing medium-term policy loans and cut borrowing costs for the second time this year, a Reuters poll showed on Monday, as the a fresh wave of coronavirus infections weighs on the broader economy.

Reuters reported that twenty-nine out of the 49 traders and analysts, or 59% of all participants, predicted a reduction to the interest rate on one-year medium-term lending facility (MLF) when the central bank is set to renew 100 billion yuan ($15.75 billion) worth of such loans on Tuesday.

Meanwhile, China’s government has ordered a province of 24 million people into lockdown as it tries to contain the new outbreak that has spread to multiple locations. The risk to markets is that the lockdowns could trigger shock waves across global supply chains.

At the time of writing, the Hang Seng Index is down 3.82%, marking the lest levels since 2016:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.