- Analytics

- News and Tools

- Market News

- GBP/JPY Price Analysis: Rallies and reclaim the 200-DMA but stalls at the 100-DMA

GBP/JPY Price Analysis: Rallies and reclaim the 200-DMA but stalls at the 100-DMA

- The GBP/JPY advances as the Bank of England (BoE’s) third rate hike looms.

- As safe-haven peers dropped, a risk-off market mood was not an excuse for the British pound to climb.

- GBP/JPY Price Forecast: Shifts from a downward bias to a neutral though upside risks remain.

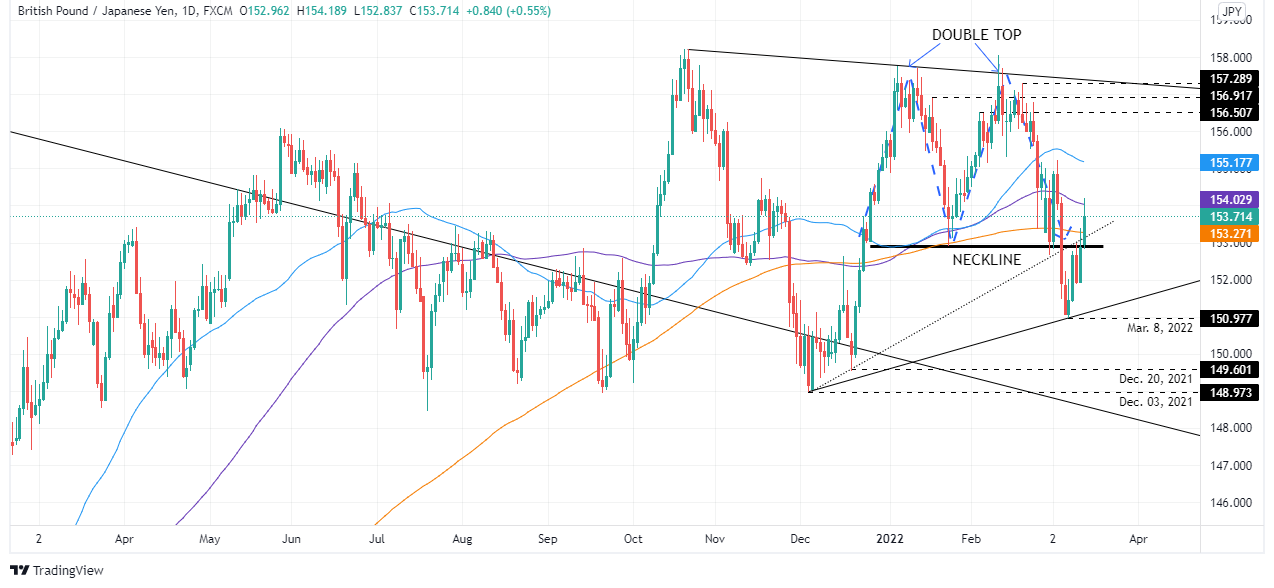

The British pound breaks above a double-top neckline around 152.94 and rallies sharply but stalled at the 100-day moving average (DMA) around 154.09, which appears to be a sudden shift in the market mood, from mixed to negative, as reflected by US equities. At press time, the GBP/JPY is trading at 153.71.

The risk-sensitive GBP rallies on positive market sentiment

Overnight, an upbeat market mood originated the rally of the GBP/JPY. Alongside market sentiment, the Bank of England (BoE) would hike rates for the third consecutive meeting, which would lift the bank’s rate from 0.50% to 0.75%, on Thursday, boosting sterling.

Analyzing the previous two-sessions price action, the GBP/JPY opened near the session’s lows and climbed steadily, reaching near the London Fix, the daily’s high at 154.18, retreating below the 154.00 mark afterward.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY shifted from a downwards to a neutral bias. Why? Failure of GBP/JPY bears to keep the spot under the neckline at 152.94 exacerbated an upward move, breaking on its way the 200 and 100-DMA, each at 153.07 and 154.03, respectively. However, if GBP/JPY bulls want to regain control, they need a daily close above the 100-DMA.

Upwards, the GBP/JPY first resistance would be the confluence of the 100-DMA and the 154.00 mark. Breach of the latter would expose the 155.00 mark, immediately followed by the 50-DMA at 155.17. Otherwise, the GBP/JPY first support would be the 200-DMA at 153.27. A sustained break would expose the double-top neckline at 1.52.94, near the 153.00 mark, followed by the 152.00 psychological level.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.