- Analytics

- News and Tools

- Market News

- EUR/USD weaker, drops to 1.0930 post-NFP

EUR/USD weaker, drops to 1.0930 post-NFP

- EUR/USD keeps the bearish note intact below 1.1000.

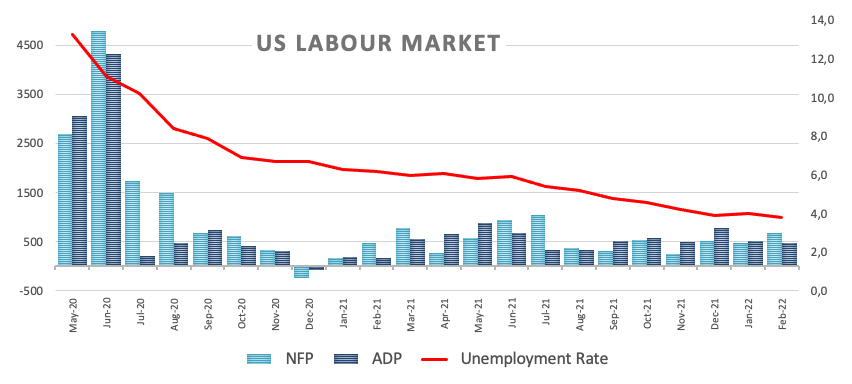

- US Non-farm Payrolls rose by 678K jobs in February.

- The unemployment rate ticked lower to 3.8%.

The selling interest around the single currency remains well and sound at the end of the week and drags EUR/USD to the 1.0930 area in the wake of US NFP.

EUR/USD in fresh lows around 1.0930

EUR/USD keeps the negative stance on Friday after the US economy created 678K jobs during February, bettering expectations for a gain of 400K jobs. The January reading was revised to 481K (from 467K).

Further data showed the jobless rate eased to 3.8% and the critical Average Hourly Earnings – a proxy for inflation via wages – came flat on a monthly basis and expanded 5.1% over the last twelve months. Another key gauge, the Participation Rate, improved to 62.3%.

EUR/USD levels to watch

So far, spot is losing 1.13% at 1.0940 and faces the next up barrier at 1.1192 (10-day SMA) followed by 1.1309 (55-day SMA) and finally 1.1395 (weekly high Feb.16). On the other hand, a drop below 1.0924 (2022 low Mar.4) would target 1.0900 (round level) en route to 1.0870 (low May 25 2020).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.