- Analytics

- News and Tools

- Market News

- AUD/USD bulls run into a wall of resistance, eyes turn to 0.73 the figure

AUD/USD bulls run into a wall of resistance, eyes turn to 0.73 the figure

- AUD/USD is meeting resistance and the focus is back to the downside towards 0.73 the figure.

- Ukraine crisis and commodities are in focus, driving the price.

AUD/USD is firm in the late US session as bulls step in to slow down the bearish correction on the hourly chart. However, there are prospects for further resistance as illustrated in the technical analysis below. Meanwhile, the Australian dollar sped to the highest level since November 2021 vs the US dollar as monster gains in commodity prices looked set to shower Australian exporters in cash.

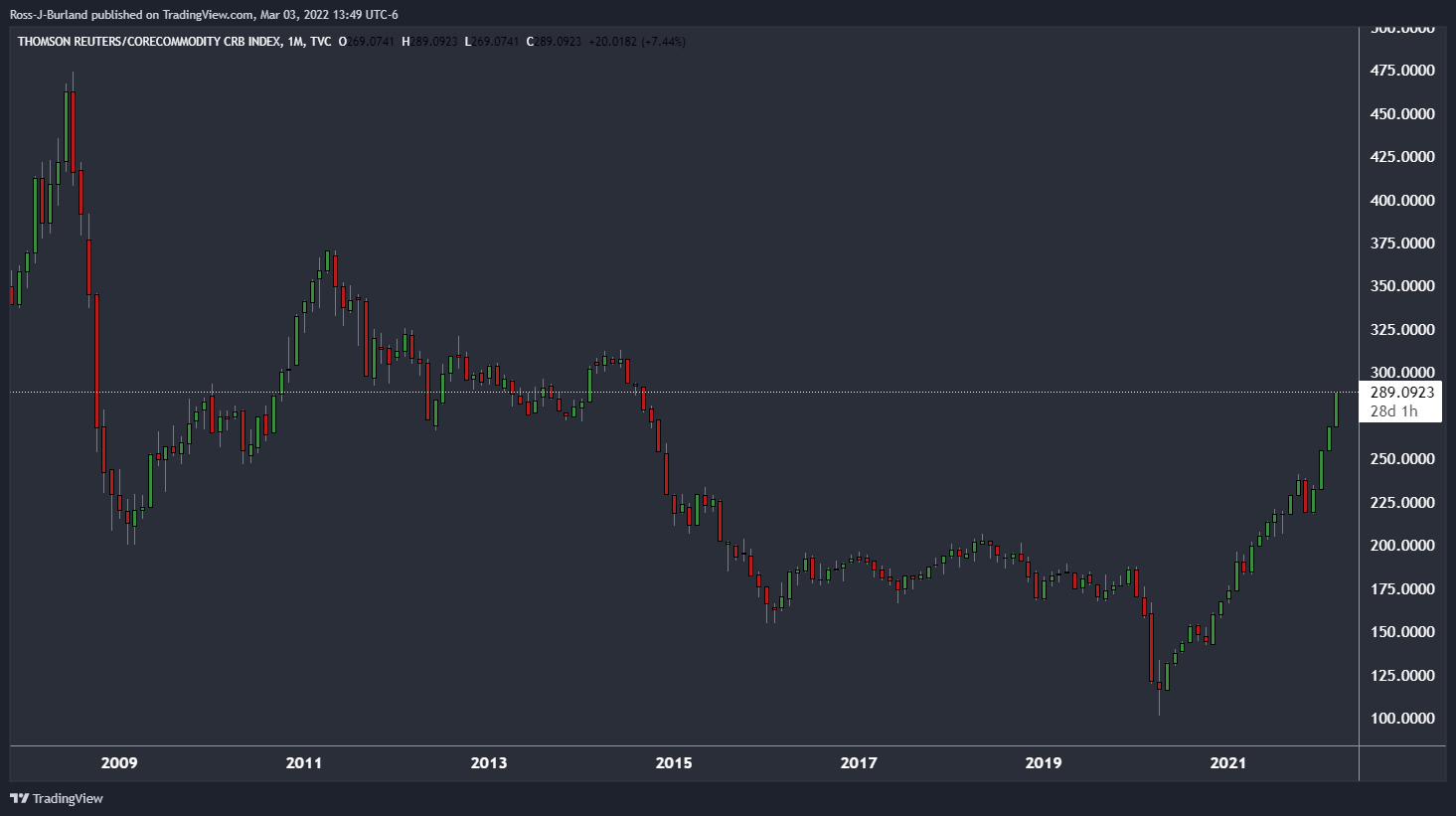

Commodities have taken off, as illustrated in the CRB Index below:

Ever-tightening sanctions on Russia have markets fearing major shortages in oil and energy, metals and wheat.

''Coal contracts rose between 25% and 50% on Wednesday as buyers sought to replace Russian supplies. The Australian government said it was helping countries connect with local coal producers to fill the gap,'' Reuters reported.

This brings us to Australia's surplus that was reported earlier in the week which ballooned to A$12.9 billion ($9.39 billion) on higher coal and iron ore earnings. This was the largest surplus on record and well above market forecasts of A$9 billion,'' Reuters explained and there is more in the pipeline according to Taylor Nugent, an economist at NAB. "Records will be broken in coming months if prices are sustained." Bigger earnings mean bigger flows out of the greenback into the Aussie as US dollar earnings are converted.

Meanwhile, as of yet, Russian troops have not made it to the Ukraine capital Kyiv as the invasion of Ukraine entered its eighth day Thursday. However, the mayor of Kherson said the strategic port city in Ukraine's south had been "captured" by Russian forces. The apparent capture of Kherson, situated on the Dnieper River, marks the first major city to fall into Russian hands as Ukrainians continue to defend key hubs across their country.

The focus has remained on a number of strategic cities, including the capital, Kyiv, Ukraine's second-biggest city, Kharkiv, and another key port city, Mariupol. In more positive news, Russia and Ukraine are agreeing to a ceasefire in heavily embattled areas where humanitarian corridors will be developed to allow the evacuation of its citizens from the bombed cities.

AUD/USD technical analysis

The price is stalling on the bid and following another failed attempt to rally, meeting the 61.8% Fibonacci level, the focus is back to the downside towards 0.73 the figure.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.