- Analytics

- News and Tools

- Market News

- When is the RBA and how will it affect AUD/USD?

When is the RBA and how will it affect AUD/USD?

- RBA is expected to leave the target cash rate at 0.10%.

- AUD risks are skewed higher if the outcome leans more hawkish than dovish.

The Reserve Bank of Australia is slated for 0330 GMT today where, although no changes to policy settings are expected with the target cash rate staying at 0.10%, the focus will be the rhetoric concerning the timing of the tightening cycle.

The fourth quarter '21 wages were in line with its forecasts and this likely means that the central bank will reiterate that it can be 'patient'.

''The Q4'21 wages outcome makes a Jun'22 hike less likely. It's more likely the RBA shifts to a hawkish stance at that meeting and delivers a hike in Aug as we expect,'' analysts at TD Securities said.

How might the decision affect AUD/USD?

AUD risks are skewed higher if the outcome leans more hawkish than dovish, reflecting well-populated short positions which edged slightly lower according to the past Commitment of Traders report. The Aussie has been taking its cues from the external forces, such as higher inflation prospects, commodity prices and the Ukraine crisis. Risk has been mixed which has enabled the Aussie to chase higher levels at times of a recovery in the global stock markets.

Overall, the outcome would be expected to support AUD the Bank has just announced a move away from pandemic policy OMO settings. Moreover, Federal Reserve watchers have marked down their expectations of a 50bps hike at the forthcoming meeting which would be expected to keep a lid on the US dollar.

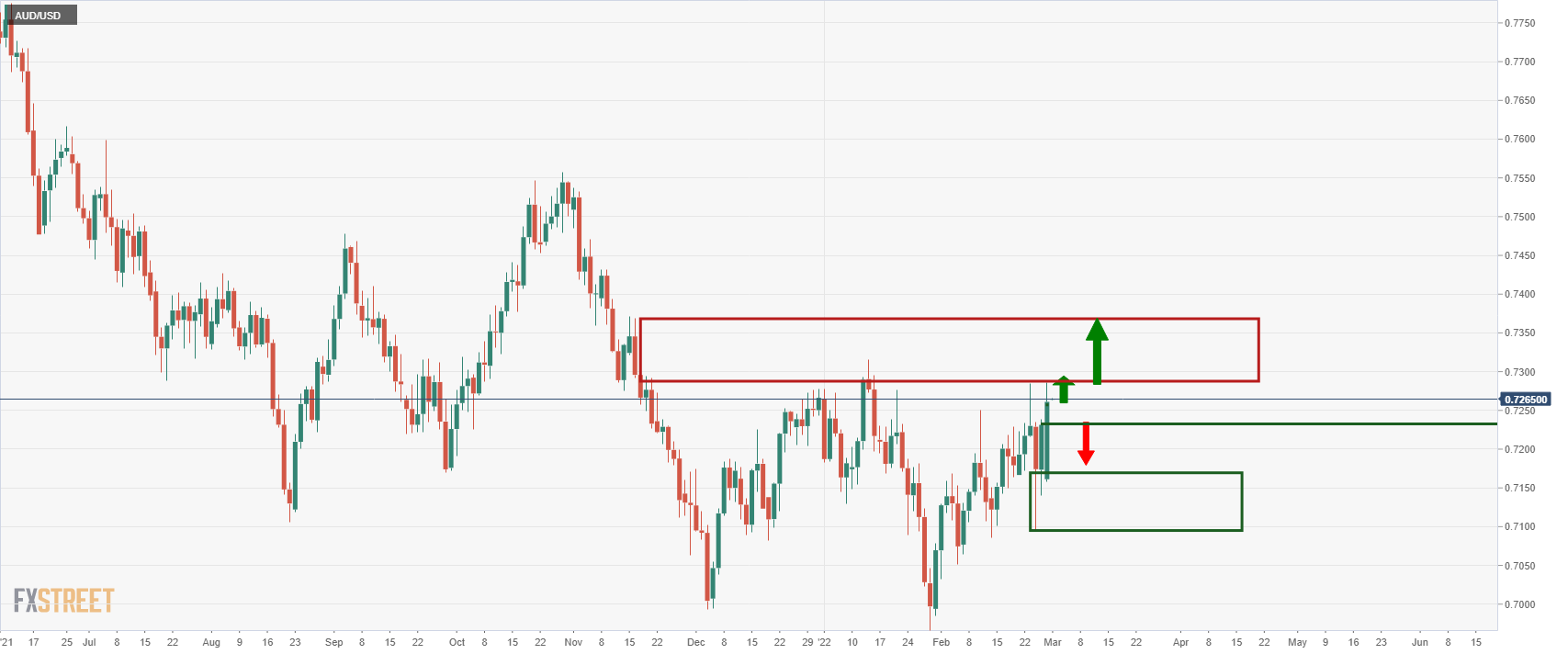

On the 15-min chart below, we can see that there is scope for a move into the 0.7280s to mitigate the imbalance of price and likely higher from there...

AUD/USD daily chart's prospects are bullish at this juncture with the 0.7350s eyed. However, a drop below 0.7230 will put the barton in the bear's hands again.

About the RBA

Decisions regarding this interest rate are made by the Reserve Bank Board, and are explained in a media release which announces the decision at 2.30 pm after each Board meeting.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.