- Analytics

- News and Tools

- Market News

- USD/CAD Price Analysis: Bears weighing the price of oil vs equities, 1.2640 eyed

USD/CAD Price Analysis: Bears weighing the price of oil vs equities, 1.2640 eyed

- The price has formed a weekly pennant and the rising wedge could be subject to a breakout.

- Russian invasion could occur within 48hrs according to the US, risk-off is hurting high beta currencies.

The Canadian dollar was trying to strengthen against its US counterpart on Wednesday as global financial markets started off calm in Asia. However, risk sentiment flipped on its head with investors waiting to see Russian President Vladimir Putin's next move after he sent troops into separatist regions of Ukraine.

The news fell in just after the opening on Wall Street that Ukraine had planned to declare a state of emergency after warnings from the US that Russia will invade within 48hrs. Further reports enhanced the risk-off moves that cited convoys of military equipment moving towards Donetsk in eastern Ukraine from the direction of the Russian Frontier.

Additionally, the price of oil has rallied on the news that the US will sanction the company building Russia's Nord Stream 2 pipeline. This leaves the outlook for CAD uncertain considering the high beta status it holds to global equities, commodity prices and specifically to oil:

-637812367521912757.png)

USD/CAD daily chart

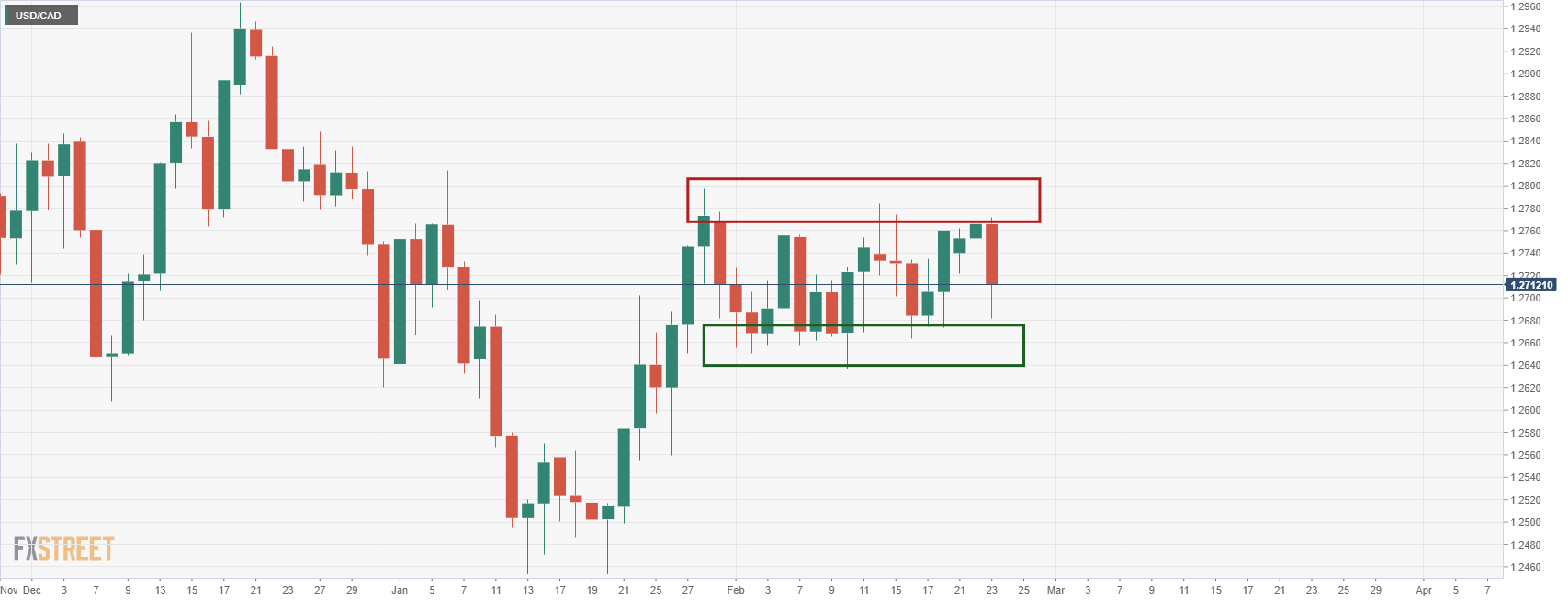

From a technical perspective, the picture is no clearer given the price is stuck between a sideways daily channel as follows:

1.2640 is a key support level that guards a break of critical weekly structure.

USD/CAD weekly chart

However, the weekly chart may hold some clues:

The price has formed a pennant and given the current trajectory to the upside, the bias would be for a bullish breakout. However, when scaling out, the broader trend is bearish and the rising wedge could be subject to a breakout to target as low as 1.23 the figure:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.