- Analytics

- News and Tools

- Market News

- EUR/USD looks bid and retests 1.1350 on dollar weakness

EUR/USD looks bid and retests 1.1350 on dollar weakness

- EUR/USD extends Tuesday’s gains to the mid-1.1300s.

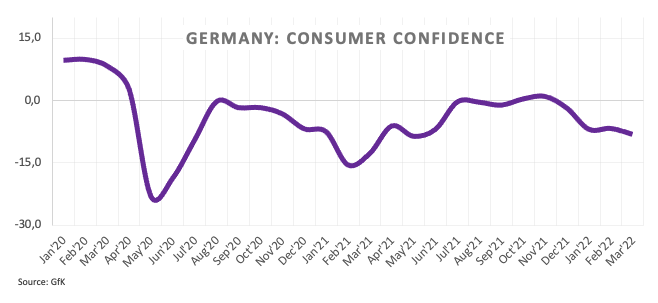

- Germany GfK Consumer Confidence worsened to -8.1 in March.

- ECB’s Holtzmann opened the door to a summer rate hike.

The European currency extends the recent optimism and lifts EUR/USD to the 1.1350 region midweek.

EUR/USD bolstered by risk appetite

The appetite for riskier assets remains well and sound among market participants and sustains the move higher in EUR/USD for the second session in a row on Wednesday.

The bid bias in the euro, in the meantime, looks underpinned by another uptick in yields of the German 10y Bund, this time retesting the vicinity of the 0.27% zone and following the equally decent improvement in the rest of yields in the global cash markets.

The pair also derived further strength from hawkish comments by ECB’s Board member R.Holtzmann, who did not rule out hiking rates before the current bond-buying programme finishes. He suggested a rate rise by the summer and another potential one towards end of the year.

Earlier in the session, Germany’s Consumer Confidence measured by GfK dropped to -8.1 for the month of March (from -6.7) and final inflation figures in the broader Euroland showed the headline CPI rose 5.1% YoY in January and 2.3% when it comes to the Core CPI.

What to look for around EUR

EUR/USD continues to look to the geopolitical scenario and the risk appetite trends for near-term direction. On this, further deterioration of the Russia-Ukraine front should keep the pair under pressure via a stronger dollar, although the ongoing bounce in the appetite for riskier assets remains supportive of further recovery. In the meantime, the improvement in the pair’s outlook appears underpinned by fresh speculation of a potential interest rate hike by the ECB probably sooner than many anticipate, higher German yields, persevering elevated inflation and a decent pace of the economic activity and other key fundamentals in the region. The threat to this view, as usual, comes from the Fed and a potential tighter-than-expected start of the normalization of its monetary conditions.

Key events in the euro area this week: Germany GfK Consumer Confidence, EMU Final January CPI (Wednesday) – Eurogroup Meeting, Germany Final Q4 GDP, EMU Final Consumer Confidence, ECB Lagarde (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is gaining 0.25% at 1.1350 and faces the next up barrier at 1.1395 (weekly high Feb.16) followed by 1.1487 (200-week SMA) and finally 1.1494 (2022 high Feb.10). On the other hand, a drop below 1.1287 (weekly low Feb.22) would target 1.1279 (weekly low Feb.14) en route to 1.1186 (monthly low Nov.24 2021).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.