- Analytics

- News and Tools

- Market News

- AUD/JPY Price Analysis: Bulls look firmer after a follow-up buying from 82.12

AUD/JPY Price Analysis: Bulls look firmer after a follow-up buying from 82.12

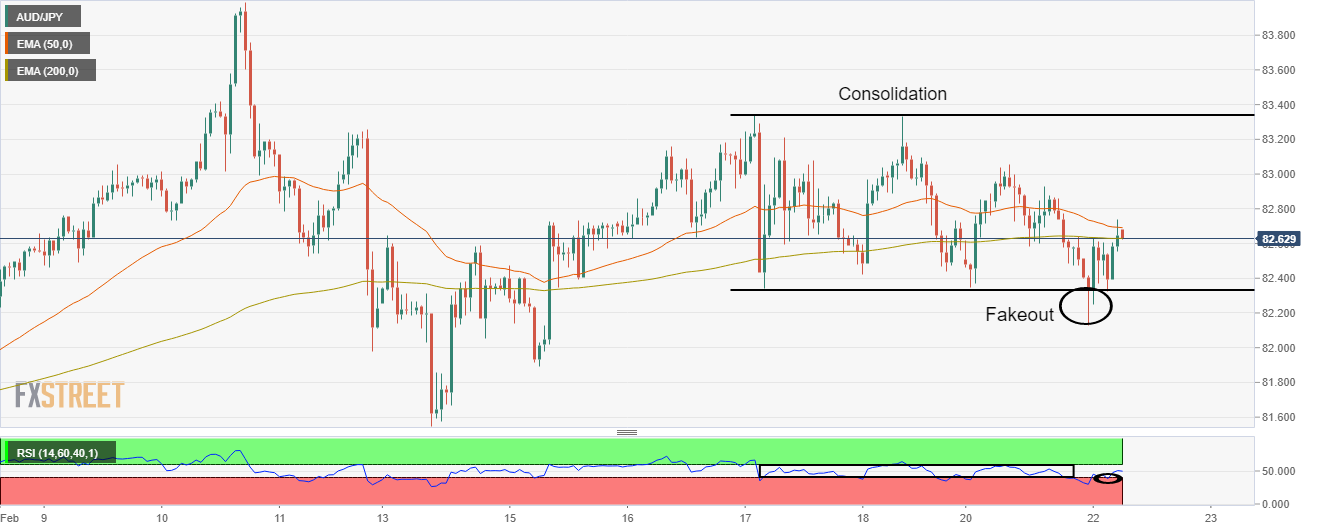

- AUD/JPY has rebounded from 82.12, which has turned into a fakeout.

- The RSI (14) indicates that the asset is back into the woods but with a bullish bias.

- Bulls need to surpass 50-EMA decisively to gain strength.

The AUD/JPY has witnessed a rebound from Tuesday’s low at 82.12. In the early Asian session, the cross has observed follow-up buying after slipping below the same lows of Monday and Thursday’s trading sessions around 82.34.

On an hourly scale, AUD/JPY has been trading in a range of 82.33-83.34 since Thursday. The cross has tried to augment the range breakout by slipping below 82.33 in the early Asian session. However, the asset has attracted significant bids later and a follow-up buying has turned the breakout into a fakeout.

Usually, a fakeout seems more decisive and confident to breach the range on the opposite side. This may underpin bulls for further upside ahead.

The 50-period and 200-period Exponential Moving Averages (EMA) are trading flat, showing no signs of a clear bull ride yet.

While, the Relative Strength Index (RSI) (14) has reclaimed its previous oscillating range of 40.00-60.00, which indicates that the asset is back into the woods but with a bullish bias.

Now, bulls are eyeing the 50- EMA, which is trading at 82.70. After surpassing the 50-EMA, AUD/JPY may rally towards Monday’s high at 83.05 and Friday’s high at 83.33 respectively.

On the flip side, bulls could lose their grip if the cross slips below 82.33 and additional losses could be witnessed toward Tuesday’s low at 82.12 ahead of February 15 low at 81.90.

AUD/JPY hourly chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.