- Analytics

- News and Tools

- Market News

- Gold Price Forecast: All ears to the ground for announcements from the Kremlin

Gold Price Forecast: All ears to the ground for announcements from the Kremlin

- Gold is subdued as markets await developments from the Kremlin.

- Russia's President Putin is to address the nation at 1800 GMT which could be market impactful.

Gold has been trapped in a sideways consolidation in Monday's range and between the toing and froing of headlines centred around the Russian/Ukraine drama. It is the zero hour for diplomacy and the Kremlin has regretfully said there were no concrete plans for a summit over Ukraine between the Russian and US presidents. The safe-havens, such as gold and the US dollar, are benefitting, thus trapping the yellow metal in a risk-off boundary.

At the time of writing, XAU/USD is flat at $1,895.92 and has travelled between $1,887.66 and $1,908.32 on the day so far. Reports that Russian president Vladimir Putin and US president Joe Biden had agreed in principle to a summit had sparked up a risk-on vibe in the opening hours of the week, weighing on precious metals.

US president Joe Biden will participate in the G7 meeting this Thursday, a White House spokesman said. The official also said, however, that the US is prepared to impose swift and severe consequences if Russia invades, adding that Russia appears to continue preparations for a full-scale assault on Ukraine very soon.

Putin to address the nation

The focus for the immediate future will be on Putin at the top of the hour where he is scheduled to address the nation. Markets will be on the edge of their seats to understand whether Putin has decided today whether to recognise the independence of two breakaway regions in eastern Ukraine.

The BBC wrote that ''the Donetsk and Luhansk regions have been contested by Ukraine and Russia-backed rebels for years, with regular violence despite a ceasefire agreement.

Leaders of both regions asked Russia to recognise their independence on Monday.

But Western powers fear such a move could be used as a pretext for Russia to invade its neighbour.

Since 2019, Russia has issued large numbers of passports to people living in the two regions.

Analysts say that if the two regions were recognised as independent, Russia might send troops into Ukraine's east under the guise of protecting its citizens.''

Market implications

Should there be signs of the infiltration of troops into the region, such an escalation will be a big blow for markets and gold would be expected to benefit on the knee-jerk s trend-followers and speculators reengage.

Gold, technical analysis

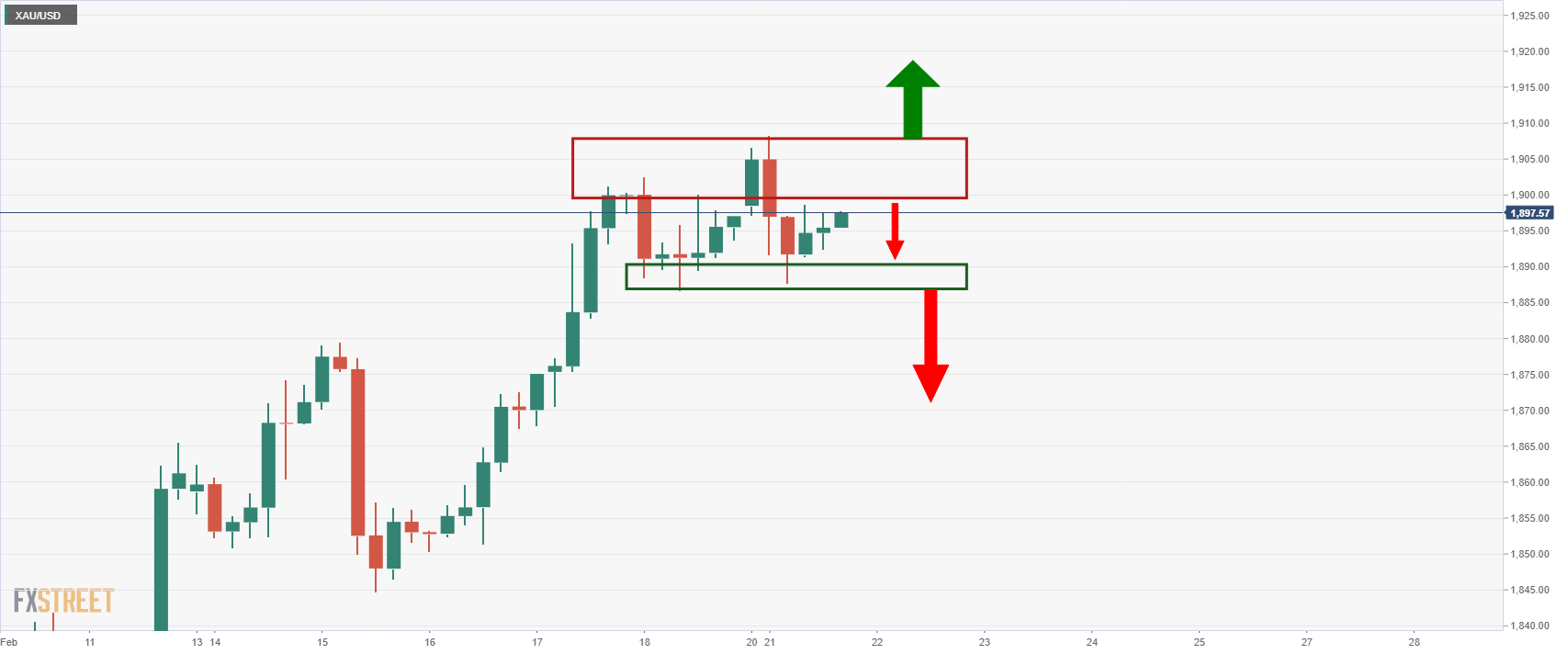

The price is trapped in 4-hour range traders are waiting for the breakout, one way or the other.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.