- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls keep eyes on $1,916 amid Ukraine crisis – Confluence Detector

Gold Price Forecast: XAU/USD bulls keep eyes on $1,916 amid Ukraine crisis – Confluence Detector

- Gold price remains underpinned by geopolitics, easing 50bps March fed rate hike bets.

- Blinken-Lavrov meeting next week sparks a ray of hope but tensions still persist.

- Gold Price Forecast: XAU/USD remains a ‘buy the dip’ trade, diplomacy talks eyed.

Gold price remains at the mercy of the geopolitical developments concerning the Russia-Ukraine crisis so far this week. The expectations of an imminent Russian invasion of Ukraine has eased, in anticipation of the planned diplomatic talks between the US and Russian officials, have cheered investors and capped gold’s upside. Bulls are, however, likely to regain poise, as the obscurity on the Ukrainian border still persists, keeping gold’s safe-haven appeal underpinned. Further, dialling down of 50-bps March Fed rate hike bets have also aided the metal’s recent upsurge to eight-month highs above $1,900.

Read: How the coming Fed hiking cycle will differ – And why it matters

Gold Price: Key levels to watch

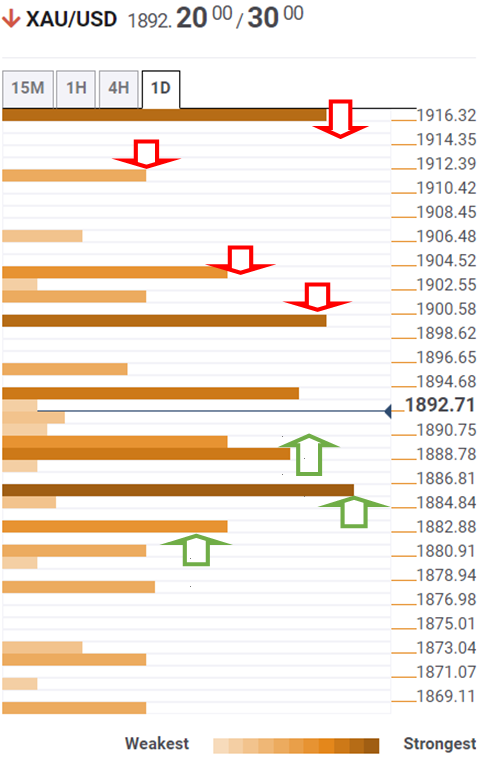

The Technical Confluences Detector shows that gold price has bounced off crucial support at $1,888, which is the convergence of the Fibonacci 38.2% one-day and the Bollinger Band one-day Upper.

So long as bulls defend the latter, the renewed upside could extend towards the June 2021 highs of $1,916.

Ahead of that target, gold buyers will need to recapture a strong supply zone around $1,900-$1,903 – where the Fibonacci 161.8% one-month, the previous day’s high and pivot point one-week R2 coincide.

The next relevant bullish stop is seen at $1,911, the pivot point one-day R1.

If the abovementioned powerful cushion gives way, then the correction could resume towards the confluence of the SMA10 four-hour and pivot point one-month R2 at $1,885.

Further south, the demand zone around $1,881 will come into play, which is the meeting point of the Fibonacci 61.8% one-day and the pivot point one-week R1.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.