- Analytics

- News and Tools

- Market News

- USD/TRY remains side-lined near 13.60 post-CBRT

USD/TRY remains side-lined near 13.60 post-CBRT

- USD/TRY extends its consolidation theme in the mid-13.00s.

- The CBRT kept the One-Week Repo Rate unchanged at 14.00%.

- The CBRT stands ready to support the “liraization” strategy.

The Turkish lira depreciates marginally and lifts USD/TRY back above the 13.60 level, although always within the broad-based range bound theme prevailing since mid-January.

USD/TRY unfazed by CBRT decision

USD/TRY extends the choppy activity so far this week and it is no exception on Thursday, after the Turkish lira stayed mostly apathetic on the decision by the Turkish central bank (CBRT) to leave the One Week Repo Rate constant at 14.00%.

The central bank deemed as appropriate leaving the policy rate unchanged against the backdrop of the strong economic recovery in Turkey, which was also helped by solid external demand.

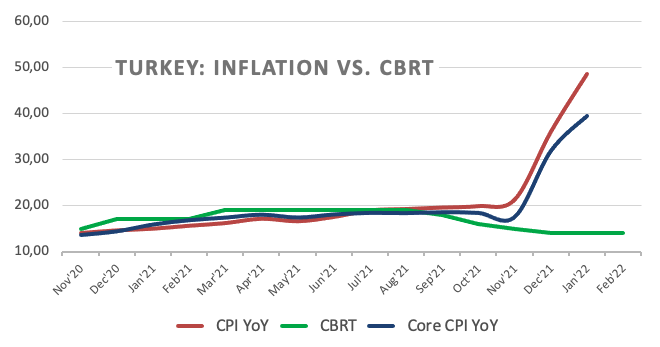

The CBRT reiterated that elevated domestic inflation comes in response to “pricing formations that are not supported by economic fundamentals”, higher commodity and energy prices as well as supply disruptions and demand issues.

In addition, the central bank stressed its readiness to keep supporting the “liraization” strategy (whatever that means) in order to achieve the medium-term 5% inflation goal amidst a permanent drop in inflation.

What to look for around TRY

The pair keeps its multi-week consolidative theme well in place around 13.50/60. While skepticism keeps running high over the effectiveness of the ongoing scheme to promote the de-dollarization of the economy, the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are expected to maintain the lira under scrutiny for the time being.

Key events in Turkey this week: CBRT interest rate decision (Thursday) – Consumer Confidence (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 0.26% at 13.6280 and a drop below 13.4317 (weekly low Feb.11) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 13.6767 (weekly high Feb.15) seconded by 13.9319 (2022 high Jan.10) and then 18.2582 (all-time high Dec.20).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.