- Analytics

- News and Tools

- Market News

- EUR/USD comes under downside pressure and revisits 1.1320

EUR/USD comes under downside pressure and revisits 1.1320

- EUR/USD drops to 2-day lows near 1.1320.

- Risk aversion weighs on the pair and supports the dollar.

- ECB-speak, US weekly Claims, Philly Fed Index next on tap.

The resumption of the risk-off mood among investors lends fresh oxygen to the dollar and forced EUR/USD to retreat to the 1.1320 region, or 2-day lows, on Thursday.

EUR/USD weaker on geopolitical concerns

EUR/USD grinds lower and reverses two consecutive sessions with gains in the second half of the week on renewed geopolitical jitters stemming from the Russia-Ukraine conflict. Indeed, fresh risk aversion irrupted in the markets, motivating the demand for the greenback to revive and put the pair under moderate downside pressure.

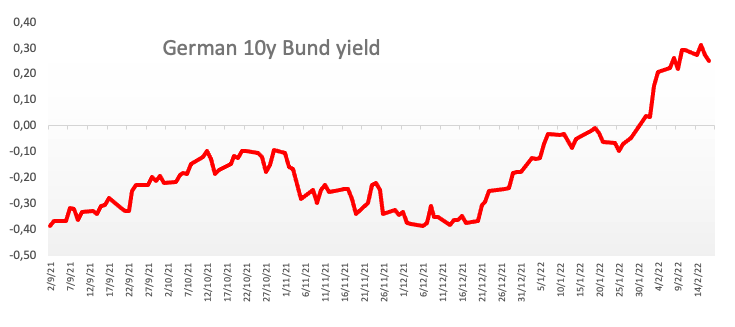

The knee-jerk in spot comes in tandem with further correction in yields of the key German 10y bund, which retreat to the 0.25% region, or multi-day lows, so far on Thursday.

Later in the session, ECB’s Board members I.Schnabel and P.Lane are due to speak. In the NA session, the focus of attention will be on the regional manufacturing gauge released by the Philly Fed seconded by usual Initial Claims and results from the housing sector.

What to look for around EUR

EUR/USD now seems to have met decent resistance around the 1.1400 zone amidst some loss of momentum in the relief rally in combination with the resumption of the geopolitical-led risk aversion. Looking at the broader scenario, the improvement in the pair’s outlook appears underpinned by fresh speculation of a potential interest rate hike by the ECB at some point by year end, higher German yields, persevering elevated inflation and a decent pace of the economic activity and other key fundamentals in the region

Key events in the euro area this week: Flash EMU Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is retreating 0.12% at 1.1358 and faces the next up barrier at 1.1395 (weekly high Feb.16) followed by 1.1491 (200-week SMA) and finally 1.1494 (2022 high Feb.10). On the other hand, a drop below 1.1323 (low Feb.17) would target 1.1279 (weekly low Feb.14) en route to 1.1186 (monthly low Nov.24 2021).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.