- Analytics

- News and Tools

- Market News

- EUR/USD Price Analysis: Bulls seek out territory through 1.14 the figure, eye 61.8% golden ratio

EUR/USD Price Analysis: Bulls seek out territory through 1.14 the figure, eye 61.8% golden ratio

- EUR/USD bulls taking on bearish commitments as euro defies gravity.

- The 61.8% ratio is within earshot, but bears are lurking.

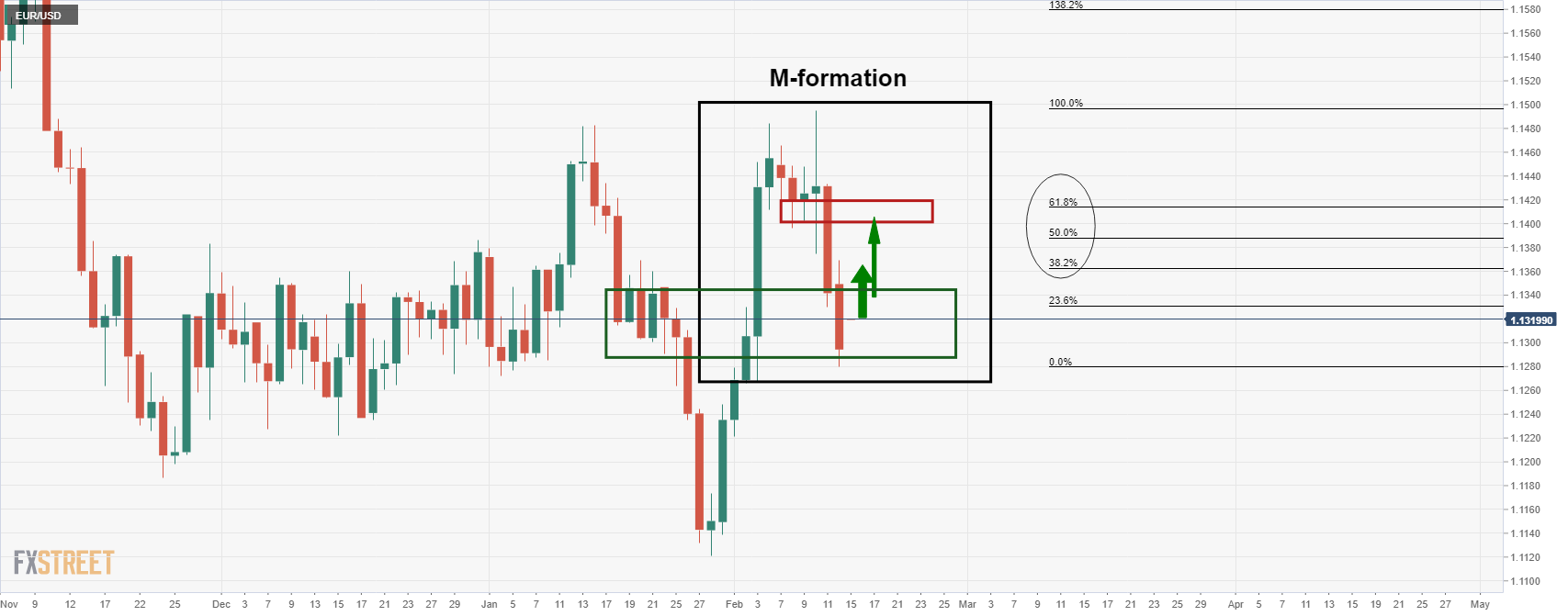

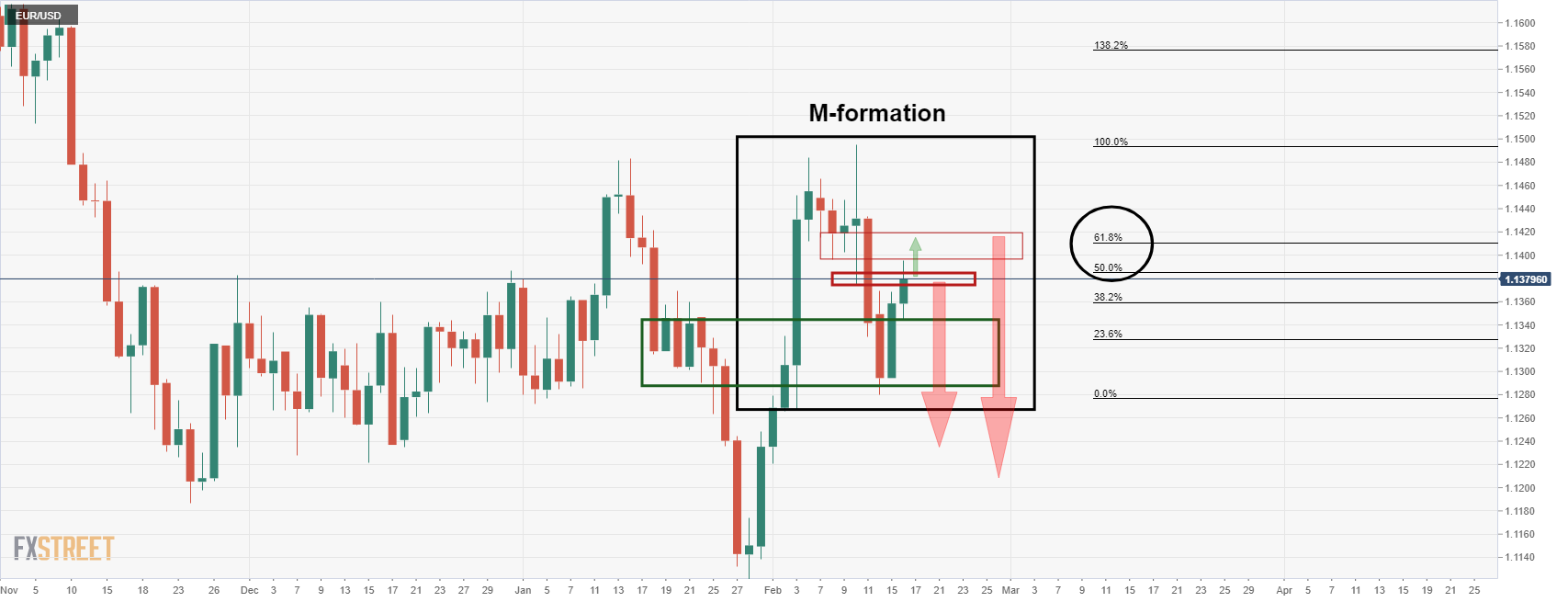

As per a series of analyses this week, EUR/USD Price Analysis: Bulls eye 61.8% golden ratio, but bears are in the slipstream, and EUR/USD bulls tread around with caution in a field of land mines and disruptive Russian headlines, the price stays on course as follows:

EUR/USD prior analysis

The M-formation was regarded as a reversion pattern with the price expected to correct towards the neckline of the 'M'...

While technical, the above prior analysis had also taken into account the improved, yet tentative, risk sentiment reverberating around global markets following prospects of the de-escalation of an imminent Russian invasion of Ukraine ...

EUR/USD live market

The price has reached a 50% mean reversion in recent trade and the tip of the M-formation's neckline wick, a prior daily low at 1.1396. The 61.8% ratio is near 1.1413 but the Russian headlines are a major distraction from the technicals. The bias, considering global inflationary pressures, a hawkish Federal Reserve, bets on front-loaded tightening could keep losses to a minimum. Therefore, the path of least resistance at this juncture is weighed to the downside, as illustrated in the above analysis.

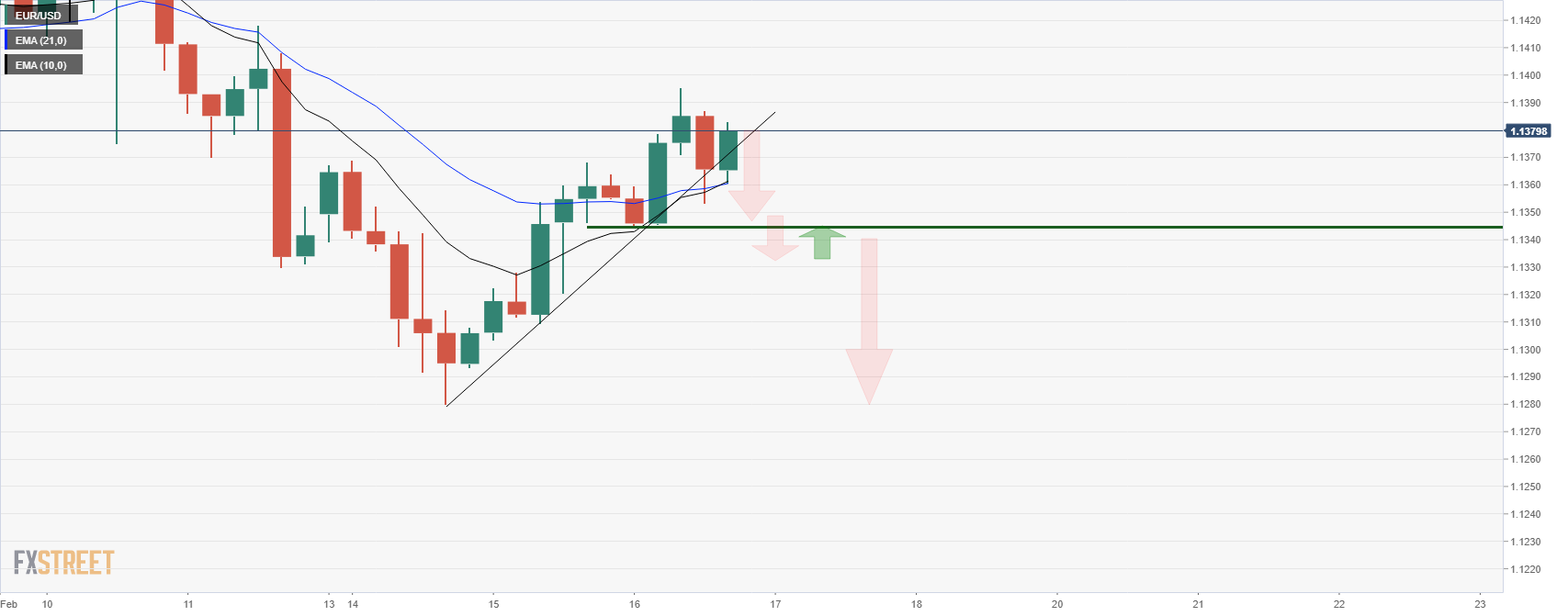

EUR/USD H4 chart

Bears will be monitoring for signs of exhaustion in the correction from lower time frames. A break below 1.1345 on the H4 chart could be the signal:

However, so long as the 10 EMA threatens a bullish cross-up above the 21-EMA, there are prospects of an upside continuation as overall momentum is in the hands of the bulls still. This would eventuate in a test through 1.14 the figure, moving in on the 61.8% ratio as illustrated above. Nevertheless, unless there is a diplomatic breakthrough between leaders of NATO and Russia, (unlikely that this can be resolved so soon), then the euro will remain vulnerable.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.