- Analytics

- News and Tools

- Market News

- US Dollar Index remains under pressure below 96.00 ahead of data, FOMC

US Dollar Index remains under pressure below 96.00 ahead of data, FOMC

- DXY stays on the defensive in the sub-96.00 zone.

- US yields correct a tad lower from recent peaks.

- The release of the FOMC Minutes will be in the limelight.

The greenback, in terms of the US Dollar Index (DXY), extends Tuesday’s pullback to the area below the 96.00 yardstick so far on Wednesday.

US Dollar Index focuses on FOMC, risk trends

The index retreats for the second session in a row and keeps challenging the 96.00 zone on the back of persistent appetite for the risk complex as well as the knee-jerk in US yields, all ahead of the opening bell in Euroland midweek.

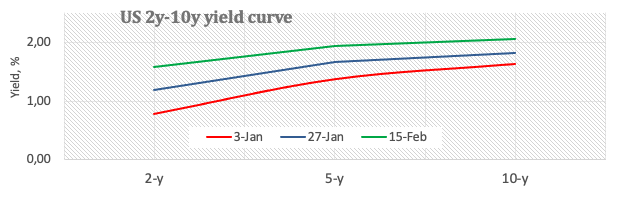

Indeed, US yields come under some mild downside pressure, although they maintain the upper end of the range close to recent tops across the curve.

The dollar, in the meantime, continues to suffer positive news from the Russia-Ukraine front, although not without rising cautiousness, which has been sustaining the pick-up in the risk-on trade in past hours.

In the US calendar, the publication of the FOMC Minutes will take centre stage later in the NA session, although Retail Sales will also grab attention along with the weekly MBA Mortgage Applications.

What to look for around USD

The resumption of the appetite for riskier assets weighed on the greenback and forced DXY to recede from recent tops. However, the ongoing corrective downside is seen as temporary only, as the positive stance in the buck remains underpinned by the current elevated inflation narrative as well as the probability (bigger now) of a 50 bps rate hike by the Fed (instead of the more conventional 25 bps move) at the March gathering. Looking at the longer run, and while the constructive outlook for the greenback appears well in place for the time being, recent hawkish messages from the BoE and the ECB carry the potential to undermine the expected move higher in the dollar in the next months.

Key events in the US this week: MBA Mortgage Applications, Retail Sales, Industrial Production, NAHB Index, FOMC Minutes (Wednesday) – Building Permits, Housing Starts, Initial Claims, Philly Fed Manufacturing Index (Thursday) – CB Leading Index, Existing Home Sales (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issue.

US Dollar Index relevant levels

Now, the index is losing 0.15% at 95.84 and a break above 96.43 (weekly high Feb.14) would open the door to 97.44 (2022 high Jan.28) and finally 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 95.17 (weekly low Feb.10) followed by 95.13 (weekly low Feb.4) and then 94.62 (2022 low Jan.14).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.