- Analytics

- News and Tools

- Market News

- Breaking: Chinese inflation miss pressures AUD/USD, bulls now rely on risk appetite returning

Breaking: Chinese inflation miss pressures AUD/USD, bulls now rely on risk appetite returning

The Consumer Price Index is released by the National Bureau of Statistics of China has arrived lower than expected and is pressures AUD a touch, off by some 5 pips so far:

China CPI

China CPI (YoY) Jan: 0.9% (est 1.0%, prev 1.5%)

China PPI

China PPI (YoY) Jan: 9.1% (est 9.5%, prev 10.3%) .

AUD/USD update

The AUD/USD bulls have not got what they were looking for in this data, but Wall Street ended sharply higher on Tuesday, as signs of de-escalating tensions along the Russia-Ukraine border sparked a risk-on session. This in turn spread to the high beta currencies such as the Australian dollar.

-

AUD/USD Price Analysis: Chinese CPI anticipated, but may not be what the bulls are hoping for

Moreover, inflation concerns are a global paradox that is likely to underpin the commodity sector for which AUD trades as a proxy and can benefit. The Reserve bank of Australia is also tipped toeing around the edge of hawkishness and tightening expectations remain elevated. All of which supports a meanwhile bullish outlook for AUD crosses.

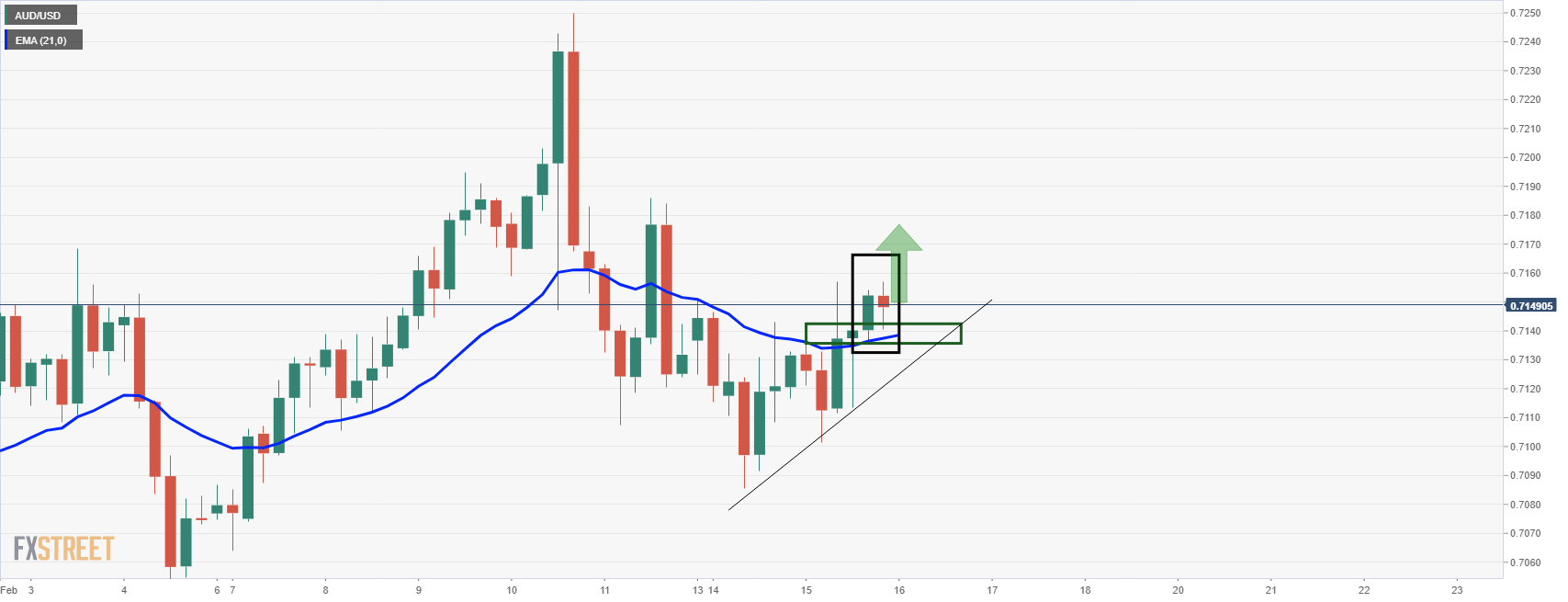

AUD/USD 4-hour chart

About the Consumer Price Index

The Consumer Price Index is released by the National Bureau of Statistics of China. It is a measure of retail price variations within a representative basket of goods and services. The result is a comprehensive summary of the results extracted from the urban consumer price index and rural consumer price index. The purchase power of the CNY is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. A substantial consumer price index increase would indicate that inflation has become a destabilizing factor in the economy, potentially prompting The People’s Bank of China to tighten monetary policy and fiscal policy risk. Generally speaking, a high reading is seen as positive (or bullish) for the CNY, while a low reading is seen as negative (or Bearish) for the CNY.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.