- Analytics

- News and Tools

- Market News

- AUD/USD Price Analysis: Chinese CPI anticipated, but may not be what the bulls are hoping for

AUD/USD Price Analysis: Chinese CPI anticipated, but may not be what the bulls are hoping for

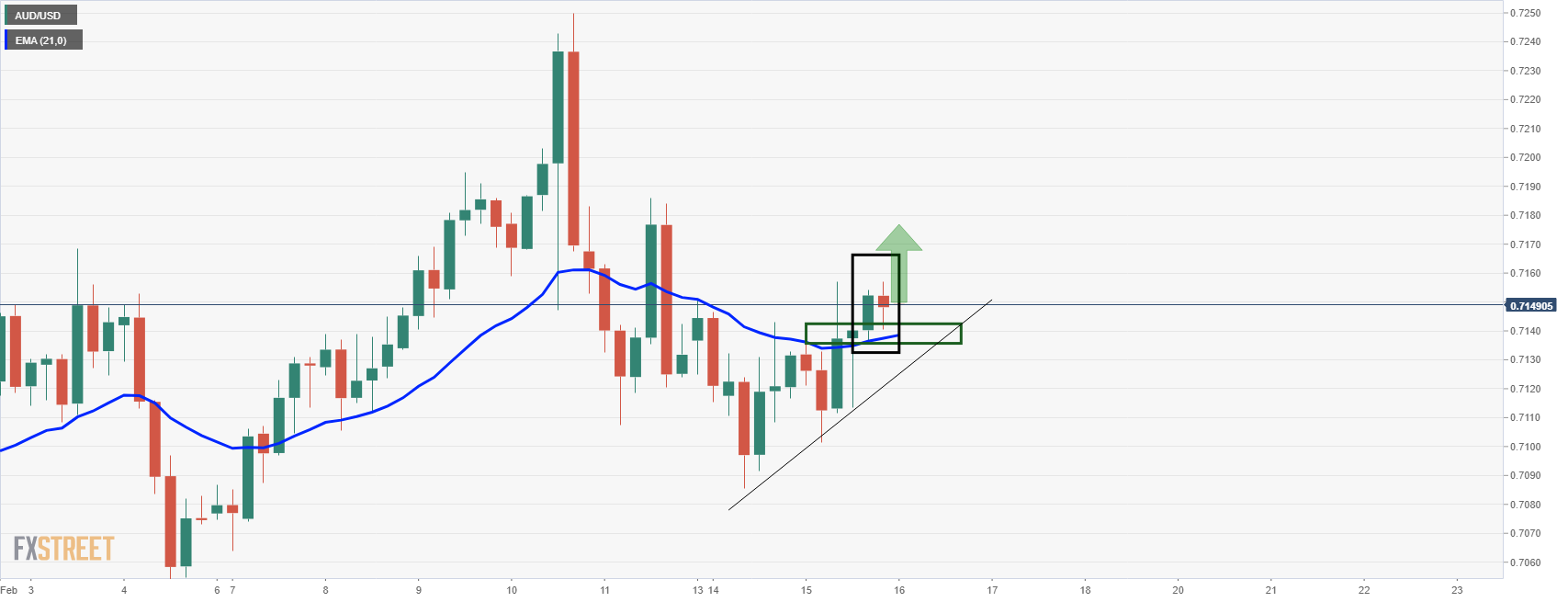

- AUD/USD is firming from 4-hour support ahead of Chinese inflation data.

- The bulls will be looking for a discount at this juncture.

- Further demand could be on the cards in the coming sessions with eyes on 0.72 the figure.

As per the New York analysis from Tuesday's session, AUD/USD Price Analysis: Bulls looking for a break to test 0.7180 H4 resistance, where the 21-EMA was cited as a key support area, the bulls will be looking to Chinese data for a lift at the top of the hour. However, there are expectations of the data to emain weak in January despite intense supply-side pressures.

''CPI will be dampened by another drop in pork prices, capping overall food price inflation, as well as a high base. Industrial commodities, steel and oil prices continued to push higher over the month, while PMI input prices rose to their highest since October, suggesting any moderation in PPI will be limited,'' analysts at TD Securities argued.

Nevertheless, AUD/USD is breaking to the upside with the price holding above H4 21-EMA. This is seen as an encouraging development for the bulls ahead of the data. Eyes will be on 0.7180s and then 0.73 the figure as a critical milestone in the pursuit of a higher daily high.

AUD/USD prior analysis

AUD/USD live market

The price has respected the 21 EMA and support structure as illustrated above and bulls will be seeking to engage at a discount at this juncture.

AUD/USD weekly chart

On the other hand, the bears will note the weekly chart's resistance and bulls will need to overcome this near 0.7180.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.