- Analytics

- News and Tools

- Market News

- EUR/USD Price Analysis: Bulls eye 61.8% golden ratio, but bears are in the slipstream

EUR/USD Price Analysis: Bulls eye 61.8% golden ratio, but bears are in the slipstream

- EUR/USD bulls stay in control and target a deeper correction for the day ahead.

- The 61.8% ratio is within reach, but Russia remains a threat and the bulls are not out of the woods yet.

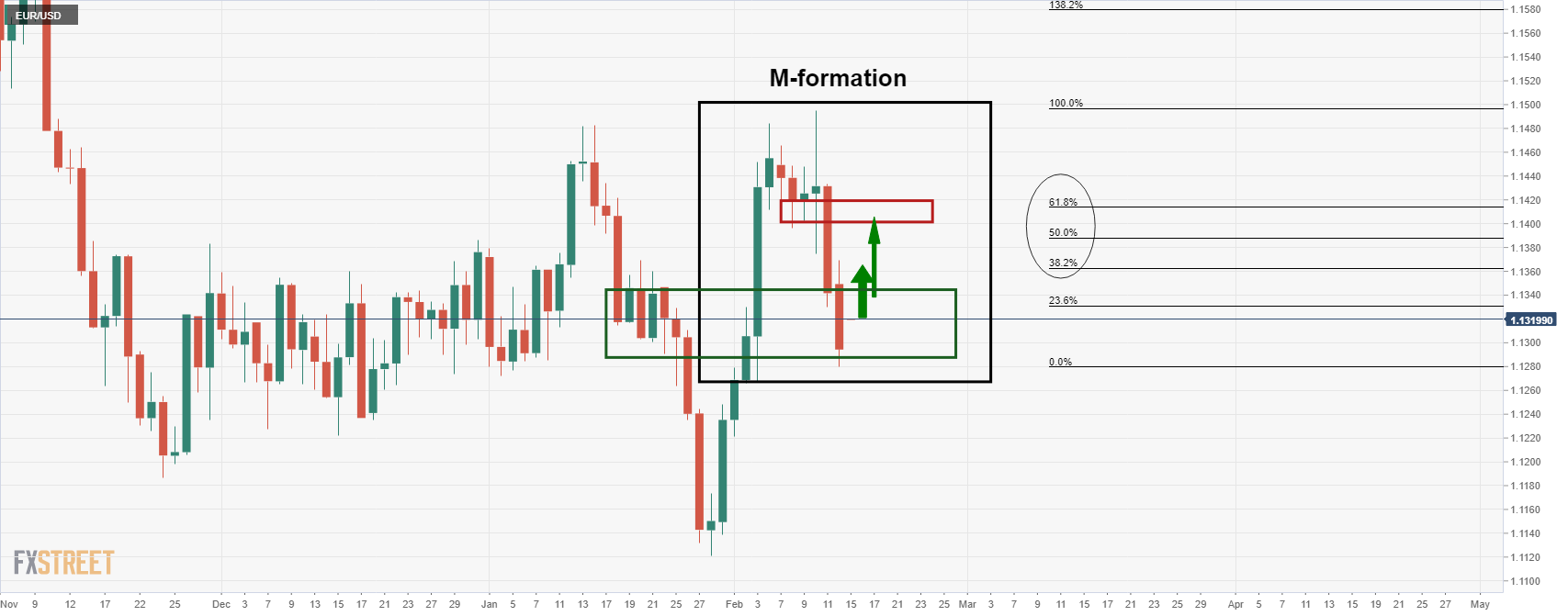

As per the prior day's pre-Europen analysis, EUR/USD bulls tread around with caution in a field of land mines and disruptive Russian headlines, whereby the euro was on a firmer footing and expected to continue higher, the price has moved in on the 38.2% ratio as follows:

EUR/USD prior analysis

It was stated prior to Tuesday's trading in Europe that ''with the price stabilising in a familiar support area, the M-formation is compelling especially as the neckline has a confluence with the 50% and 61.8% ratios.''

Given the de-escalation type of rhetoric from the Russian president, Vladimir Putin, on Tuesday, the price has continued its approach towards the aforementioned confluence area as follows:

EUR/USD daily chart

Russian President Vladimir Putin on Tuesday said he was “ready” to work with the West on de-escalating tensions, the latest signal that the prospect of war with Ukraine could be receding. "We are ready to work further together. We are ready to go down the negotiations track," Putin said following talks with German Chancellor Olaf Scholz in Moscow.

However, the bulls are not out of the woods yet and the situation is on a knife's edge still. US President Joe Biden said "we have not yet verified the Russian military units are returning to their home bases. Indeed, our analysts indicate that they remain very much in a threatening position." The President also underscored that "Russia has more than 150,000 troops circling Ukraine and Belarus and along Ukraine's border, and invasion remains distinctly possible."

Markets can turn on a dime at the drop of a disruptive Russian headline, and the 1.11 area is by no means a distant possibility.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.