- Analytics

- News and Tools

- Market News

- NZD/USD bulls eye the 0.6650's and 6690's on Russia's withdrawal of troops

NZD/USD bulls eye the 0.6650's and 6690's on Russia's withdrawal of troops

- NZD/USD bulls let off as risk sentiment improves on the Russian pivot.

- The imbalance left between 0.6690's and the 0.6650's for the days ahead in focus.

NZD/USD is trading 0.37% higher on the day as markets suspect that an imminent Russian invasion has been averted which has enabled a recovery in risk appetite on Tuesday. Russia said it had withdrawn some of its troops from the Ukraine border. However, the announcement, the United States and NATO said they had yet to see evidence of a drawdown.

Nevertheless, the Kiwi is higher again, averting a sell-off from 4-hour resistance. However, there are still plenty of uncertainties within a very fluid situation surrounding Russia and Ukraine. Not least, the Federal Reserve could be a ticking time bomb for the forex space with regards to its next move at the March meeting.

''Volatility remains the order of the day,'' analysts at ANZ bank argued. ''Higher US yields are battling things like higher commodity prices for attention; while rates have had less of an influence on FX of late, the knee-jerk reaction to higher US bond yields tends to be NZD-negative.''

US yields started the week off depressed from safe-haven flows but Federal Reserve's James Bullard’s continued hawkishness on Monday led to a complete turnaround. Bullard advocates for 100 bps of tightening by July. Bullard says that he is worried that the Fed is not moving fast enough as inflation is much higher than expected. On Wednesday, Bullards concerns were met by the US Producer Price Index data that arrived much hotter than anticipated for January at 9.7% YoY. Core PPI is now at 8.3% YoY indicating that inflation is running at a rampant pace.

Fed tightening expectations

Meanwhile, Fed tightening expectations remain elevated and the following is noted by Brown Brothers Harriman:

WIRP suggests nearly 70% odds of a 50 bp move next month, up from 60% at the start of this week. Two 25 bp hikes May 4 and June 15 are still fully priced in that would take the rate up 100 bp by mid-year. Another 50 bp of tightening in H2 is fully priced in, with 60% odds of another 25 bp hike by year-end vs. over 40% odds at the start of the week. Looking further out, swaps market now sees a terminal Fed Funds rate around 2.25% and that should eventually move closer to 2.5% or even higher once this risk off episode ends.

NZD/USD technical analysis

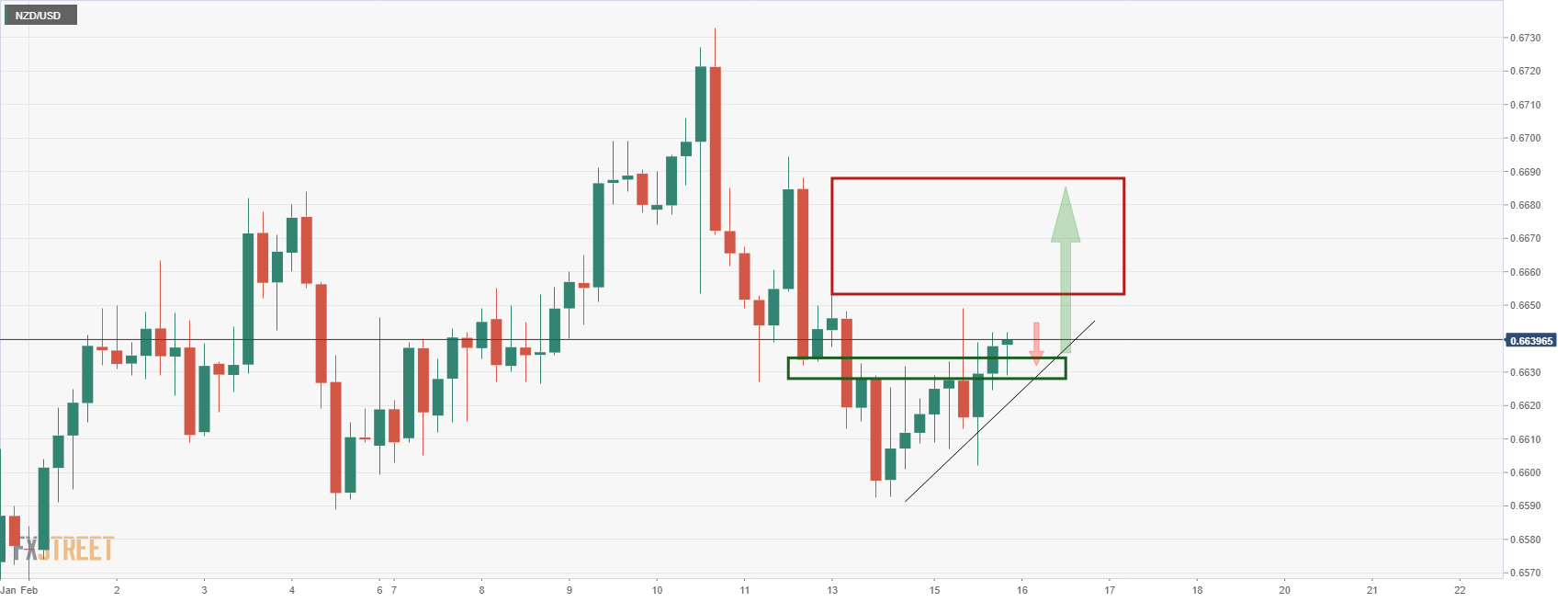

As per the prior analysis, NZD/USD Price Analysis: Trapped and consolidation is in play below bearish structure, it was noted that the price was respecting the prior 4-hour lows as resistance, but the daily support structure was menacing for the bears.

The price had been creeping in on the old support turned to resistance but the prospects of a downside continuation were thwarted in New York's trade when the price broke to fresh corrective highs:

This leaves the bulls in play and there are prospects of a surge into the imbalance left between 0.6690's and the 0.6650's for the days ahead.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.