- Analytics

- News and Tools

- Market News

- Silver Price Forecast: XAG/USD plunges from $24.00 to $23.30s amid a risk-on market

Silver Price Forecast: XAG/USD plunges from $24.00 to $23.30s amid a risk-on market

- The white metal drops sharply 2% on increasing market mood sentiment.

- Eastern Europe tensions diminished as Russia withdrew “some” troops as negotiations continued.

- XAG/USD Technical Outlook: Neutral biased, but the path of least resistance is downwards.

Silver (XAG/USD) follows gold’s footsteps during the North American session, plunging from a ten-month-old downslope resistance trendline towards the 100-day moving average (DMA), which lies at $23.20. At the time of writing, XAG/USD is trading at $23.38.

Geopolitical tensions abate between Russia, Ukraine, and NATO

On Tuesday, tensions between Russia/Ukraine appeared to abate after German chancellor Olaf Scholz met with Russian President Vladimir Putin. Putin told reporters that talks with Scholz were businesslike.

The meeting happened after last Friday’s announcement by the US press that according to US officials, Russias invasion of Ukraine was “imminent.” At the same time, the Kremlin denied those accusations. In fact, earlier news crossing the wires said that “some” Russian troops were returning home.

European and US equities took that as a positive development in the region, as all of the indices trade in the green. In the meantime, the US 10-year T-note yield rises four basis points sit at 2.035%., weighing on Silver’s non-yielding status.

Putting geopolitical matters aside, factors like the Federal Reserve tightening keep the non-yielding metal under selling pressure. On Monday, St. Louis President James Bullard reiterated his view that the US central bank would need to hike 100 bps by the July meeting. Also, he emphasized that the balance sheet reduction could begin in Q2 and wants discussions to get underway.

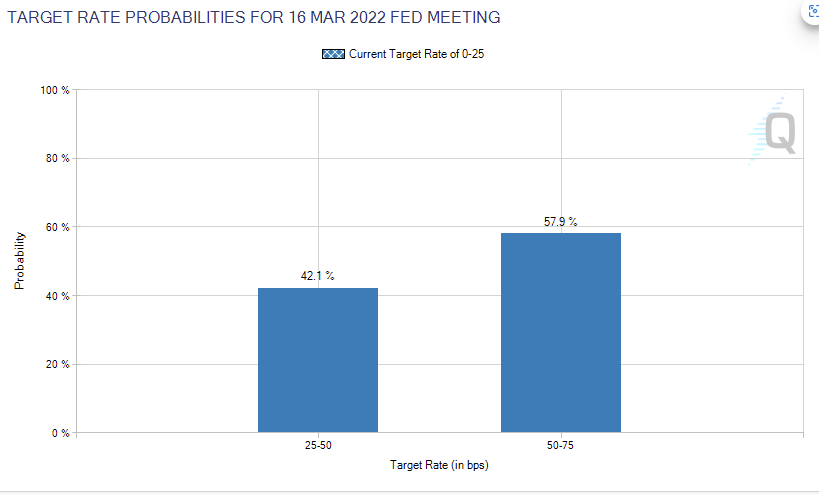

As of Tuesday, the FEDWATCh Tool has a 100% chance of a 25 bps rate hike, while a 57.9% chance of a 50 bps. The next Federal Reserve meeting would be in March but following the release of the US Consumer Price Index (CPI) of February, which could give clues regarding the possible outcome of the reunion.

Prices paid by producers in the US are 0.6% y/y higher than estimated

Meanwhile, the Department of Labor reported the Producer Price Index (PPI) for January, which came unchanged in line with the previous month, increasing by 9.7% y/y, higher than the 9,1% estimated. The so-called Core PPI rose to 8.3% y/y, two tenths lower than December’s but higher than 7.9% foreseen.

XAG/USD Price Forecast: Technical outlook

XAG/USD dropped $1.00 during the overnight session, on fundamental news, but also a ten-month-old downslope trendline around $23.65-70 area exacerbated the downward move that stalled near the $23.00 figure.

That said, XAG/USD is neutral biased. However, the path of least resistance is downwards, and its first support would be the 100-DMA at $23.24. Breach of the latter would expose the confluence of the figure and the 50-DMA at $23.00. Once that area gives way for USD buyers, the next challenge would be the February 3 daily low at $22.00.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.