- Analytics

- News and Tools

- Market News

- When are the UK jobs and how could they affect GBP/USD?

When are the UK jobs and how could they affect GBP/USD?

UK Jobs report overview

Early Tuesday, the UK’s Office for National Statistics (ONS) will release the January month Claimant Count figures together with the Unemployment Rate in the three months to December at 07:00 AM GMT.

Given the expectations of another rate hike by the Bank of England, coupled with the upbeat economic growth and inflation fears, today’s jobs report becomes crucial for the GBP/USD pair traders. Also highlighting today’s employment numbers is the cable’s recently sidelined performance above the 100-DMA.

The UK labor market report is expected to show that the average weekly earnings, including bonuses, in the three months to December, ease to 3.9% from the previous figures of 4.2%, while ex-bonuses, the wages are seen declining to 3.6% from 3.8% during the stated period.

Further, the ILO Unemployment Rate is likely to remain unchanged at 4.1% for the three months ending in December. It’s worth noting that the Claimant Count Change figures are likely to improve to -28.0K versus -43.3K prior in January.

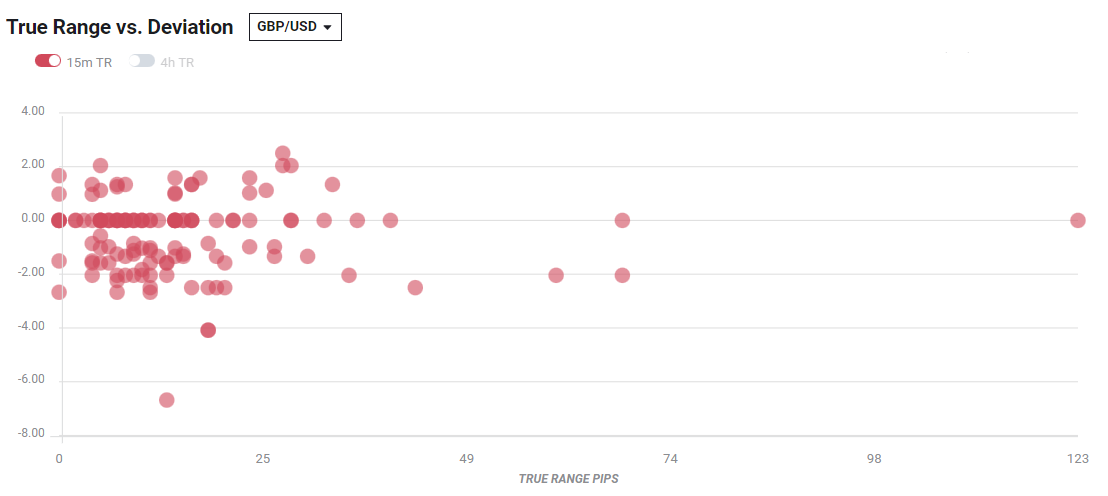

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could they affect GBP/USD?

GBP/USD struggles to justify hawkish BOE concerns amid risk-off mood and Brexit woes of late, which in turn keeps the quote inside a 100-pip trading range between the 100-DMA and 1.3600. That said, the quote recently cheers pullback in the US dollar, due to easy Treasury yields, while printing mild gains around 1.3540 during early Tuesday morning in Europe.

That said, the UK employment data may offer intermediate direction to the GBP/USD prices but may witness a milder response as global markets remain most interested in the Russian updates and Fedspeak in recent times. Even so, firmer data can keep the pair buyers hopeful.

“UK’s recovery should continue to edge the ILO unemployment rate lower in December (market f/c: 4.1%),” said analysts at Westpac.

Technically, the recent rebound in the Momentum indicator enables the pair buyers to flex muscles ahead of the key data/events. However, 1.3600 and the 200-DMA level of 1.3700 will restrict the short-term upside of the cable pair. On the contrary, the 100-DMA level near 1.3500 challenges the GBP/USD pair sellers.

Key notes

GBP/USD Forecast: Pound tests key 1.3500 support, pressured by risk aversion

GBP/USD seesaws past-1.3500 on Brexit, Russia news, UK Unemployment Rate eyed

About UK jobs

The UK Average Earnings released by the Office for National Statistics (ONS) is a key short-term indicator of how levels of pay are changing within the UK economy. Generally speaking, the positive earnings growth anticipates positive (or bullish) for the GBP, whereas a low reading is seen as negative (or bearish).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.