- Analytics

- News and Tools

- Market News

- Silver Price Forecast: XAG/USD leaves the 100-DMA behind as bull’s eye $24.00 after US CPI

Silver Price Forecast: XAG/USD leaves the 100-DMA behind as bull’s eye $24.00 after US CPI

- Silver broaden its weekly gains, up so far 5.17%.

- US inflation reached levels last seen in August 1982, above 7% for the second consecutive month.

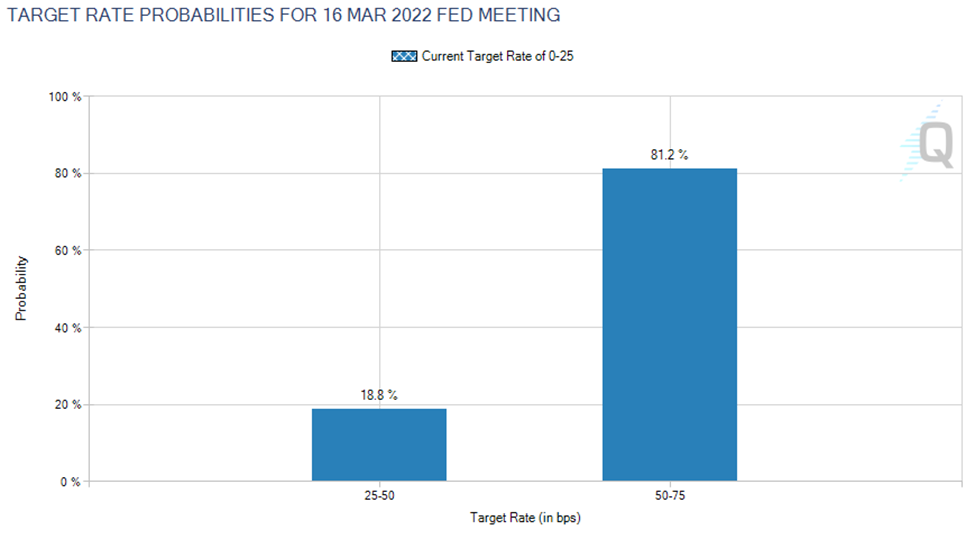

- Money market futures have priced in an 80% chance of a 50 bps increase on the Fed’s March meeting.

- XAG/USD is neutral biased, but bulls get ready to attack the 200-DMA at $24.20.

Silver (XAG/USD) expands its rally to five straight days following a hot US inflation report that reached levels not seen since the 1980s. At the time of writing, XAG/USD is trading at $23.70.

An hour before the US cash equity markets opened, the Bureau of Labor Statistics (BLS) revealed that the Consumer Price Index (CPI), the inflation indicator in the US in January, reached 7.5% y/y, more than the 7.3% estimated by analysts. The so-called core CPI, which excludes volatile items like food and energy, rose to 6%, higher than the 5.9% estimated.

According to analysts at RBC, they noted that “near-term inflation is driven by higher home rent and vehicle prices.· Further added that inflation pressures are broadening “as majority of the consumer basket is seeing +2% growth in inflation.”

Following the data release, market players have fully priced in a 25 basis point increase to the Federal Funds Rate (FFR) by the Federal Reserve. However, there is an 80% chance of a 50 basis point increase, as reported by the CME FEDWATCH Tool, as of February 10, 2022, at press time.

Source: CME Group

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of peers, slide 0.27%, currently at 95.26. The US 10-year Treasury yield rises eight basis points sits at 2.024%, which usually would derail the white metal from pushing for higher prices, but appears to be ignored by investors.

Alongside the inflation report, the US economic docket featured the Initial Jobless Claims for the week ending on February 5 rose to 223K, better than the 230K forecasted by analysts while Continuing Jobless Claims stayed unchanged at 1621K compared to the revision of the previous week.

XAG/USD Price Forecast: Techincal outlook

XAG/USD is neutral-upward biased, as shown by the daily charts. Silver’s Thursday price action left the 100-day moving average (DMA) as support at $23.21, and following the US CPI release, broke the January 3 daily high resistance level at $23.40, which now turned support.

Once those levels cleared, XAG/USD’s next resistance would be a 10-month-old downslope trendline lying around $24.20, but first, XAG/USD bulls will need to crack down the $24.00 psychological figure. If the $24.00-20 region gives way, there would be nothing in the path towards $25.00.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.