- Analytics

- News and Tools

- Market News

- AUD/USD bulls cling to the prospects of a hawkish emergence from the RBA

AUD/USD bulls cling to the prospects of a hawkish emergence from the RBA

- AUD/USD bulls stay in charge but face a wall of resistance.

- The US CPI data this week will be key.

AUD/USD is inching higher on Wednesday in Asia. At 0.7158, the pair is up 0.16% after climbing from a low of 0.7142 to a high of 0.7159. This follows an overnight session where the AUD drifted sideways in a choppy day as risk assets digested fresh multi-year highs for US yields ahead of US CPI tomorrow.

Nevertheless, The Australian and New Zealand dollars are better bid today as investors priced in the risk of more aggressive action from a chorus of central banks, sending local bond yields to three-year peaks. Yields on Aussie 10-years have surged 25 basis points in four sessions to hit 2.10%, and briefly reached their highest since March 2019 at 2.157%.

As for the US curve and US dollar, the 10-year Treasury yield surged as high as 1.97% on Tuesday for the first time since Nov. 2019. The yield on the two-year note, which is more sensitive to interest rate expectations, reached 1.347 for the first time since February 2020.

Markets are pricing in more than a 70% chance of a 25 basis point hike and a nearly 30% chance for a 50 basis point hike when US policymakers meet in March, according to CME's FedWatch Tool, as Reuters reported in a note earlier today. The dollar index (DXY) has also edged 0.02% higher to 95.614, after jumping from the 2-1/2-week low of 95.136 reached Friday. It touched the highest since June 2020 at 97.441 at the end of last month.

Meanwhile, net AUD short positions declined for the third week. They remain elevated despite a dovish tilt from the RBA. However, in the spot market, markets have moved to price in more moves by the RBA. Reuters reports that a ''first move to 0.25% is implied by June, while in the past week futures have added in a fifth hike for this year to reach 1.25%. Further increases to 2.5% are priced in by July 2023.''

''We think RBA is closer to their inflation objectives and could well afford to signal a more hawkish stance given the recent better data outturns,'' analysts at TD Securities argued.

AUD/USD technical analysis

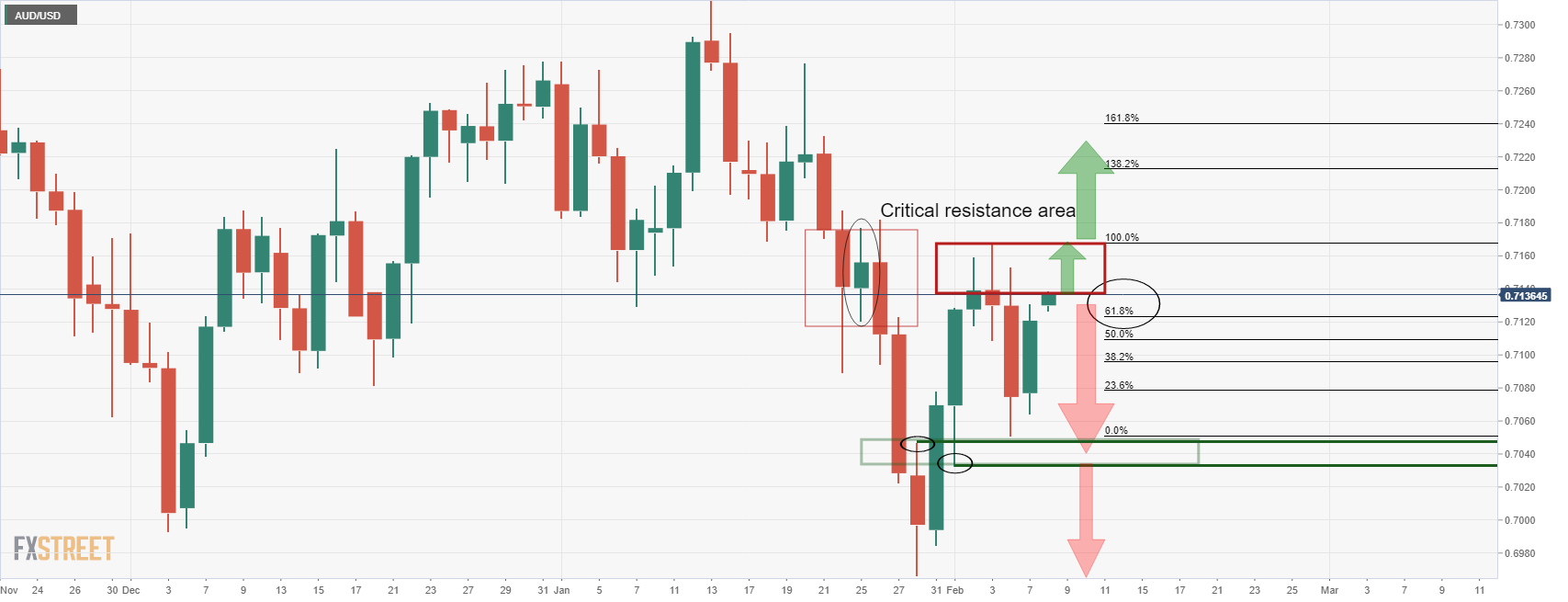

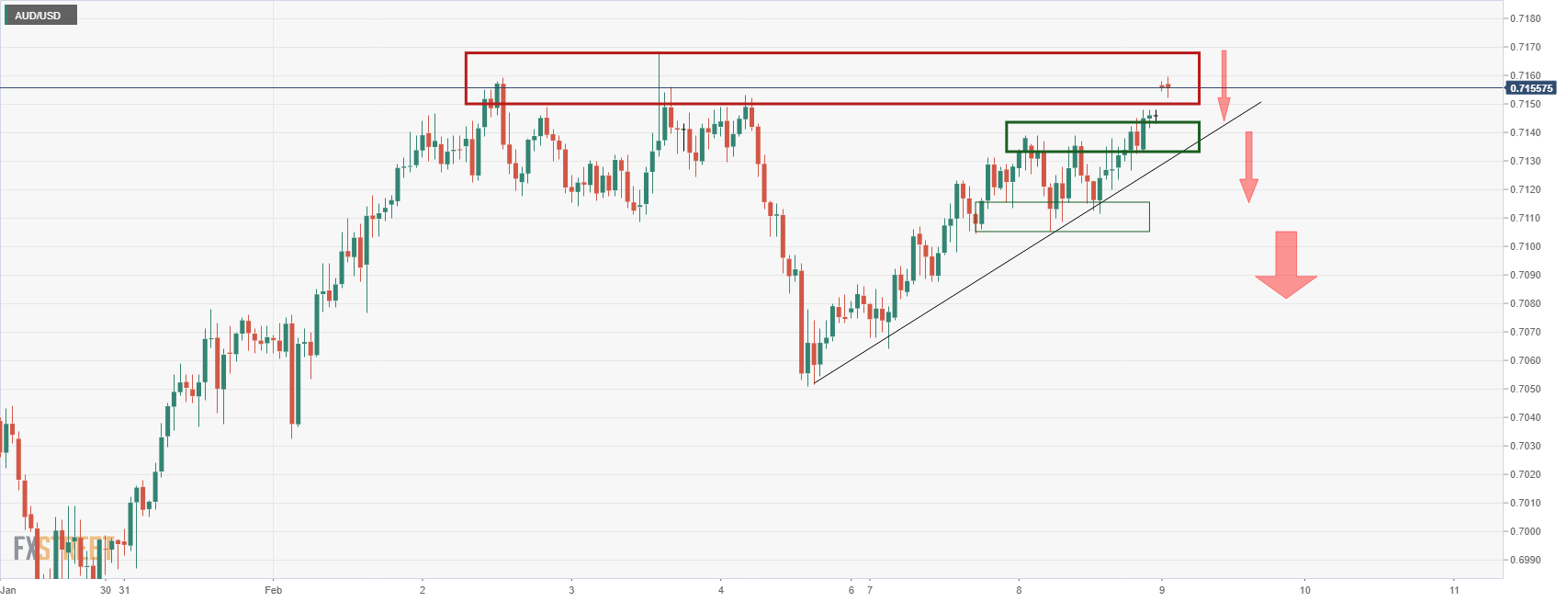

As per the new York session's analysis, AUD/USD Price Analysis: Bears could start to emerge soon, eyes on the H1 0.7105 swing lows, the bulls are coming up for air but will need to break through some heavy volumes into the 0.7180 area and overcome another critical daily resistance:

From an hourly perspective:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.