- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD moves in on a critcal resistance zone

Gold Price Forecast: XAU/USD moves in on a critcal resistance zone

- For gold's next move, all eyes turn to the US dollar and CPI later this week.

- CTA trend followers could add to outflows should prices close below $1800/oz.

At $1,827, gold, XAU/USD is higher on the day by 0.40%. The price has moved from a low of $1,815.49 to reach a high of $1,828.40 so far. Overall, it's a slow start to the week and there is a lack of volatility on the forex space which means the US dollar is stuck around opening levels for the week as traders await key inflation data on Thursday.

However, benchmark US 10-year Treasury yields are pushing up key technical levels which, if broken, could send the yields over the key psychological threshold of 2% this week. This is supporting the greenback on Tuesday. DXY is over 0.2% higher, which is an index that measures the US dollar vs. a basket of rival major currencies. The index has ranged between 95.398 and 95.75.

Looking ahead, with gold at a critical juncture, as illustrated on the charts below, analysts at TD Securities explain, that at first glance, 'the set-up is in gold ripe for another position squeeze, as several participants including TD Securities have established tactical short gold positions.

They explained that this is following the decisively hawkish Fed meeting, only to find substantial volume on the bid keeping prices from breaking below their bull-market-era trendline support. ''This time'', they argue, however, ''the bar is high for a substantial squeeze, suggesting macro headwinds will ultimately weigh on gold.''

''. It remains to be seen whether central bank purchases might be playing a substantial role in keeping gold prices from breaking lower, but shorts are unlikely to feel much pain as the data continues to point to little speculative interest for the yellow metal. Conversely, CTA trend followers could add to outflows should prices close below $1800/oz.''

Gold technical analysis

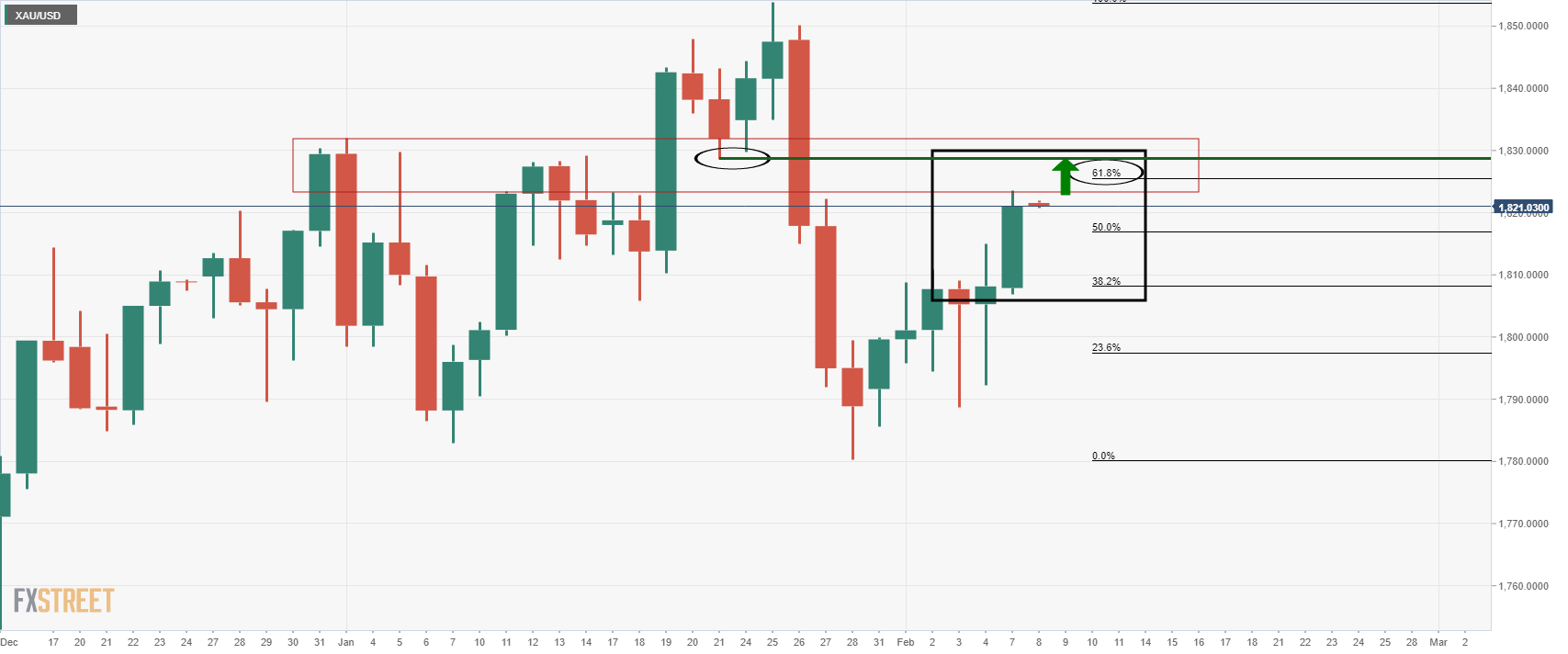

As per the prior analysis, and this week's, Gold, Chart of the Week: Bulls take on the 38.2% Fibo, now eye the 61.8% golden ratio, the price has finally moved on the 61.8% ratio as follows:

Gold, prior analysis

''While there are no direct confluences at a specific price target between the neckline of the M-formation and the 61.8% ratio, the area between the two mile-stones near $1,830 will be expected to offer firm resistance.''

Gold live market

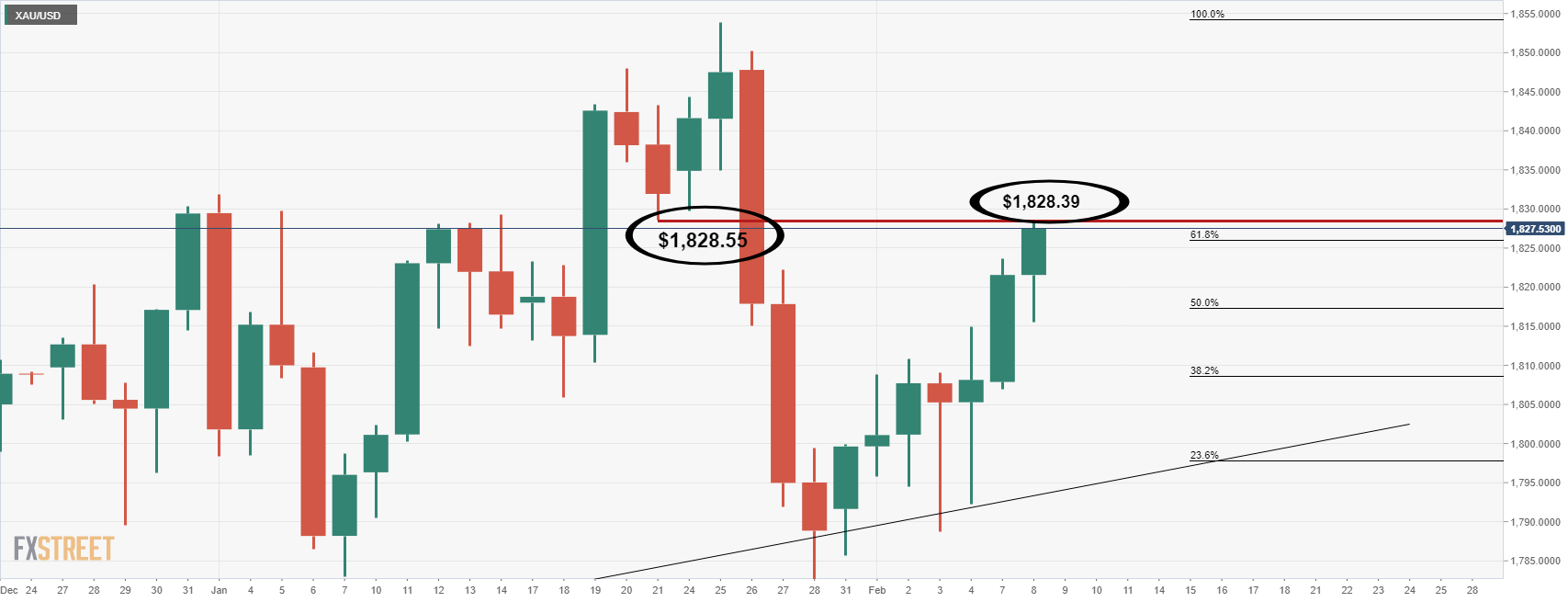

As illustrated, the bulls have moved in on the 61.8% ratio. What now?

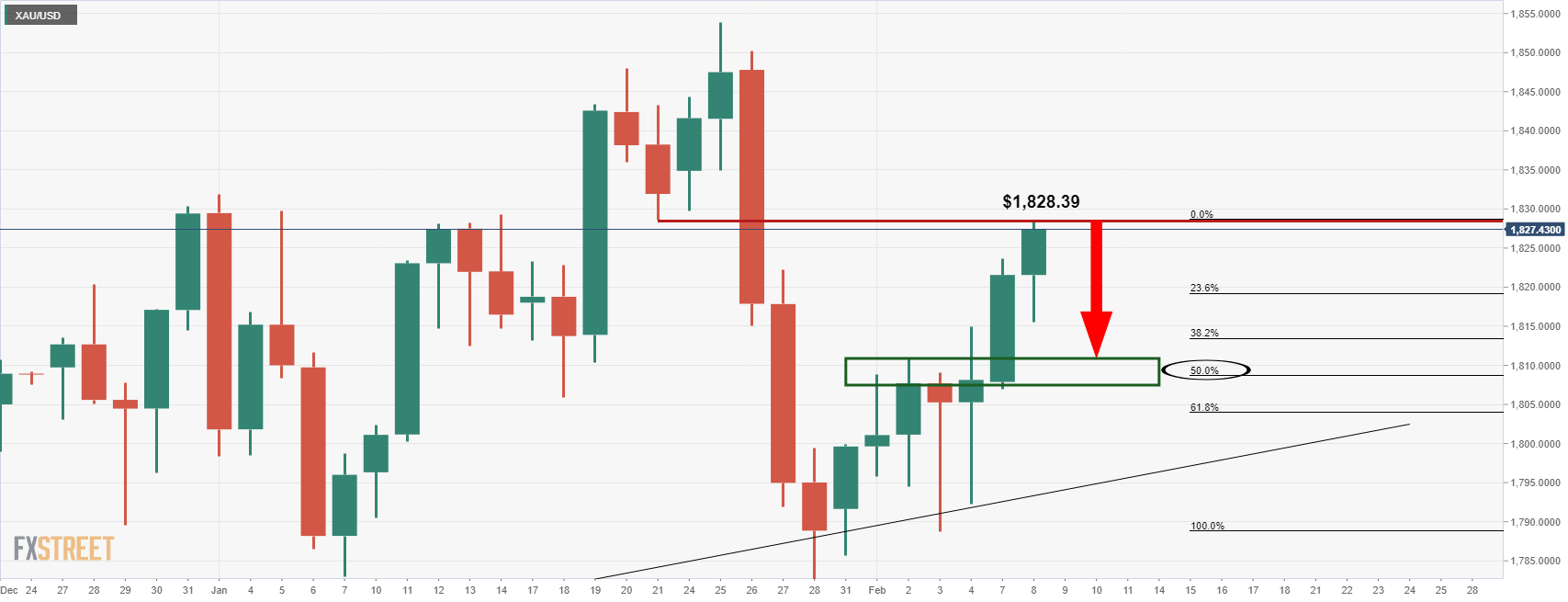

In the chart below, we see that the price has reached the neckline of the M-formation to the rounded down $1,828. This matters because this is an area of liquidity that could lead to supply entering the market which would typically cap the price. This leaves the focus on the downside which leaves the $1,811 vulnerable:

The W-formation's neckline aligns, albeit not perfectly to the US dollar, with a 50% mean reversion of the prior bullish impulse, so this is an ''area'' between $1,811 and $1,808 that the bears could be looking to target.

With all that being said, there is every possibility that the bulls will stay in control which exposes $1,850 on consecutive daily closes above the current highs. On the other hand, the bears will be monitoring for topping formations on both the daily and lower times frame charts at this juncture.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.