- Analytics

- News and Tools

- Market News

- Gold Price Forecast: Bulls have eyes to the 6.8% golden ratio

Gold Price Forecast: Bulls have eyes to the 6.8% golden ratio

- Gold bulls are in control, but the focus is on the downside while below key daily resistance.

- More substantial CTA trend follower liquidations below $1800/oz.

- XAU/USD indecisive as investors assess central banks' rate outlook.

Gold, XAU/USD, was a form performer at the start of the week due to solid demand for safe-haven assets amid rising geopolitical tension. The concerns of imminent monetary policy tightening by the US Federal Reserve was cast aside as a consequence and gold has printed a fresh corrective high at $1,823.59.

The US dollar, despite the risk-off tones, was a touch fragile on the day due to the surprise hawkish rhetoric from the European Central Bank last week. The ECB now sees “upside risk to inflation” and Lagarde noted “things have changed”." President Lagarde's clear signal that the door has opened for rate hikes later this year is a real game-changer for the foreign exchange market," said MUFG analyst Lee Hardman.

"Over the past year the EUR has underperformed on the back of expectations that the ECB will maintain loose policy while the BoE and Fed tighten," Hardman argued. These themes were being digested in slow Monday markets which have led to the US dollar index DXY to steady at around 95.50.

Who's buying gold?

Analysts at ANZ Bank explained that ''the yellow metal has remained stubbornly resilient during China's Spring Festival celebrations against the weight of a decisively hawkish Fed. Even the outstanding beat in last week's US jobs data did not provide enough firepower for gold prices to break below their bull-market-era trendline established since 2018.''

''On the surface, one might assume that a growing appetite for safe-havens amid Russian tensions could be driving prices higher. However, tracking ETF flows suggests little such interest in the yellow metal when accounting for options-related distortions, whereas the Fed's decisively hawkish tone is keeping capital from sustainably flowing into the yellow metal, the analysts added.''

''It remains to be seen whether central bank purchases might be playing a substantial role in keeping gold prices from breaking lower, as the data continues to point to little speculative interest for the yellow metal.''

''Ultimately, the macro regime should keep prices vulnerable to a deeper consolidation, in support of our tactical short gold position.'' However, they expect more substantial CTA trend follower liquidations below $1800/oz.

Gold technical analysis

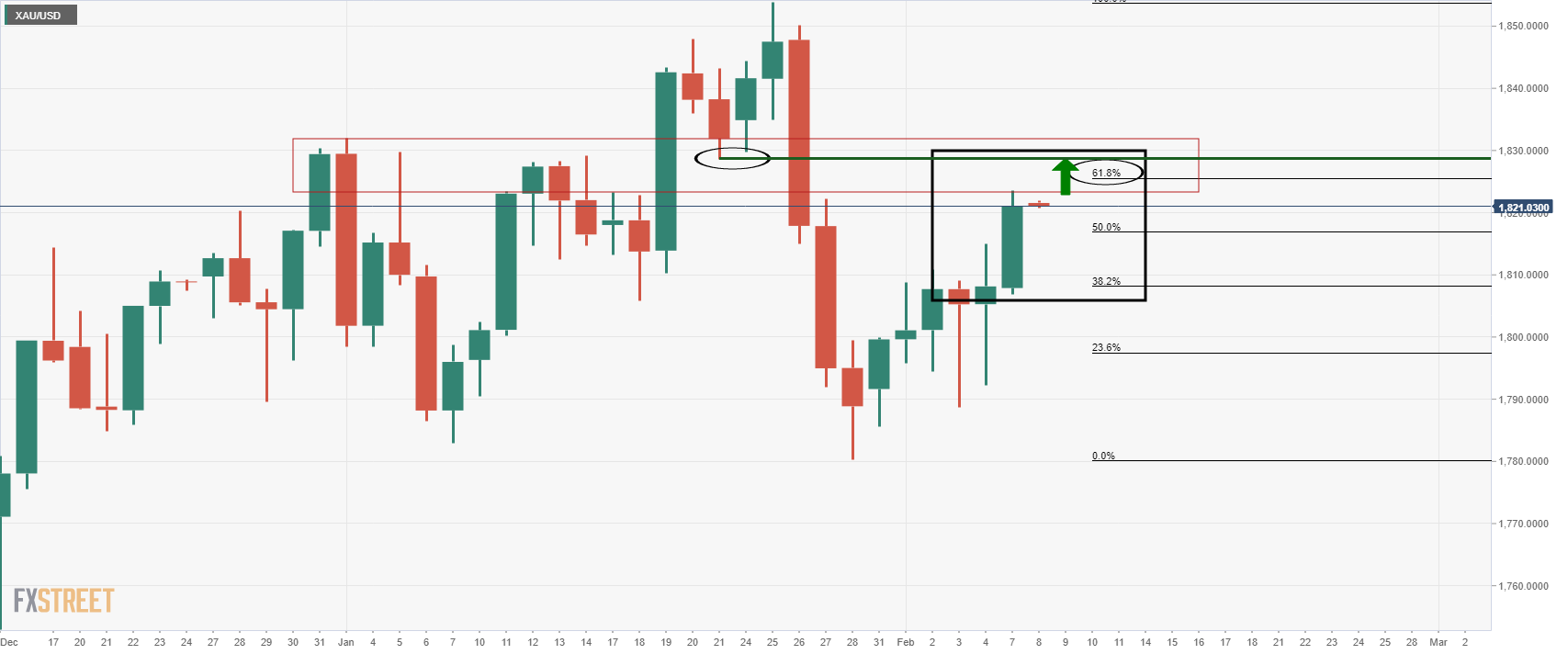

As illustrated on the daily chart, the bulls have overcome the sellers in the $1,810 area and are in pursuit of the 61.8% golden ratio.

Gold, prior analysis

Gold, live market

While there are no direct confluences at a specific price target between the neckline of the M-formation and the 61.8% ratio, the area between the two mile-stones near $1,830 will be expected to offer firm resistance.

In any case, until the M-formation's neckline is broken, the focus is on the downside, as illustrated in pre-open markets earlier this week as follows:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.