- Analytics

- News and Tools

- Market News

- NZD/USD bulls to challenge higher time frame bears

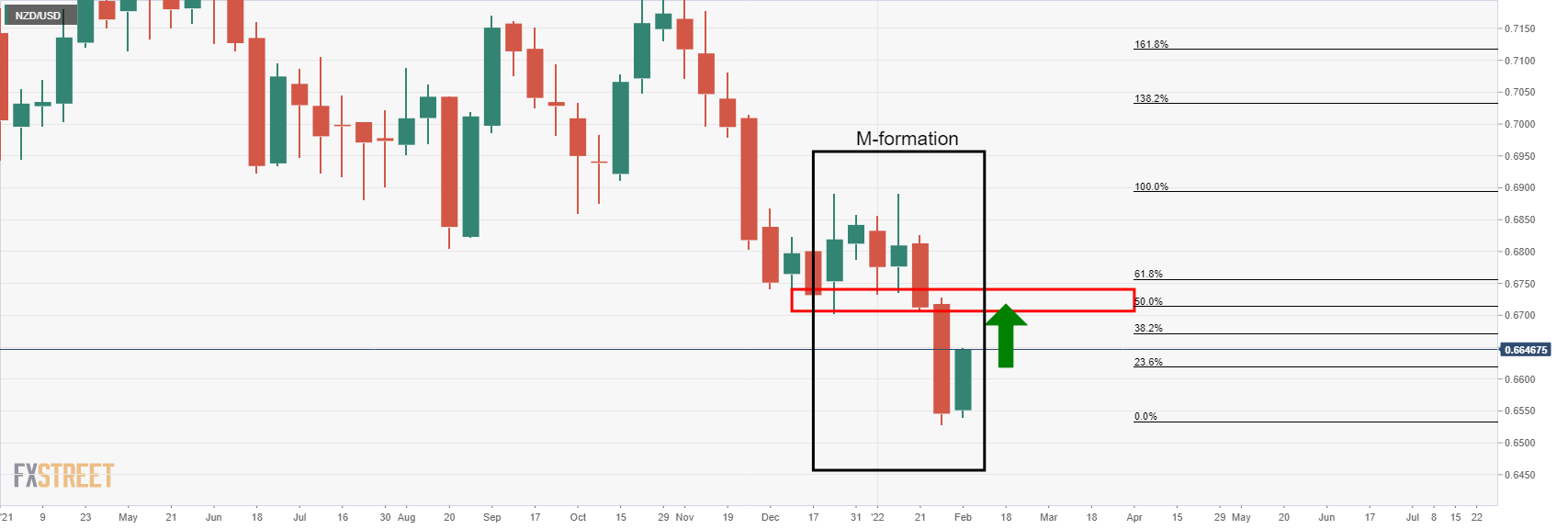

NZD/USD bulls to challenge higher time frame bears

- NZD/USD bulls are hunting down a weekly key target.

- A quiet start to the week, a time to reflect on both domestic ad offshore fundamentals.

NZD/USD is firm at the start of a new week and has eyes on the weekly targets towards 0.67 the figure. At 0.6630, the pair is trading 0.28% higher on the day towards a critical target on the longer-term time frames, as illustrated below.

However, overall, it has been a quiet start to the week so far as traders digest a busy week of events last week and significant fundamentals that are setting the stage for March and the third round of 2022's central bank meetings.

''FX markets have generally been pretty tame since Friday, and that was despite much stronger-than-expected US data that rattled bonds,'' analysts at ANZ Bank explained. ''This is a quiet week for domestic data, with mostly second-tier data. But US CPI could cause volatility,'' the analysts said.

For an insight into what is to be expected in the data, analysts at TD securities explained, ''Core, as well as total prices likely, slowed on an m/m basis, with the pace still fairly strong. Strength in used vehicles was probably partly offset by weakness in hotels and airfares. Our forecast implies 7.2%/5.8% yoY for total/core prices, up from 7.0%/5.5%. The report will include updated weights and seasonal factors, neither of which should change trends significantly.''

Meanwhile, the ''bigger picture,'' analysts at ANZ argue, ''we still see the NZD as conflicted rather than trending – local data has been very strong, commodity prices are booming and interest rates are best in class, but the rest of the world is experiencing its own “re-awakening”, and fears of a hard landing and/or housing market wobbles never seem to be too far away.''

NZD/USD technical analysis

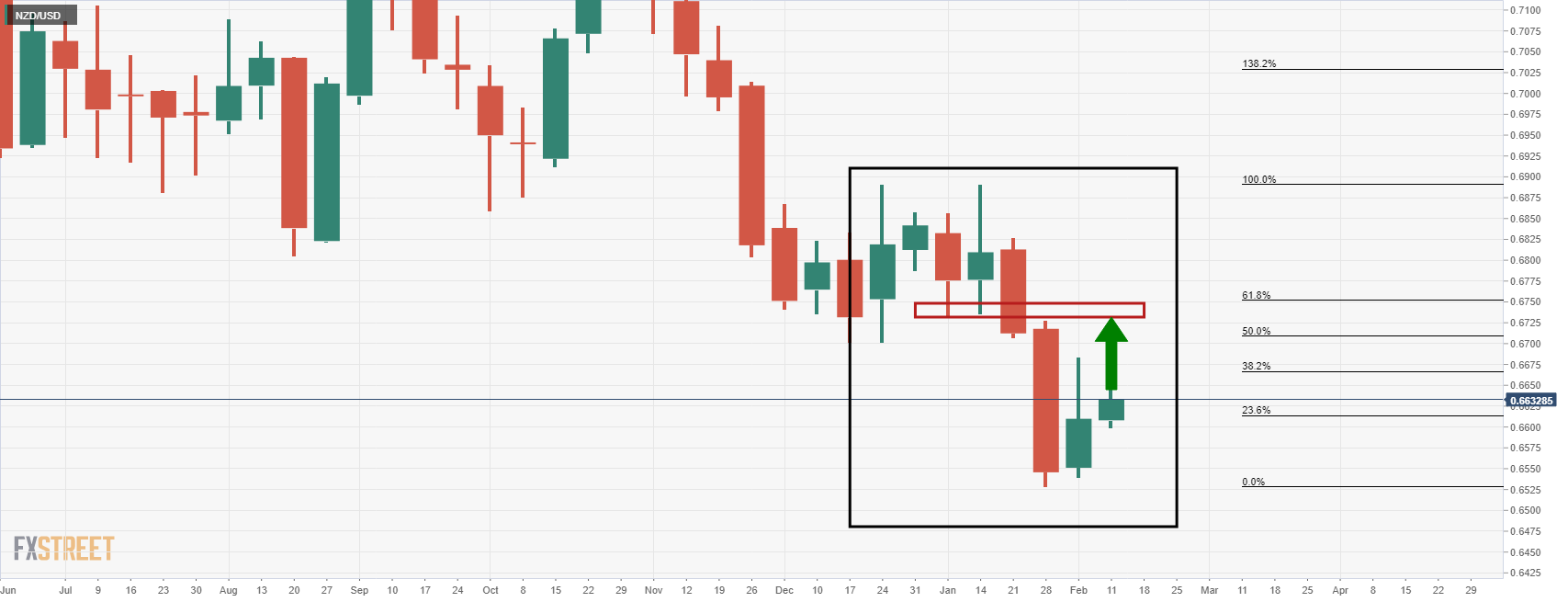

- NZD/USD Price Analysis: The 50% mean reversion is giving way in Asia

NZD/USD is on the verge of finding itself in a significant area on the charts, as per the prior analysis above.

NZD/USD live market

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.