- Analytics

- News and Tools

- Market News

- US Dollar Index struggles for direction near 95.50

US Dollar Index struggles for direction near 95.50

- DXY alternates gains with losses in the mid-95.00s.

- US yields look to extend the recent uptick on Monday.

- Consumer Credit Change next on tap in the US docket.

The greenback, in terms of the US Dollar Index (DXY), looks to extend Friday’s post-NFP corrective upside in the 95.50 region following the opening bell in Euroland on Monday.

US Dollar Index looks to risk trends, yields

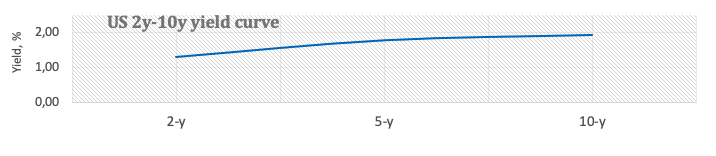

Following fresh lows in the 95.15/10 band on Friday, the index managed to regain some upside traction motivated by the solid prints from the January Nonfarm Payrolls (+467K). The corrective move in the buck was also propped up by the strong bounce in US yields across the curve.

The better-than-expected US job creation during last month reinforced the view of a strong labour market and added to the already rising speculation of a probable tighter normalization of the Fed’s monetary conditions.

In the US docket, December Consumer Credit Change will be the sole release later in the NA session in a week that is expected to be dominated by the publication of the inflation figures tracked by the CPI (Thursday).

What to look for around USD

The dollar regained some poise in the wake of the healthy results from the Nonfarm Payrolls for the month of January. While the constructive outlook for the greenback remains well in place for the time being, recent hawkish messages from the BoE and the ECB carry the potential to slow the pace of a move higher in the index in the next months. The view of a stronger dollar remains, in the meantime, underpinned by higher yields, persistent elevated inflation, supportive Fedspeak and the solid pace of the US economic recovery.

Key events in the US this week: Consumer Credit Change (Monday) - Balance of Trade (Tuesday) - Wholesale Inventories, MBA Mortgage Applications (Wednesday) - CPI, Initial Claims (Thursday) - Flash Consumer Sentiment (Friday).

Eminent issues on the back boiler: Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issue. Escalating geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is gaining 0.09% at 95.56 and a break above 96.07 (55-day SMA) would open the door to 97.44 (2022 high Jan.28) and finally 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 95.13 (weekly low Feb.4) seconded by 95.00 (round level) and then 94.62 (2022 low Jan.14).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.