- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls attack 200-SMA as yields retreat

Gold Price Forecast: XAU/USD bulls attack 200-SMA as yields retreat

- Gold keeps Friday’s recovery, grinds higher around intraday top.

- US jobs report propelled yields, USD but concerns over Fed, cautious optimism in markets weigh on bond coupons of late.

- US inflation becomes a key weekly event, risk catalysts are important too.

- Gold Weekly Forecast: XAU/USD indecisive as investors assess central banks' rate outlook

Gold (XAU/USD) stays mildly bid around $1,810, extending Friday’s rebound amid the early Monday morning in Europe.

While the US dollar’s lack of ability to track the strong Treasury yields favored gold buyers the previous day, the metal’s latest upside could be linked to the pullback in bond coupons from a multi-day high.

That said, the US Dollar Index (DXY) rebounded from a three-week low after the monthly employment data released on Friday. Even so, the greenback gauge closed on the negative side as far as the weekly chart is concerned, up 0.12% around 95.55 at the latest.

On the other hand, the US 10-year Treasury yields snap two-day run-up to ease from the highest levels since January to 1.91% at the latest.

Mixed concerns over the inflation and the Fed’s next move in March become the key hurdle for the US Treasury yields. Although upbeat US jobs report propelled bond coupons to the fresh multi-day high on Friday, indecisive figures of inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, tested bulls afterward.

As per the latest US jobs report, the headline Nonfarm Payrolls (NFP) rose by 467K versus the median forecast for a 150K rise and 510K revised prior while the Unemployment Rate rose to 4.0% from 3.9% in December, compared to expectations for a no-change figure. It’s worth noting, however, that the U6 Underemployment Rate extended the south-run to 7.1% from 7.3% previous readouts. Also encouraging was Average Hourly Earnings that jumped strongly to 5.7% versus 4.9%.

Adding to the bullish bias could be the upbeat performance of Chinese equities and a light calendar ahead of Thursday’s US Consumer Price Index (CPI) for January. Also important to watch are concerns over Russia and China.

Technical analysis

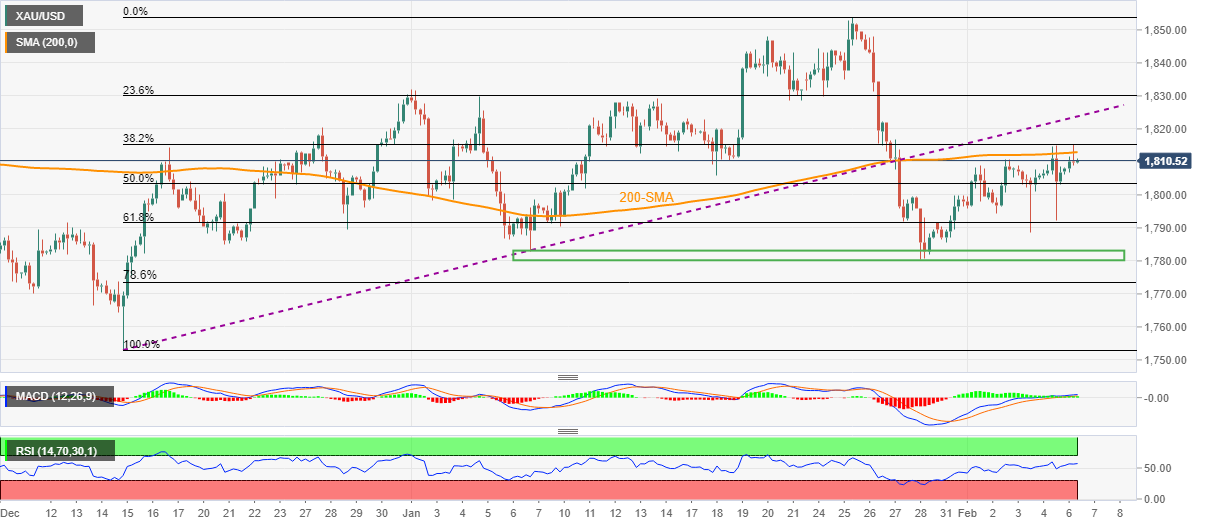

A clear bounce from the monthly horizontal support joins firmer oscillators to keep gold buyers hopeful around 200-SMA, near $1,813 at the latest.

Adding to the upside filters is the previous support line from December 15 and 23.6% Fibonacci retracement (Fibo.) level of December-January upside, respectively around $1,824 and $1,830.

Meanwhile, a downside break of the stated horizontal support zone, near $1,783-80, will be crucial for the gold seller’s return.

Following that, the 78.6% Fibo. near $1,761 may test gold bears before directing them to December’s low of $1,753.

It’s worth noting that bullish MACD joins higher-low of the gold prices and RSI to keep buyers positive of late.

Gold: Four-hour chart

Trend: Further upside expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.