- Analytics

- News and Tools

- Market News

- Gold Price Forecast: Eyes on the US dollar and Fed sentiment

Gold Price Forecast: Eyes on the US dollar and Fed sentiment

- Gold bulls stay in control besides the strength in the US dollar.

- Fed sentiment, US CPI, oil and Russia all in play.

- XAU/USD indecisive as investors assess central banks' rate outlook

Gold has started the day a little bid, keeping the rhythm of Friday going whereby the precious metals managed to rebound despite the rally in the US dollar. At the time of writing, XAU/USD is trading around $1,810 ad higher by some 0.16% having opened near $1,807. The US dollar, as measured by the DXY index, is trading at 95.446 and flat on the day.

The greenback is consolidating Friday's moves from when it advanced from two-week lows after the Nonfarm Payrolls data showed the world's largest economy had created far more jobs than expected. Payrolls grew 467,000 jobs last month and data for December was revised higher to show 510,000 jobs created instead of the previously reported 199,000. Reuters had forecast 150,000 jobs added in January while estimates ranged from a decrease of 400,000 to a gain of 385,000 jobs.

''Labour market data out last week show a hot and tight job market, likely raising the odds of a 50bps hike in March. US Treasuries sold off on the robust January job report,'' analysts at ANZ Bank commented on Monday about the Nonfarm Payrolls outcome, adding:

''January Consumer Price Index data this week are expected to show headline and core inflation remain elevated. Any sizable upward surprise would add to the case for the Fed starting off more aggressively.''

Meanwhile, with regards to rates, analysts at TD Securities explained that investors are now pricing in nearly 5.5 hikes in 2022 and nearly 50% odds of a March 50bp hike. ''The CPI report next week will be key as further strength will likely exacerbate pricing for faster hikes. This should push 10y real rates higher and is likely to keep 2y TIPS BEs elevated (particularly amid the surge in oil prices).''

As for oil prices, this could be a key theme in markets this week. On a monthly basis, WTI is quite literally off the charts:

With an OPEC meeting on the horizon and Russia-Ukraine tensions remaining at a boil, this is a trend that is likely to continue, adding to the case for an aggressive Fed move on the horizon. To date, however, more hawkish-than-expected Federal Reserve messaging, along with the market pricing in more aggressive Fed Funds increases this year, prompted money managers to aggressively cut their gold exposure.

''At the same time, higher yields across the Treasury curve and talk of a possible 50bps move the next time the FOMC meets drove fund managers to cut long exposure an outsized 41k lot,'' analysts at TD Securities said with respect to the last CFTC data.

''However, as oil prices surged and some gold market participants expressed uncertainty surrounding the US central bank's commitment to getting restrictive enough to bring inflation down, likely drove specs back into long exposure, which again drove prices back to above $1,800/oz.''

Gold technical analysis

-

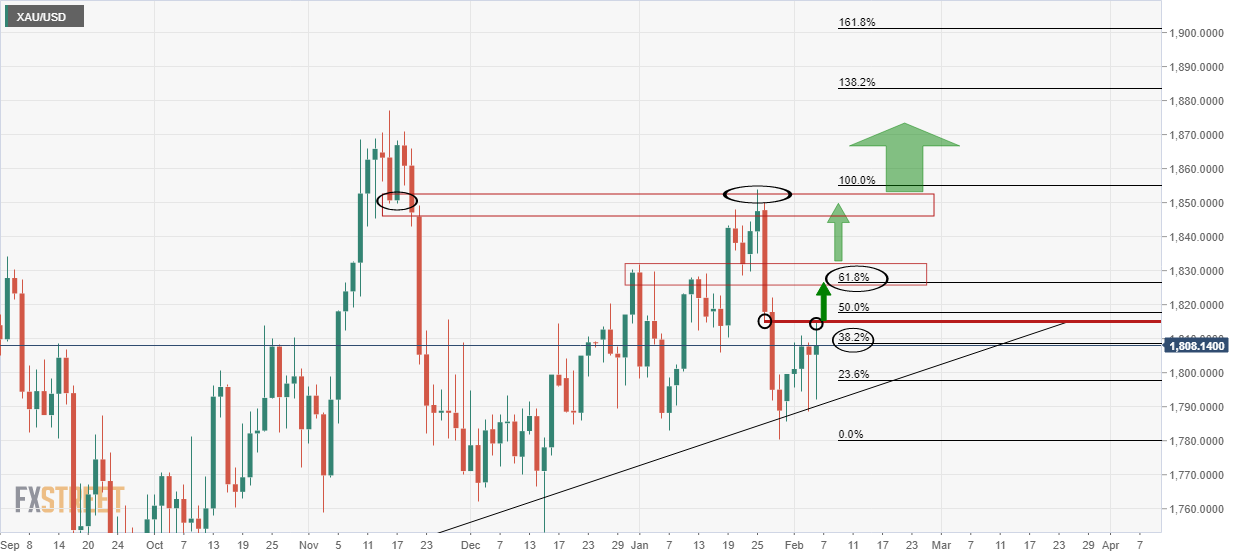

Gold, Chart of the Week: Bulls take on the 38.2% Fibo, now eye the 61.8% golden ratio

In the linked analysis, it is explained that ''until the M-formation's neckline is broken, the focus is on the downside:

On the flip side, a break of the neckline will put a significant focus on the upside as follows:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.