- Analytics

- News and Tools

- Market News

- AUD/USD Price Analysis: Bears sink their teeth into US Nonfarm Payrolls

AUD/USD Price Analysis: Bears sink their teeth into US Nonfarm Payrolls

- AUD/USD bears are taking back control, seeking a bearish weekly close.

- 0.6991 is a key downside level that bears will be aiming to close below.

AUD/USD was hit hard on Friday after data showed the world's largest economy created far more jobs than expected, raising the chances of a larger Federal Reserve interest rate increase at the March policy meeting. As a consequence, the AUD reversed half the week’s gains on the data that drove a surge in yields.

The US dollar moved its way up the 95 area as measured by the DXY index, crippling the Aussie that fell 0.88% vs the greenback by the close of play. The move translated into a telegraphed price drop from the previous analysis made ahead of Friday's Nonfarm Payrolls event as follows:

AUD/USD prior analysis

- AUD/USD Price Analysis: Bulls stay in charge but face a wall of daily resistance

It was stated that the bears were in anticipation of a Dijo close followed by a Bearish Engulfing. While it did not come in the previous daily close, it finally came nonetheless and confirms the bearish bias for the week ahead.

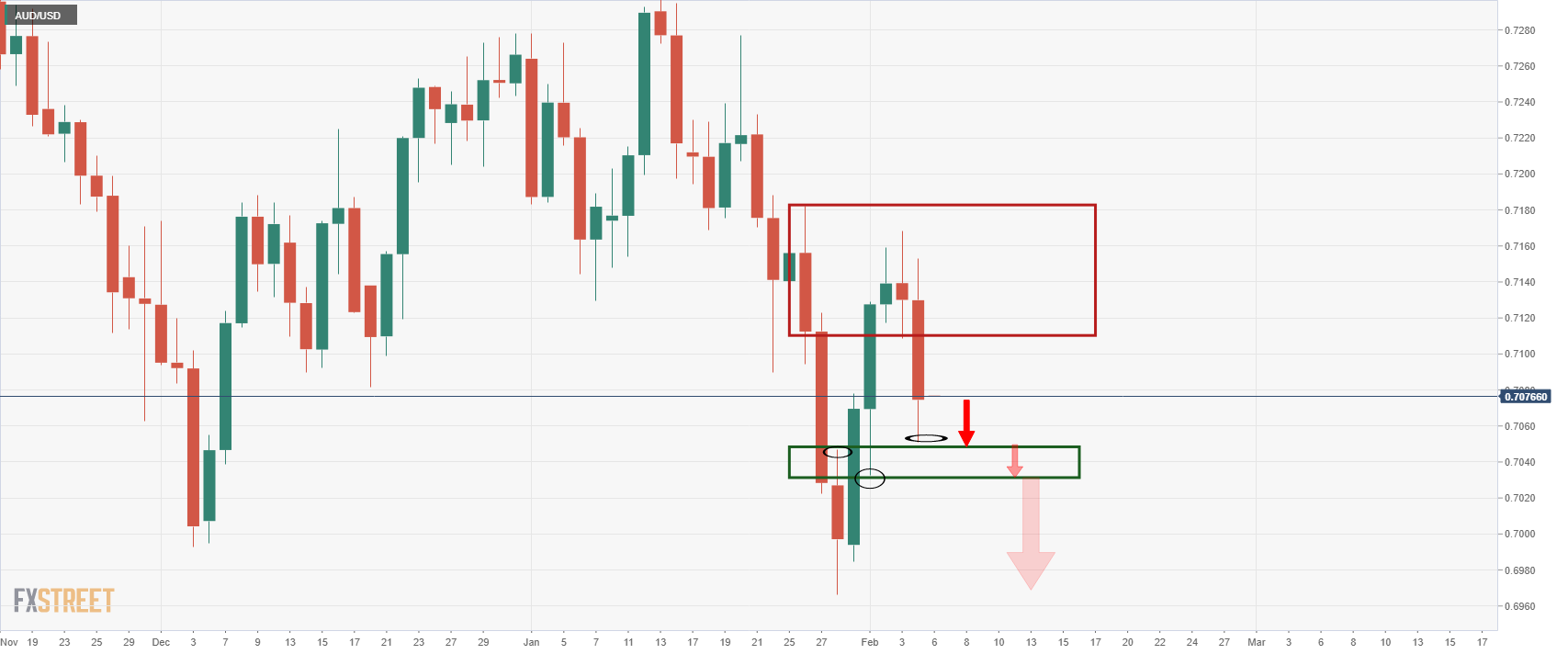

AUD/USD live market, daily chart

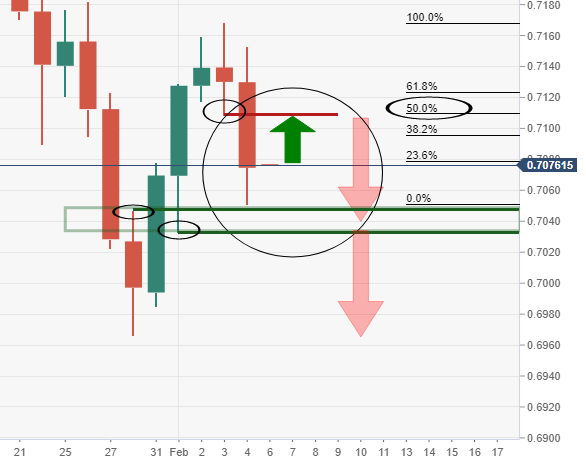

As illustrated, the price's last two day's of business engulfed the mid-week Doji, significantly. Bar potential mitigation of the markdown and the imbalance thereof, a break of 0.7050 and then 0.7030 would be key:

The above scenario includes a bullish open to take on bear's commitments in a 50% mean reversion of the prior two day's of bearish closes at 0.7110.

This could occur in the opening sessions as local rates market play catch up to the US Treasury yields that surged to new cyclical highs after the surprisingly strong Nonfarm Payrolls data.

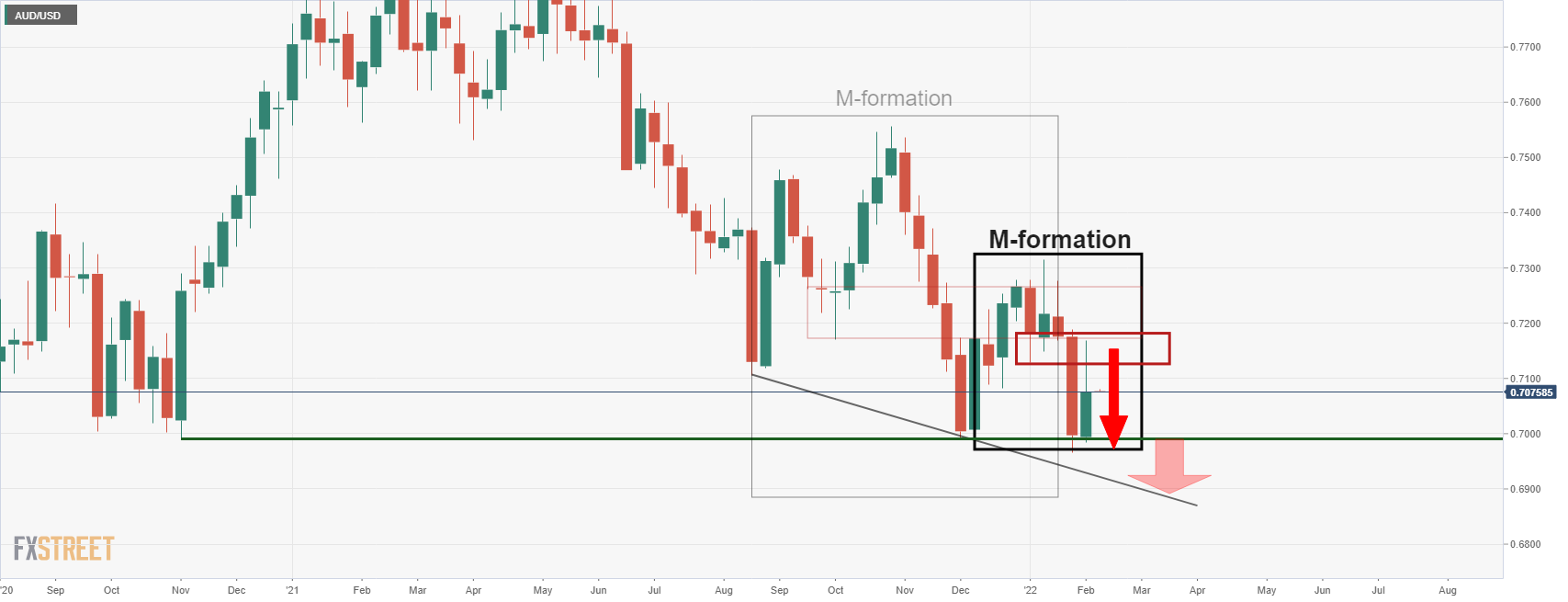

AUD/USD weekly chart

Bears are monitoring the M-formation at this juncture and the weekly close below the neckline following the restest of the area leaves a bias to the downside for the week ahead. Bears will want to break the Nov swing lows near 0.6990's confirmation that the longer-term bear trend is in tact.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.