- Analytics

- News and Tools

- Market News

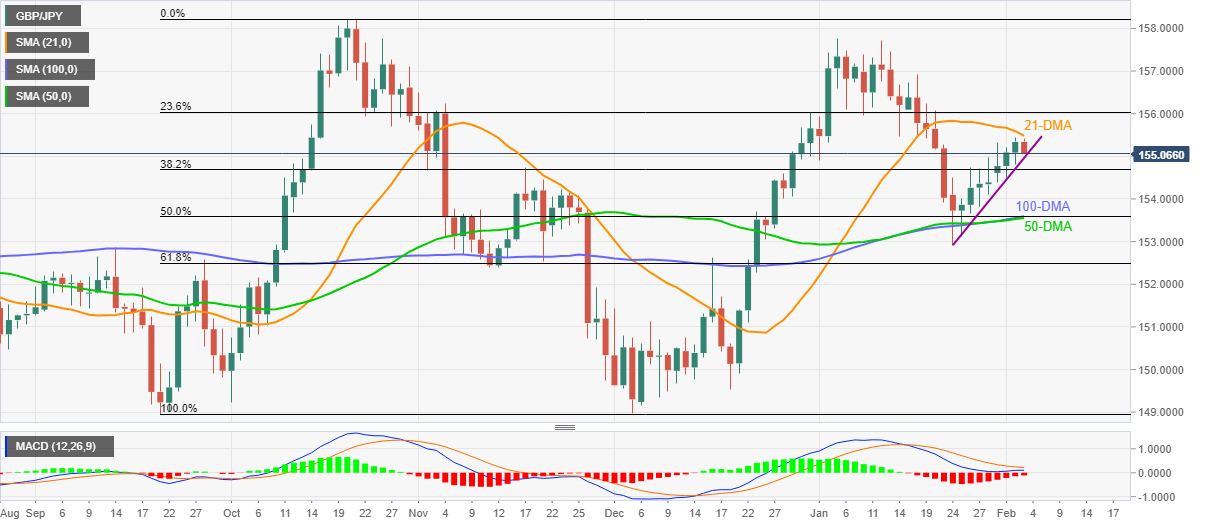

- GBP/JPY Price Analysis: Extends pullback from 21-DMA towards 155.00 ahead of BOE

GBP/JPY Price Analysis: Extends pullback from 21-DMA towards 155.00 ahead of BOE

- GBP/JPY snaps seven-day uptrend as bulls turn cautious before BOE.

- Weekly support line holds the key to further downside, MACD keeps buyers hopeful.

- 50% Fibonacci retracement joins 100-DMA, 50-DMA to offer tough nut to crack.

- Bank of England Interest Rate Decision: Gilts are the crucial topic

GBP/JPY takes offers to refresh intraday low near 155.10, printing the first daily loss in eight ahead of the Bank of England (BOE) monetary policy meeting.

In doing so, the cross-currency pair portrays a U-turn from the 21-DMA level of 155.50, attacking a one-week-old ascending trend line, near 154.90.

It should be noted, however, that the receding bearish bias of MACD and sustained trading beyond the short-term support line favor buyers.

That said, fresh buying will wait for a clear upside break of the 155.50 level before directing GBP/JPY prices towards 23.6% Fibonacci retracement (Fibo.) of September-October 2021 upside, near 156.00. Following that, the January 2022 peak of 157.75 will be in focus.

Meanwhile, a downside break of the stated support line near 154.90 will direct GBP/JPY towards 38.2% Fibo. level surrounding 154.70.

However, a convergence of the 100-DMA, 50-DMA and 50% Fibonacci retracement level around 153.55-60 become a tough nut to crack for the bears.

GBP/JPY: Daily chart

Trend: Bullish

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.