- Analytics

- News and Tools

- Market News

- Gold Price Forecast: Bears wait in the flanks below counter-trendline daily resistance

Gold Price Forecast: Bears wait in the flanks below counter-trendline daily resistance

- Gold holds in a corrective territory on the daily chart as markets remain in anticipation of NFP.

- The US dollar has been pressured to start the week by a chorus of less hawkish Fed remarks.

At $1,800, gold, XAU/USD, is consolidating within a bullish correction on the daily chart after hitting a 38.% Fibonacci retracement level in Tuesday's trading. The yellow metal has benefitted from a switch in risk appetite and less hawkish rhetoric from a chorus of Federal reserve speakers since the Fed's governors uber hawkish tone.

Several US Federal Reserve officials are playing down the prospects of aggressive rate hikes coming imminently. For instance, although St. Louis Fed president Bullard (hawkish, voter) said that market pricing of 5 rate hikes this year is not a bad bet, he also said that a 50bp move probably is not helpful.

Over the weekend, Raphael Bostic reiterated that he is sticking to his prediction that three 25 bp hikes this year is the most likely outcome whilst warning that “Every option is on the table for every meeting.” Philadelphia Fed President Patrick Harker was equally cautious and he pushed back on a rate increase of half a percentage point in March, saying he would need to be convinced it was needed. Consequently, the dollar index eased to 96.235 (DXY) and off its recent 19-month high of 97.441.

Looking ahead, there will be a focus on the US jobs market in Nonfarm Payrolls. ''The recovery in employment was probably temporarily interrupted by the Omicron-led surge in COVID cases,'' analysts at TD Securities said.

''Many of the employees who had to isolate likely continued to be paid, and thus remained on payrolls, but many were likely not paid. The report will probably show continued strength in wage gains. The report will include the annual revision to the data.''

However, if there is a weak jobs print owing to the virus, it is unlikely to sway the Fed from its decisively hawkish tone. Traders could decide to look past recent weakness as being related to Omicron's fallout, analysts at TD Securities argued in a note on Tuesday.

''In this context, the data doesn't help to inform global macro participants on whether we are facing a new regime at the Fed, or whether they are jawboning to tame inflation expectations. We expect that the precious metals complex will struggle to attract capital in this context.''

''Given that Chinese demand overwhelmingly supported gold in recent weeks, a seasonal lull following Lunar New Year could mark the end of supportive Chinese demand, suggesting prices are vulnerable to a deeper consolidation in support of our tactical short gold position.

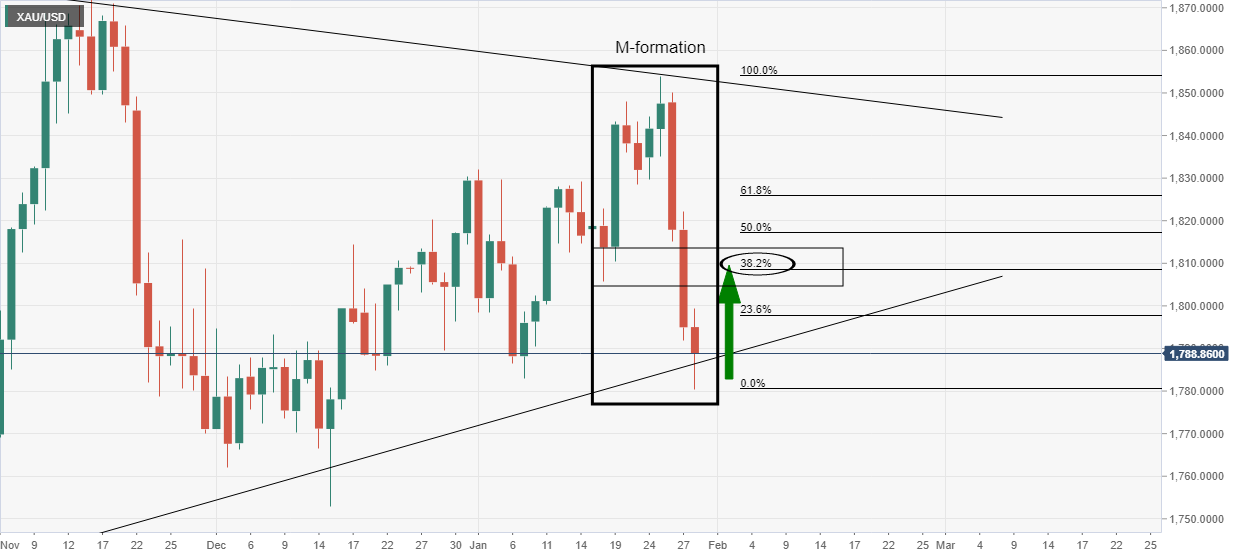

Gold daily chart

In a prior analysis, it was stated that ''considering the trendline support and the daily M-formation, the technicians would argue that a significant correction of the bearish impulse could be in play''...

The analysis noted that the M-formation is a reversion pattern. ''In the case above, the 38.2% Fibonacci retracement level near $1,810 has a confluence with prior structure as illustrated.''

''Should this playout,'' it was stated, ''and if the bears commit near to here, then additional supply could be straw that breaks the camelback for a sizeable continuation to crack the trendline support as follows:''

Gold live market

The price hot the target in Tuesday's trade and the bears will be now monitoring for a bearish structure in anticipation of a bearish continuation in the coming days:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.