- Analytics

- News and Tools

- Market News

- RBA Statement: Pushes back on market wagers for an early rate rise

RBA Statement: Pushes back on market wagers for an early rate rise

The Reserve bank of Australia left its cash rate at a record low of 0.1% on Tuesday and ended its A$275 billion ($194.40 billion) bond-buying campaign as expected.

However, traders were disappointed because the statement has pushed back on market wagers for an early rate rise.

The statement emphasised that ceasing bond purchases did "not imply" a near-term increase in interest rates and the Board was still prepared to be patient.

"As the Board has stated previously, it will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range," RBA Governor Philip Lowe said in a brief statement. "While inflation has picked up, it is too early to conclude that it is sustainably within the target band."

Key points

Rba says it also decided to cease further purchases under the bond purchase program, with the final purchases to take place on 10 February.

RBA says committed to maintaining highly supportive monetary conditions.

RBA says the RBA's central forecast is for gdp growth of around 4¼ per cent over 2022 and 2 per cent over 2023.

RBA says will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range.

RBA says board is prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve.

RBA says the central forecast is for the unemployment rate to fall to below 4 per cent later in the year and to be around 3¾ per cent at the end of 2023.

RBA says while inflation has picked up, it is too early to conclude that it is sustainably within the target band

RBA says there are uncertainties about how persistent the pick-up in inflation will be as supply-side problems are resolved

RBA says likely to be some time yet before aggregate wages growth is at a rate consistent with inflation being sustainably at target

RBA says ceasing purchases under the bond purchase program does not imply a near-term increase in interest rates.

RBA says the board will consider the issue of the reinvestment of the proceeds of future bond maturities at its meeting in May.

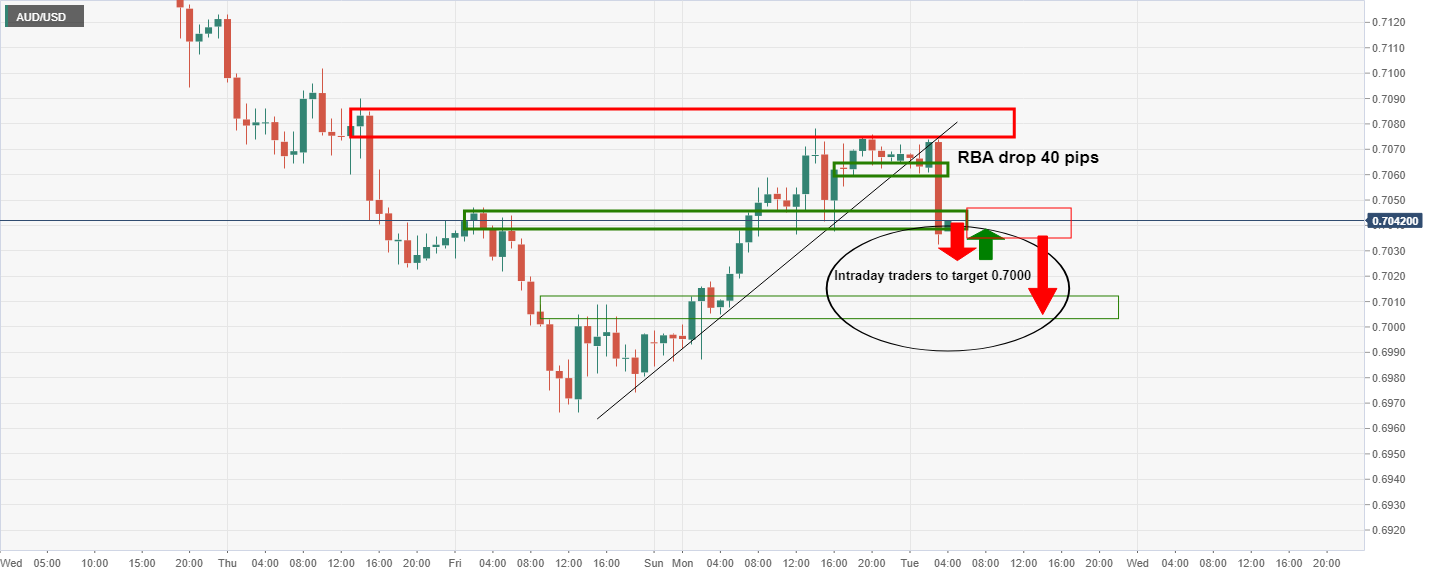

AUD/USD reaction

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.