- Analytics

- News and Tools

- Market News

- Breaking: RBA ends QE and holds rates at 0.1%, AUD/USD falls 50 pips on knee-jerk

Breaking: RBA ends QE and holds rates at 0.1%, AUD/USD falls 50 pips on knee-jerk

- RBA keeps the Cash Rate at 0.10%, as expected.

- RBA to discontinue the bond-buying programme. No surprises there.

- AUD/USD drops 50 pips on the knee-jerk.

The Reserve Bank of Australia's highly anticipated event has just occurred whereby the RBA was expected to end its pandemic-related bond-buying program.

Market participants had speculated that policymakers would bring forward rate hikes’ guidance, potentially offering fresh incentives for AUD traders. The conundrum for the markets was how much of such an outcome has already been priced in and whether Governor Lowe would push back at market expectations of progressive rate hikes this year.

Key takeaways from the RBA, so far

- RBA keeps the Cash Rate at 0.10%, as expected.

- RBA to discontinue the bond-buying programme. No surprises there.

- AUD/USD drops 50 pips on the knee-jerk.

- Sees underlying inflation rising to around 3.25%.

- Sees underlying inflation falling to around 2.75% over 2023.

- Economy to grow 4.25% over 2022, 2% over 2023.

- Omicron outbreak hasn't derailed economic recovery.

- RBA says while inflation has picked up, it is too early to conclude that it is sustainably within the target band. (That's DOVISH, AUD heavy).

Taking these points into consideration, traders can conclude that RBA is in no hurry to raise rates and will not do so until inflation is sustainably within target, adding it will be "patient" on rising prices.

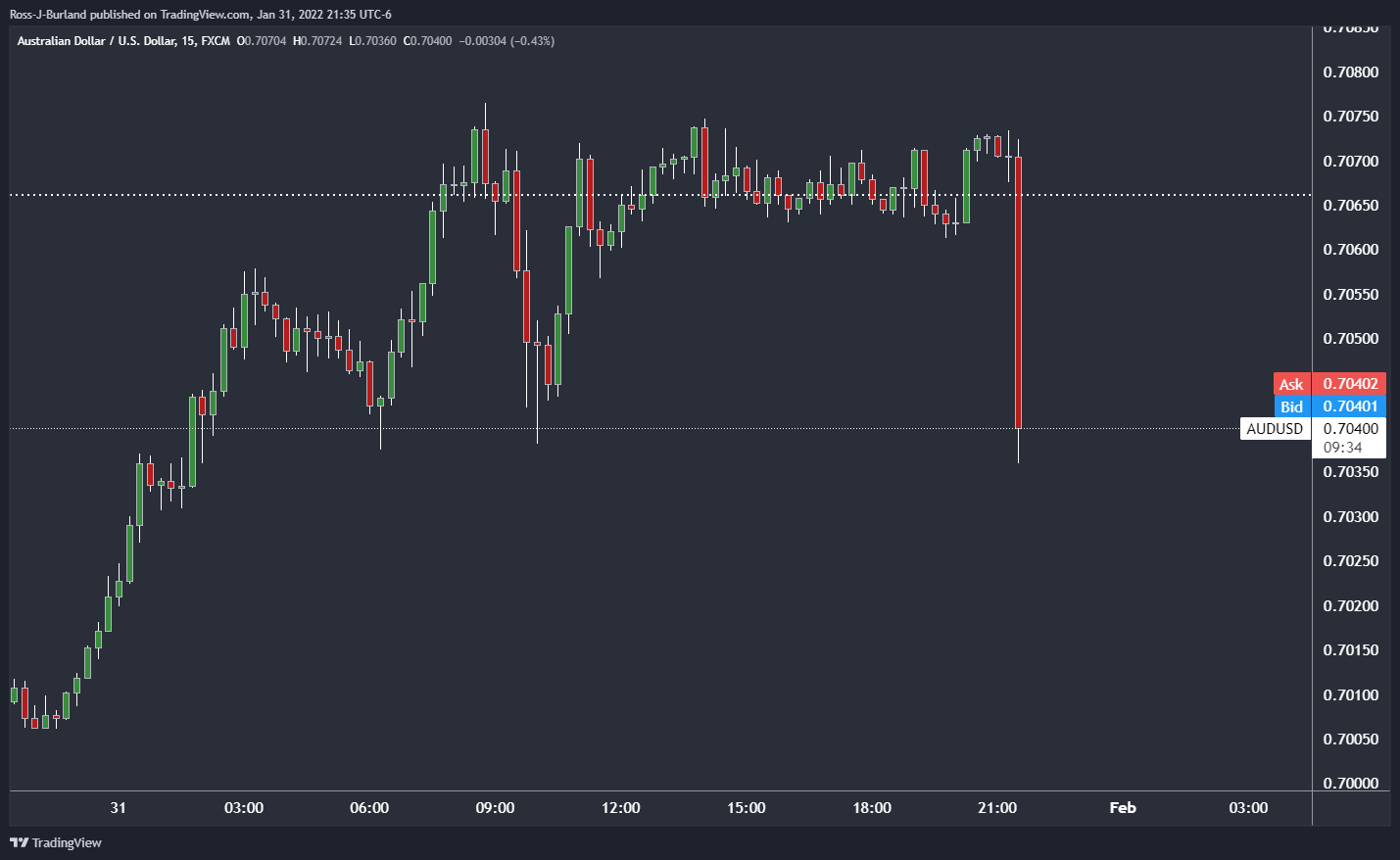

AUD/USD knee-jerk reaction

(15-min chart)

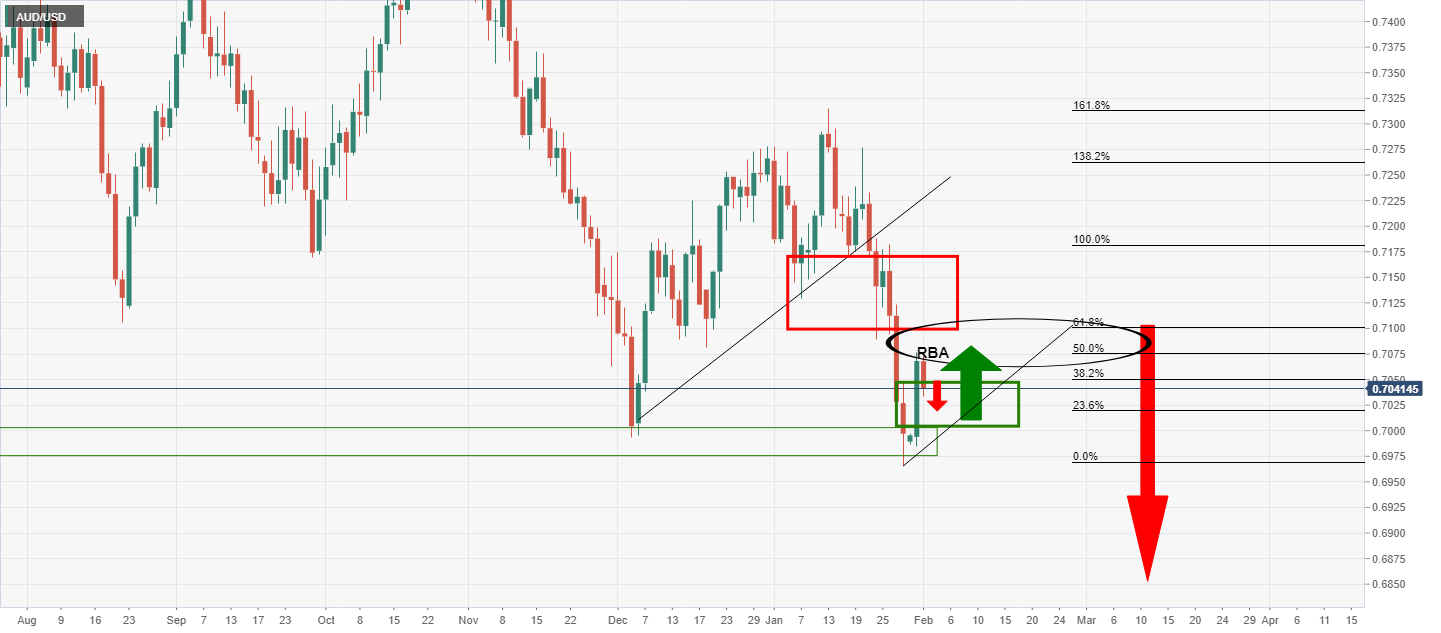

Prior to the event, the following analysis acknowledged the upside correction in the Aussie in the wake of US dollar weakness: AUD/USD Price Analysis: Bulls move in on a critical liquidity zone

As illustrated, the price had moved in on the forecasted target zone, but more to come from the bulls in the days to come prior to the next test of the 0.6950s was anticipated.

The market reaction, however, could be merely part of the deceleration of the bullish correction, forming structure along the way:

Meanwhile, the intraday traders could be encouraged by the dovishness of the RBA to target 0.70 the figure for the sessions ahead:

(AUD/USD H1 chart)

About the RBA meeting

RBA Interest Rate Decision is announced by the Reserve Bank of Australia. If the RBA is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the AUD. Likewise, if the RBA has a dovish view on the Australian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

Decisions regarding this interest rate are made by the Reserve Bank Board, and are explained in a media release which announces the decision at 2.30 pm after each Board meeting.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.