- Analytics

- News and Tools

- Market News

- EUR/USD pushes higher and flirts with 1.1200

EUR/USD pushes higher and flirts with 1.1200

- EUR/USD approaches the key barrier at 1.1200.

- German 10y Bund yields advance past 0.03%.

- EMU flash Q4 GDP rose 4.6% YoY, 0.3% QoQ.

The buying interest around the European currency keeps growing on Monday and pushes EUR/USD to the very boundaries of 1.1200 the figure.

EUR/USD bid on risk-on trade, data

EUR/USD posts gains for the second session in a row on Monday, bolstered by the generalized risk-on sentiment, positive data releases and investors’ repricing of a potential interest rate hike by the ECB at some point by year end.

In addition, yields of the key German 10y Bund advance to levels last seen in May 2019 past 0.03%, while yields of the US 10y benchmark navigate above 1.80%.

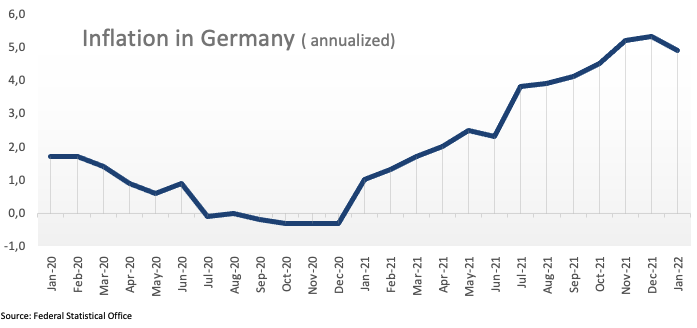

In the euro docket, advanced EMU Q4 GDP figures showed the economy is expected to have expanded 0.3% QoQ and 4.6% YoY. In Germany, preliminary inflation figures now see the CPI rising 0.4% MoM in December and 4.9% from a year earlier.

EUR/USD levels to watch

So far, spot is gaining 0.38% at 1.1190 and faces the next up barrier at 1.1198 (weekly high January 31) seconded by 1.1304 (55-day SMA) and finally 1.1369 (high Jan.20). On the other hand, a break below 1.1121 (2022 low Jan.28) would target 1.1100 (round level) en route to 1.1000 (psychological level).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.