- Analytics

- News and Tools

- Market News

- US Dollar Index gives away some gains, back near 97.00

US Dollar Index gives away some gains, back near 97.00

- DXY starts the week on the defensive near the 97.00 zone.

- US yields extend the corrective downside from recent peaks.

- Chicago PMI, Dallas Fed Manufacturing Index come next in the docket.

The US Dollar Index (DXY), which tracks the greenback vs. a bundle of its main competitors, kicks in the trading week near the 97.00 area following the opening bell in Euroland.

US Dollar Index weaker on profit taking, yields

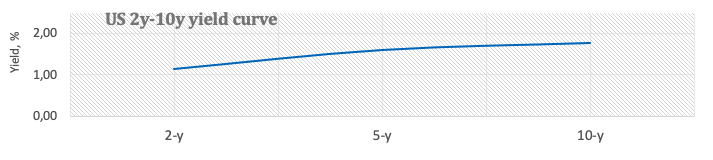

The index comes under some selling pressure following Friday’s new cycle tops near 97.50. The current knee-jerk in the dollar seems to be suffering some profit taking in light of the recent strong gains, while another so far negative performance of US yields also collaborates with the downbeat mood around the buck. Furthermore, the bear flattening of the curve remains well in place, while the closely watched 2y-10y yield spread remained at recent lows around 63 pts at the end of last week.

It is worth recalling that the recent strong inflows into the dollar have been reinforced following the hawkish message from the FOMC event last Wednesday as well as Chair Powell’s indication of an interest rate hike as soon as at the March 16 meeting. Indeed, on the latter and according to CME Group’s FedWatch Tool, the probability of a 25 bps rate hike hovers around 85% and 15% when it comes to a larger 50 bps hike.

Minor releases in the US calendar will see the Chicago PMI and the Dallas Fed Manufacturing Index, both for the month of January.

What to look for around USD

The dollar’s strong march north gathered further steam during last week, particularly in response to the expectations that the Federal Reserve will start its hiking cycle and quantitative tightening in the relatively short-term horizon. Against that, the US Dollar Index (DXY) surpassed the 97.00 barrier quite convincingly and recorded fresh cycle tops near 97.50 (January 28). Furthermore, the constructive outlook for the greenback is expected to remain unchanged for the time being on the back of rising yields, persistent elevated inflation, supportive Fedspeak and the solid pace of the US economic recovery.

Key events in the US this week: ISM Manufacturing, Final Manufacturing PMI (Tuesday) – ADP Employment Change (Wednesday) – Initial Jobless Claims, ISM Non-Manufacturing PMI, Factory Orders (Thursday) – Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issues. Escalating geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is losing 0.20% at 97.02 and a break above 97.44 (2022 high Jan.28) would open the door to 97.80 (high Jun.30 2020) and finally 98.00 (round level). On the flip side, the next down barrier emerges at 96.08 (55-day SMA) seconded by 95.41 (low Jan.20) and then 94.62 (2022 low Jan.14).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.