- Analytics

- News and Tools

- Market News

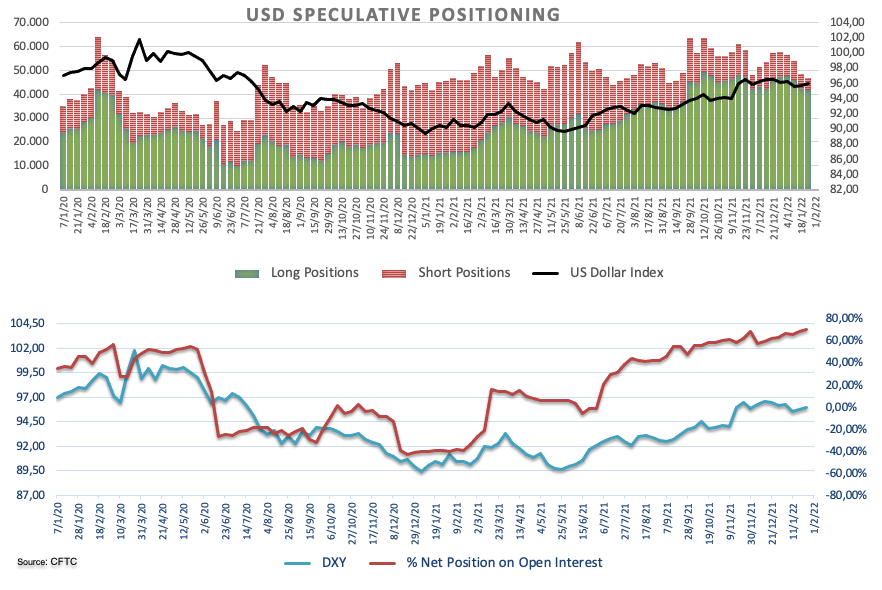

- CFCT Positioning Report: USD net longs in 3-week highs

CFCT Positioning Report: USD net longs in 3-week highs

These are the main highlights of the CFTC Positioning Report for the week ended on January 25th:

- Speculators reduced both their long and shorts positions in USD, taking the net long position to a 3-week high. The greenback remained side-lined during the week under scrutiny amidst rising concerns surrounding the Russia-Ukraine front while Fed-speakers had already started to signal three or four interest rate hikes by the Federal Reserve this year.

- Gross longs in EUR went up for the sixth consecutive week, lifting the net longs to the highest level since mid-August 2021. Further rangebound in EUR/USD remained in place against the backdrop of alternating risk appetite trends amidst the rate cut by the PBoC, geopolitical effervescence and supportive comments for a sooner-than-expected Fed’s lift-off.

- Net shorts in the Japanese yen retreated to 3-week low following the combination of the corrective move in US yields and some geopolitics-induced risk aversion. That said, USD/JPY eased to as low as the mid-113.00s, where some decent contention turned up.

- The negative stance in the British pound remained well in place after net shorts rose to 2-week highs, as investors continued to fade the December-January rally on the back of domestic political turmoil and the unabated spread of the omicron pandemic.

- Net longs in the Russian ruble dropped to levels last seen in mid-June of last year, all amidst the increasing political effervescence as well as rising rumours of a potential military intervention in Ukraine, at the time when West powers continued to threaten with strong sanctions, both against Russian individuals and companies.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.