- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD flirts with $1,800 ahead of US PCE Inflation

Gold Price Forecast: XAU/USD flirts with $1,800 ahead of US PCE Inflation

- Gold prints a corrective pullback from a three-week low.

- Yields pause previous declines, US stock futures print mild gains but Asia-Pacific equities trade mixed.

- Firmer US data, inflation expectations keep gold bears hopeful before Fed’s preferred inflation gauge, India gold demand tests sellers.

- Gold Price Forecast: Poised to challenge January’s low at 1,782.60

Gold (XAU/USD) licks the Fed-led wounds of around $1,797-98, up 0.15% intraday during Friday’s Asian session. In doing so, the yellow metal reacts to the upbeat demand forecasts for the world’s top gold consumer, as well as mildly bid US equity futures, amid a sluggish session.

The bright metal refreshed a three-week low the previous day as markets cheered the US Federal Reserve’s (Fed) signals of the March rate hike and room for more lift-offs. That said, the hawkish Fed hints offered a $50.00 slump in the gold prices before the latest bounce from $1,791.

Gold prices portray a corrective pullback as demand from the world’s second-largest gold consumer India is likely to increase, per the World Gold Council (WGC) report shared by Reuters. “India's gold consumption is expected to rise further in 2022 after jumping 79% last year as pent-up demand and an improvement in consumer confidence are seen boosting retail jewelry sales,” the news said.

Indian demand has averaged 769.7 tonnes over the last 10 years and is expected to jump to the highest levels in six years, per regional CEO of WGC India, to around 800-850 tonnes versus 797.3 tonnes last year.

On a different page, markets digest Fed-led wounds amid a light calendar day in Asia, which in turn allows equities and other riskier assets like gold to consolidate the latest losses. Additionally, mixed concerns over the Russia-Ukraine tussles and cautious mood ahead of the Fed’s preferred inflation gauge also help gold prices to print a corrective pullback.

Read: US President Biden eyes additional macroeconomic help for Ukraine as Russian invasion looms

Amid these plays, the US 10-year Treasury yields stay firmer around 1.81% while the S&P 500 Futures rise half a percent by the press time. Additionally, the Asia-Pacific equities traded mixed while the US Dollar Index (DXY) struggles for a clear direction after rising to the highest levels since July 2020 the previous day.

Looking forward, the gold traders may now await the US Core PCE Price Index figures for December as they’re considered the Fed’s preferred version of inflation. Markets expect a 4.8% YoY figure versus 4.7% prior. Also important will be updates over the likely Russian invasion of Ukraine.

Read: US PCE Inflation Preview: Dollar rally has more legs to run

Technical analysis

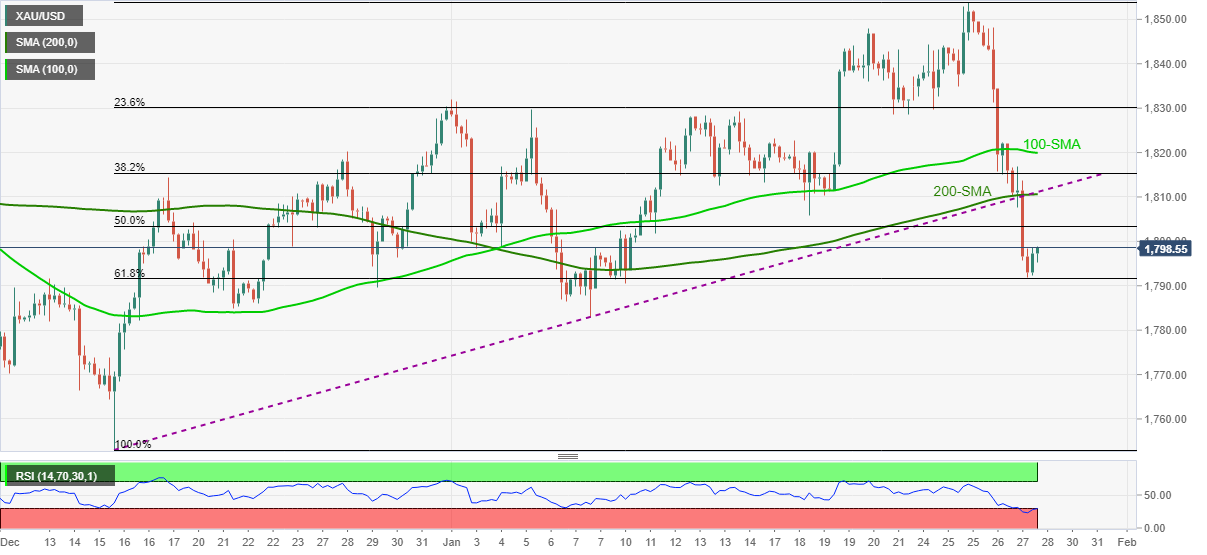

Be it a clear downside break of $1,810 support confluence on 4H or the 200-DMA level of $1,805, gold selling is in full steam.

However, oversold RSI conditions on the four-hour chart (4H) triggered the metals latest rebound from $1,791 support level comprising 61.8% Fibonacci retracement of December-January upside.

Also acting as immediate support is the area comprising multiple levels marked since late December, near $1,785.

Following that, a slump to $1,770 and the last month’s bottom surrounding $1,753 can’t be ruled out.

Gold: Four-hour chart

It’s worth noting that the daily chart shows a notable downside gap as the quote recently conquered an upward sloping support line from August, now resistance around $1,800.

Gold: Daily chart

Alternatively, a clear upside break of $1,810 will need validation from $1,831 to recall gold buyers.

Even so, the yearly resistance line and the monthly peak, respectively around $1,847 and $1,853 will be tough nuts to crack for the gold bulls.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.